On March 30, 2020, I published this plan. It uses three lines to identify buying opportunities and two indicators to signal when we’re getting near a market cycle peak.

It took a while to create this plan because I tried to put too many indicators into my analysis of the market cycle peak. After fooling around for a bit, I realized I really only need to look at two indicators.

Subscribers, I’ll let you know when we start to see those signals. I will not sell until these signals hit specific, extreme levels.

At the same time, we buy at prices that let us capture the upside, rather than buying right before a crash. We might buy in the middle of a crash, but sometimes those are the best opportunities.

The goal is to build wealth with crypto without a lot of effort, stress, or trying to time the market. Sell only as a last resort.

Take a look at the plan, broken into “When to Buy” and “When to Sell” sections. You can see for yourself what to expect.

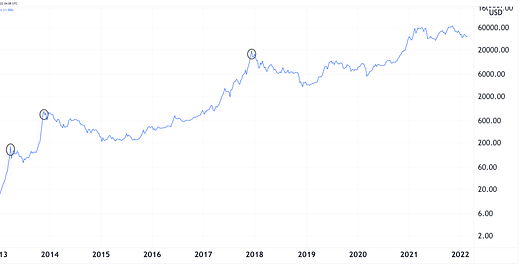

If you had followed my plan in 2017, you would have sold half of your Bitcoin at about $16,000 and the rest over several weeks, catching the market cycle peak of $20,000.

If you had followed my plan in 2013, you would have sold twice.

In March, you would have sold half of your Bitcoin at about $133 and the rest over several weeks, catching the market cycle peak of $260.

In December, you would have sold half of your Bitcoin at about $760 and the rest over several weeks, catching the market cycle peak of $1,150.

In other words, you would have sold only when the price was in the ovals:

Meanwhile, you would have bought each crash along the way, including the lull between the 2013 peaks.

You would not have sold in 2021 but you also would have not bought most of the time. For the entirety of that year, your average price would have been about $37,000 assuming you bought the same amount each day bitcoin’s price was in my buying zone.

(Dollar-cost averaging would have given you an average price of $47,000. Following my plan, you got 30% more bitcoin for the same amount of money.)

Keep in mind, I’m happy to HODL and use my bitcoin forever. In fact, I hope to do so! My plan makes sure we take advantage of the dips and avoid the peaks.

To steal a phrase from poker players, investing in bitcoin is a lot of boredom punctuated by moments of terror and ecstasy. This plan aims for less terror and more ecstasy.

Relax and enjoy the ride!

I read it, whew 😅... that’s very reassuring!! Thanks Mark

Mark, we love to follow you for the things you get right, but it would also be nice to get to know the things that didn't go so right and why. You know, we usually learn more from our failures than from our successes.