Happy Sunday!

In case you missed the announcement, I wanted to remind you that this newsletter is going up in price soon.

Right now, you can subscribe for $12/month or $136/year. After October 12, 2022, that will go up to $22/month and $180/year. If you’re not already on the paid plan, tap this button to lock in your lower price now.

If you’re already on the paid plan, no worries! Your price will not change at all for as long as you’re subscribed, even if you signed up at a lower price.

Mark, why tell us in advance? Just raise the price and move on.

I thought you might appreciate the heads-up.

Free subscribers, you should have already gotten emails encouraging you to sign up for a paid plan now before prices go up. I realize this may seem sudden if you’re on the fence. Three days is not a lot of time to make a decision! Check your inbox for emails from October 6 and 8 with more information about the change.

A quick summary of today’s crypto market, visa vis bitcoin (altcoins will go wherever bitcoin goes):

Half of the bitcoin wallets sit in profit. As a whole, whales and OGs still have substantial unrealized gains.

We see strong accumulation among people who are already in the market, but not much new money coming in.

Bitcoin’s price is beyond the extremes of its historical range against all benchmarks, but it’s also behaving exactly as it has during previous market bottoms—up and down a lot within a sideways range for months.

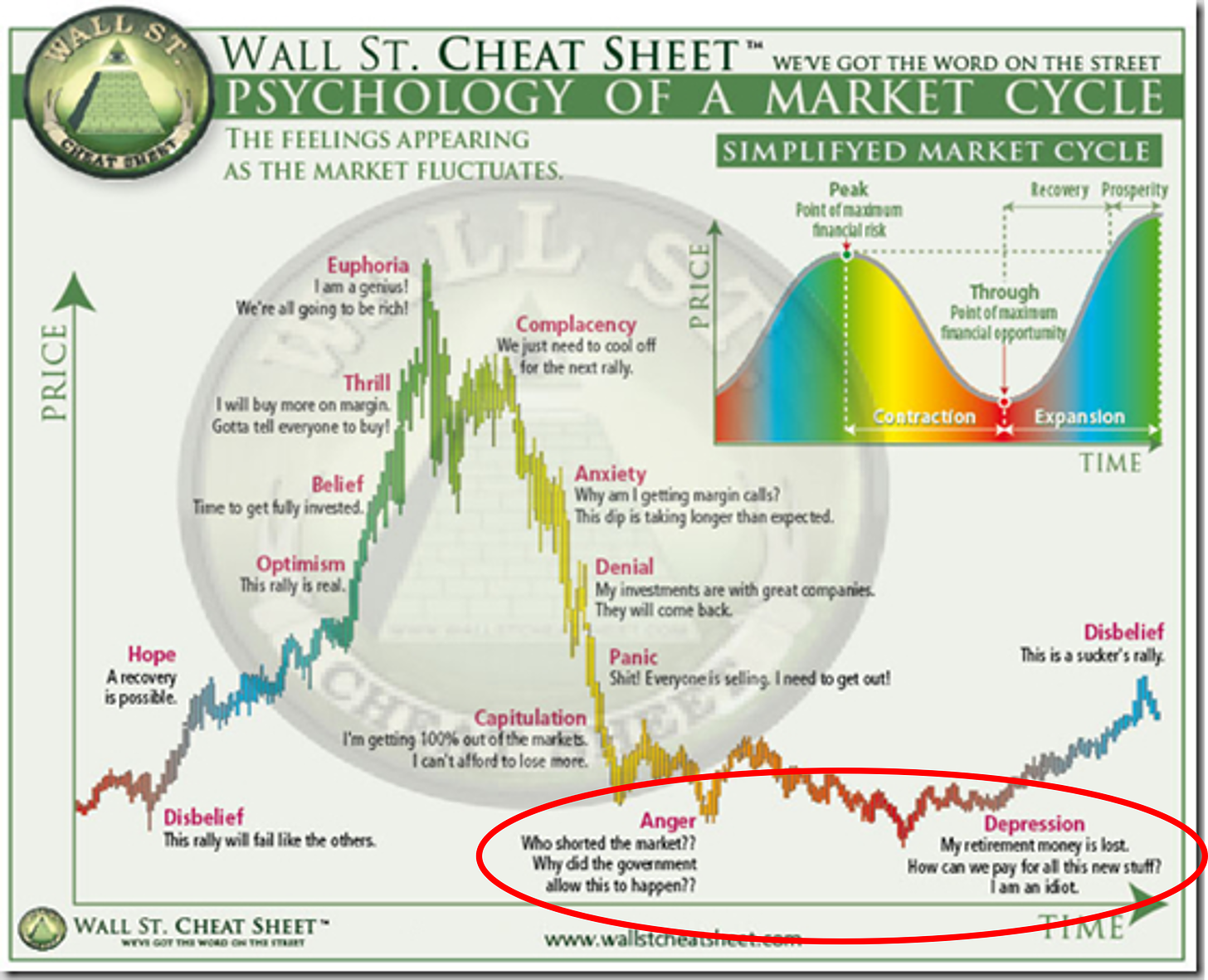

The market capitulated in May and we’re well past the anger phase of the Wall Street cheat sheet, but it’s unclear whether the bottom’s already behind us.

At the same time, the US government is draining liquidity from its financial system and trying to drive down the price of everything, everywhere. China remains aggressive in propping up its property market. England and Japan need extensive government interventions to keep their currency and debt markets from collapsing. The European Central Bank remains ambiguous about whether to raise rates into an energy crisis and possibly trigger sovereign debt defaults for some of its member countries, or let inflation run wild and possibly watch the Eurozone collapse.

Cumulatively, those economies produce roughly 70% of the world’s GDP.

And you think you’re going to find an analyst who knows exactly what’s going to happen next? You might upend your finances to avoid one fate, only to set yourself up for another.

For example, oil prices have collapsed in the past few months. You’re about to shift your investment strategy to capitalize on this change, then suddenly OPEC announces it’s cutting production in November.

How do you factor that into your decisions?

Fortunately, this is not a macro newsletter. We stick to crypto.

In my most recent update for paid subscribers, I shared an odd similarity in today’s price movements with those of April 2021, looked at some interesting behaviors among market participants, and reviewed ten more altcoins.

Tap this button to catch that update.

In last week’s poll, I asked “if forced to choose, do you think bitcoin's price will ever go lower than $17,600 again?”

67% of responders said “yes.”

That’s slightly higher than the “yes” rate when I ran the same poll in August.

What do I think?

Sure, I could see bitcoin’s price dropping to $14,000. It may even go up to $25,000 or $30,000 first. While that would seem extreme by historical standards, it would fit the range of volatility we see at market bottoms.

If you’re concerned about crypto, you might want to limit your exposure to US stocks, too. Many analysts say the stock market is correlated to bitcoin!

I’ll have another poll next week.

Mt Gox Saga Nears End of the Road

Bottom line: Mt. Gox awardees must finish their claims by January 10, 2023. In practice, this means verifying their identity, selecting a method of compensation, and registering with one of the exchanges that will pay out their claims.

My take: I thought these payments were going to go out by now. Can we get on with it? At least then we won’t have this cloud hanging over the market, where nobody knows the schedule for when these bitcoins will get distributed, how many people will opt for a cash settlement, and what impact the roughly $2 billion in bitcoins will have on the market.

Why we care: still another shoe to drop, the only question is how much impact this will have.

A few people wondered about whether to harvest tax losses (sell crypto at a loss, then buy it back again).

I share my thoughts on that in this video.

I don’t post many YouTube videos but if you want to subscribe to my channel, tap this button. You’ll get the videos as soon as I post them.

Circle removed $9 billion from USDC supply in the last three months

Bottom line: investors redeemed $9 billion USDC for US dollars since June. In other words, this cash left the crypto market and Circle burned the associated tokens.

My take: I talked about this in my September 30, 2022 update. Perhaps somebody at The Block was listening? All the other stablecoins went up or held steady. Usually, all stablecoins go up or down at roughly the same time (though not in the same amounts).

My best guess about why only USDC has seen a drop, but other stablecoins have grown or remained relatively flat?

If you’re an institution or large investor, you’re probably finally getting a good yield with T-bills, US bonds, and money-market funds without the hassles or risks of DeFi and other yield-bearing activities that involve crypto. So you’d want to cash out your USDC for US dollars, then buy those other investments.

Also, maybe some people swapped out their USDC in advance of Binance’s September 29 conversion of USDC to BUSD. Nobody knows.

Why we care: because that’s $9 billion that can’t buy crypto. At the same time, that $9 billion may have never been intended to buy crypto, it just stalking lower prices or farming yield in liquidity pools. And nothing prevents that money from coming back immediately. Getting USDC is very easy.

Stake now or forever HODL your peace

As I review ten altcoins with each update for paid subscribers, I sometimes talk about staking.

When the market’s calm and prices are low—like now—it’s a great time to move crypto into your personal wallet and stake to the protocols you like.

Staking gives you free crypto. It’s also a chance to try out the technology you’re buying into, and it forces you to learn how to navigate Web3 apps, interact with smart contracts, and use non-custodial wallets.

Blockchain.com published a good, brief article with an overview of the concept. If you’re not familiar with the idea of staking, read the article.

Visit CoinGecko or Staking Rewards to get staking information for specific projects. Also, YouTube has lots of how-to guides.

Here’s a little inspiration.

Job Corner

Gainium | Content Writer | Link to position

Phantom Wallet | Front End Dev | Link to position

WalletConnect | Swift/IOS Engineer | Link to position

Evmos | Business Development Manager | Link to position

Phala Network | Community Manager | Link to position

ENS | Project Manager | Link to position

Most of these job listings come from the ToolsForCrypto newsletter.

Relax and enjoy the ride!

Weekly Rundown - October 9, 2022