About That Massive Bitcoin Bull Flag

One killer bullish trading pattern. Let's hope it plays out differently than last time!

Are you one of the people talking about a bull flag on the daily chart?

Me too. I shared this in a recent post for my newsletter, Crypto is Easy. After a powerful uptrend, Bitcoin’s price went sideways and down in a roughly symmetrical way, then broke above the top “resistance” trendline.

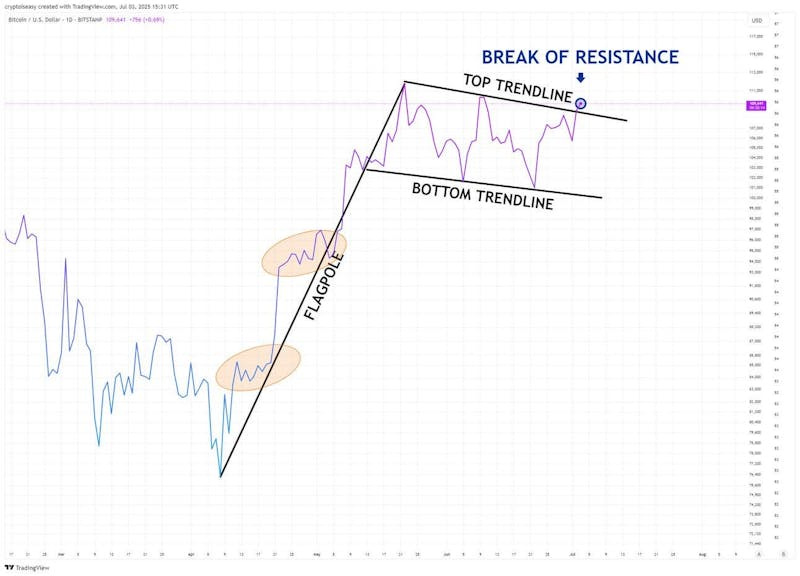

A bull flag, as the traders say. Like so:

A textbook bull flag will not have consolidation circled above, and the trendlines would be parallel. Let’s not be sticklers for lines on a chart. Close enough is good enough.

Whether the flag is textbook or fudgy, we have a bullish break of resistance after consolidation. That’s bullish.

If you’re trading the markets, you can take a long position. This pattern works out about 2/3 of the time.

If you’re not trading the market, you can ignore it.

Shades of bull flags past

Do you want an even better bull flag in similar circumstances? When Bitcoin’s price had recently hit a new all-time high, HODLing had reached its peak, technical charts and cycle theories predicted glory, and everybody agreed the market would soon blast off?

You can look at the 2021 bull flag.

Nice parallel lines, proper volume profile, nearly perfect. Price broke above the top trendline, consolidated briefly, then reached another all-time high, with a target of $100,000.

Take a look.

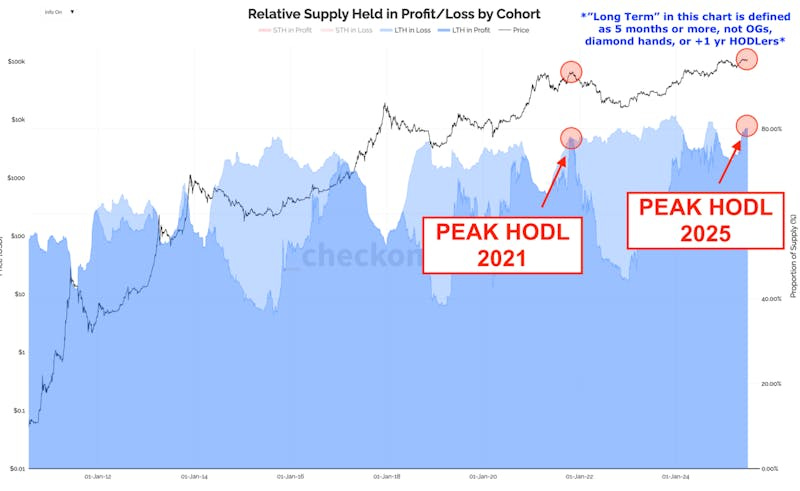

And that despite so many bullish confluences, for example, this “Peak HODL” chart from _checkonchain.

Different, kinda

To be fair, that was a different time.

We realized (in hindsight) that the HODLing metrics looked so good because people had deposited crypto on exchanges and lending platforms, then borrowed against those holdings to buy more crypto.

Today, we don’t know how many people are taking out margin loans through their brokerage using Bitcoin ETFs as collateral. Let’s hope they’re doing that without the fraud and mischief that went with 2021’s binge.

Can’t deny the bullish trading pattern.

Just make sure you’re not getting too far ahead of yourselves and projecting an outcome that hasn’t happened (and, in previous similar circumstances, did not happen).

I discuss this topic and others in my newsletter, Crypto is Easy. Head over there to learn more.