Watch this 23-minute video or get the TL;DW below (in reverse order from the video).

TL;DR—

***As of today’s update, my plan says to buy bitcoin and altcoins until bitcoin’s price goes above $30,500 or below $17,500.***

Like the way bitcoin’s price went parabolic against the US dollar for seven months starting at the end of 2020, the US dollar’s price went parabolic against bitcoin for seven months starting at the end of 2021.

Parabolas always break. The question is when.

Whatever happens next, you don’t need to rush, get excited, or worry. Once the market turns around, you’ll see people sell at $30,000 and $40,000. Many of those sellers are the very people buying now.

All you need to know is you’re getting a good deal on bitcoin. We still don’t know how many more shoes will fall and those lending platforms still have massive holes in their balance sheet. Until that gets sorted out, anything can happen.

Keep in mind, most of this year’s price action is not organic, it’s coming from people forced to buy or sell because of leveraged positions they’ve taken.

We haven’t had a lot of new buyers for a long time. Since May we have had forced selling from miners and strong hands getting liquidated, with consequent panic-selling from others who would have otherwise stayed in the market.

It’s a big impact because these are a mix of big players and smaller HODLers, not tourists and institutions. As a result, this changes the underlying fabric of the market. It will take a while to rebuild that foundation.

That doesn’t mean prices have to go down. It means no matter what the price goes, you don’t need to worry or hurry. Take your time.

While whales send bitcoins to each other in huge amounts, people like us keep stacking sats. The number of wallets that hold 1 to 99 bitcoins continues to grow—in fact, the pace of growth is accelerating. We now also see renewed growth among wallets holding less than 1 bitcoins. I share charts in the video, it’s too much to put here.

This is a sort of transfer of wealth from big players to people like you and me.

As soon as I find evidence of new money coming into the market, I’ll share it. Right now, it’s just people already in crypto putting more money into bitcoin. While that suggests the “bitcoin is dead” narrative is wrong, that doesn’t necessarily mean prices have to go up.

Watch from the 18-minute mark for my general thoughts.

Miners

We know the mining community is under pressure. While we see signs of elevated selling in the miners’ position index, it’s not extreme.

Some miners have started selling bitcoins as they get it, rather than holding inventory for sale as needed. Also, rumors abound that miners collectively have $4 billion bitcoin posted as collateral for loans. Those bitcoins will get liquidated if they can’t pay the costs to service those loans.

Miners often sell in private deals that never show up in the spot markets. In other words, their selling doesn’t necessarily push prices down, it just satisfies the demand from some entity. As a result, that means less buying pressure (the entity already filled his or her order).

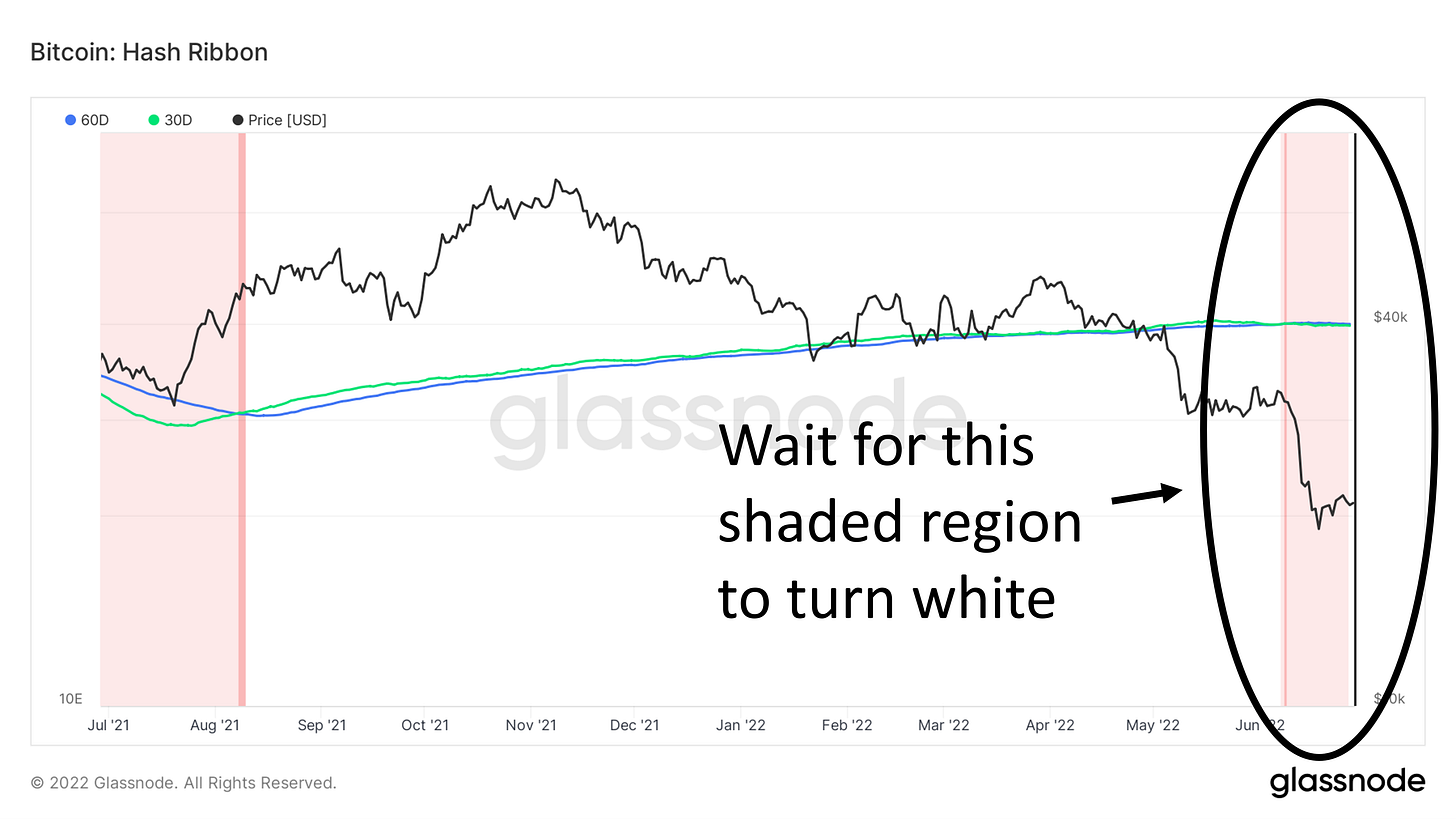

When will this trouble end?

Once the hash ribbon resolves.

I’ll keep an eye on it. Watch from the 12-minute mark for charts and more on this.

Institutions

Excluding the Canadian Purpose ETF, we’ve seen net inflows into crypto investment funds for six of the past eight weeks.

Not sure what’s going on up north, but that Canadian ETF makes up almost all of the aggregate selling from investment funds. Nobody else seems panicked.

That said, we’re also not seeing massive groundswell of traditional investors flocking to buy bitcoin funds for cheap. Watch from the 9-minute mark for more on that.

Altcoins

As far as value goes, altcoins are still a mixed bag. Many will never go higher than today’s price, some will go so high they will make up for the others many times over.

I’m still doing what I’ve been doing for about a month—buying more of each of my altcoins, one at a time, with each payday. It’ll take until the beginning of next year to get to each one.

I’m only buying small projects you probably have never heard of. For example, Syntropy (NOIA). I’ll publish an altcoin report on that project soon.

Watch from the two-minute mark for my comments on altcoins, including my altcoin dominance chart and potential next moves for the altcoin market relative to bitcoin.

Also check the feedback on altcoin ideas for other projects you may find interesting. Read, comment, and learn!

Relax and enjoy the ride!

Is there a link to the Altcoins chart you're using?