People seem to talk about GBTC/Greyscale lately because of problems at its parent company, Digital Currency Group (DCG). A four-bullet summary of the situation:

DCG is a valuable company.

Genesis is worthless and its liabilities are too big for DCG to back-stop.

Greyscale is a cash cow and the Greyscale Bitcoin Trust (GBTC) is one independent entity under the DCG umbrella.

DCG wants a bail-out but potential bailout-ers know they’ll get a better deal waiting for DCG to file bankruptcy. Bankruptcy can go a few ways. Under the most likely option, each part of the DCG empire will go to the highest bidder, spin off as its own entity, or get dismantled—but there are several paths that can produce different results.

It’s unclear to me what, if any, impact this will have on the crypto market.

Unless DCG dissolves the trust, there’s no crypto at stake, only cash commitments and liabilities—right? Do you know if there’s any crypto at stake here? Leave a comment below.

Would DCG dissolve the trust and convert all that BTC into USD? That would tank bitcoin’s price and seems counterproductive. GBTC is easy money and a lot of it. Why kill the golden goose?

I guess we’ll just have to wait and see. Why isn’t anybody talking about USD Tether anymore? We no longer have to worry about KuCoin, Nexo, and Crypto.com?

Watch this (LONG!) update or catch the TL;DW below. Usually, I aim for 20 minutes or so, but this one got away from me.

Topics:

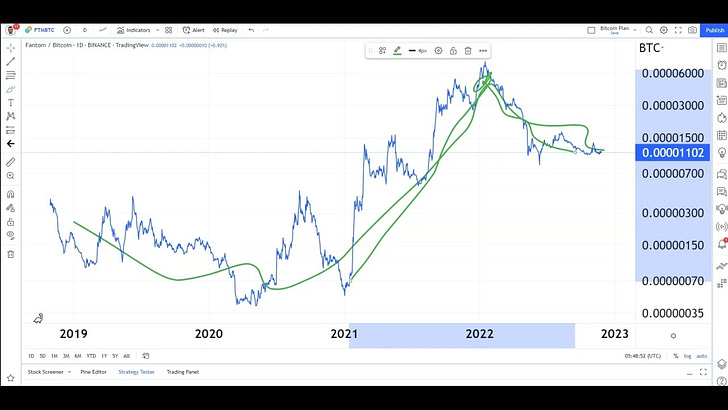

Where’s the bottom?

Miners

HODLers and stablecoins

Altcoin dominance

Altcoins Ranked #71-75

To speed up the video (shorten the playing time), tap the circled gear button at the bottom-right corner of the video: