***NOTE I wrote this a long time ago but the information is still relevant***

Bitcoin’s price just went above its all-time high.

If you’re amped up about a $20,000+ bitcoin and not thinking about altcoins, that’s ok—come back to this post when you’re ready. I’m sure your inbox is flooded with other people talking about bitcoin, and for good reason.

Just don’t sit on it for too long, because the alts might not wait for you.

Big, long-term, positive trends are starting to converge for altcoins. These trends should continue no matter which way bitcoin’s price goes over the coming weeks and months. It’s an exciting time to be in this space.

For premium subscribers, I have talked about these trends for months and will cover them for the duration of this bull market.

Prepare now for altseason

Are you ready for an altcoin explosion that will make this summer’s surge look like a three-day DeFi pump-and-dump?

If not, get ready. If you’re feeling bad about seeing bitcoin run hard, you’ll feel even worse when altcoins zoom past it.

For those who don’t have any altcoins, you might want to get a private wallet like Atomic Wallet or Ledger and learn how to use, send, and receive altcoins with them.

Then, open accounts with any exchange that has a high trust score on Coingecko. I like KuCoin, Coinbase Pro, Gemini, Binance, and Bittrex.

Once you get used to moving crypto around, then you can try decentralized exchanges and swapping platforms. For now, stick to the exchanges.

Wait, Mark. I thought you were a bitcoin guy?

I am! Bitcoin is king. It has the best risk/reward profile on earth right now, inside or outside of crypto.

Some altcoins will do amazing things. You need to have them in your portfolio. You might even enjoy using them!

Contrary to popular belief, I’m not all about bitcoin. In fact, my portfolio allocation may surprise you.

In this post, I’ll share my perspective on bitcoin/altcoin diversification. I’ll talk about the altcoin market in other posts.

This post has sections:

Take inventory of all your assets and debts

My BTC-to-altcoin allocation

Look down before you look up

Spread the wealth

Remember maths

Can’t choose? Buy both

Questions

Take inventory of all your assets and debts

Did you know altcoins are among the riskiest of risky investments?

With altcoins, you have no rights or privileges as a token holder. Often, your tokens have no fundamental value. Your government won’t bail you out if the market crashes, and even the strongest projects could break up, get hacked, or go to zero at any time.

Many altcoins have ridiculous inflation schedules or treasury policies that encourage early investors to dump tokens on the market. Some have shady teams that aren’t really committed to their projects.

While you can’t ignore the 1,000x potential returns from holding these investments, you should probably make sure you’re in good shape if they don’t work out. A little planning can’t hurt!

To make sure you’re ready for this market, take stock of everything you own and all the debts you have.

Sign up for a free account with Personal Capital and link your investments, debts, savings, real estate, and other assets—including your crypto—to their dashboard. That way, you get a full view of your wealth and how your crypto portfolio fits into the big picture.

Tap this button to get a $50 reward for signing up and linking at least one account.

You can also sign up for personal wealth management. My financial advisor is super-knowledgeable about wealth creation and how to use different assets, investment vehicles, and financial strategies to put you ahead of the game. I learn something new every time I talk to him.

The dashboard is free.

My BTC-to-altcoin allocation

I keep a strong, core bitcoin position. It’s one of several assets I hold in my overall investment portfolio along with real estate, stocks, bonds, and cash / cash equivalents.

It’s not a speculative investment—in fact, I believe everybody should have some bitcoin. I never mix my bitcoin with my altcoins.

Today, bitcoin makes up about 30% of my total allocation to crypto.

That means altcoins make up 70% of my portfolio (probably more by the end of the bull market). Specifically, a variety of large cap and small cap alts.

For each individual altcoin, I buy an equal amount in USD. Always averaging in a little at a time, staking when I can, never taking profits, never “rebalancing” into bitcoin. When I use some of my altcoins, I replace those tokens with the equivalent amount of USD.

For example, I put $100 into altcoin A, $100 into altcoin B, $100 into altcoin C, and so on. Not all at once, but in small amounts over time. Doesn’t matter about the market conditions or how much an altcoin has gone up.

If I use $10 worth of their tokens, I buy $10 to replace them.

Maybe that means squeezing a little less “juice” out of the moonshots, but in this market, opportunities abound. Moonshots are everywhere. With so many opportunities, I can’t get salty about missing a few.

I already have some moonshots in my portfolio. Those moonshots will deliver 10,000% gains. No need to get greedy.

That may seem like a crappy strategy but think about the long run. For every winner, those gains compound over time—if you let them :-)

Look down before you look up

While any random altcoin may move in the opposite direction as bitcoin at any given moment, the overall altcoin market will rise or fall as bitcoin does. Bitcoin always leads, altcoins always follow.

Look at this correlation matrix, which shows how closely price movements match each other. Anything red signals a high correlation.

All the altcoins are red.

When bitcoin goes up, everything else goes up. Large caps, small caps, micro caps, and everything in between.

This may make it seem like you can buy any altcoin and come out ahead. And that may be true, but some altcoins will not ever get back to their all-time highs from 2017 and 2018.

For example, Litecoin can go up 100% from today to the peak of this bull market and give you amazing returns, unheard of in any other market that retail investors can access—and still not reach its previous all-time high.

Meanwhile, smaller cryptos will do far, far better.

When you look at altcoins from the last two market cycles, you can see most large-caps fell out of the top-30 as the market went up. Some died.

At the 2013 peak, the top 30 looked like this:

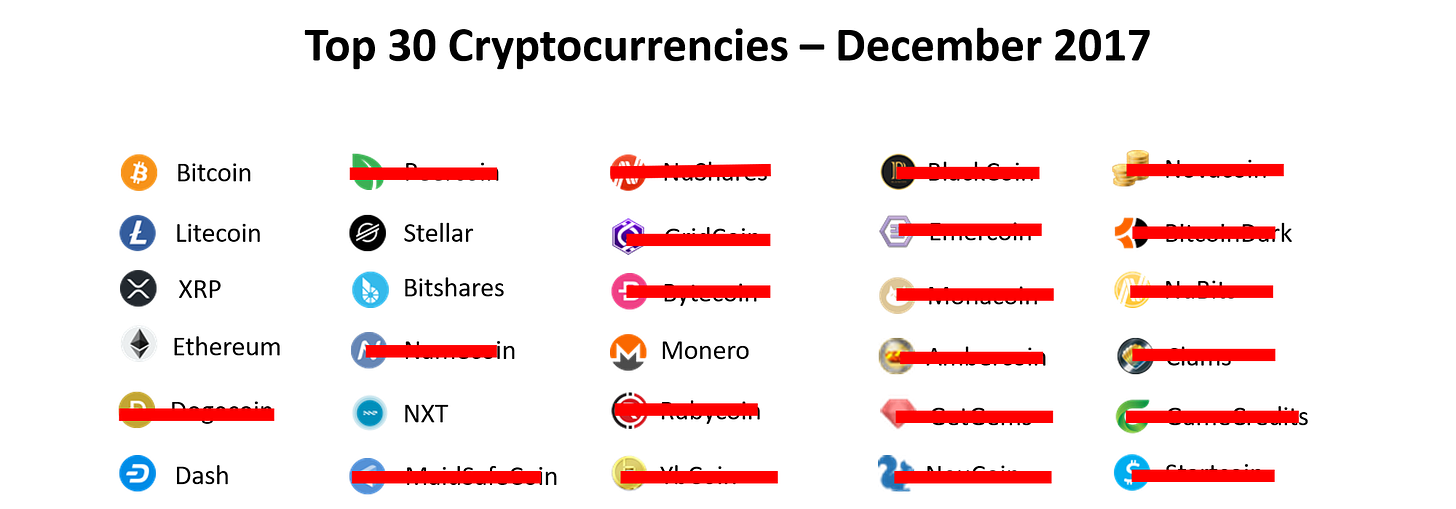

By the end of the 2017 mania, almost all had fallen off the list. Look:

Today, only three remain in the top 30:

Most died long ago.

To make this comparison a little fairer, let’s start from November 2015, the end of the first great altcoin bear market. Surely, any altcoin that survived that bear market should dominate the next bull run, right?

Not really. Here are the top 30 that survived that first altcoin bear market:

Only eight stuck around for the 2017 bull market peak:

Not good odds. It makes you wonder which of today’s top 30 will keep their spot at the peak of this next bull run.

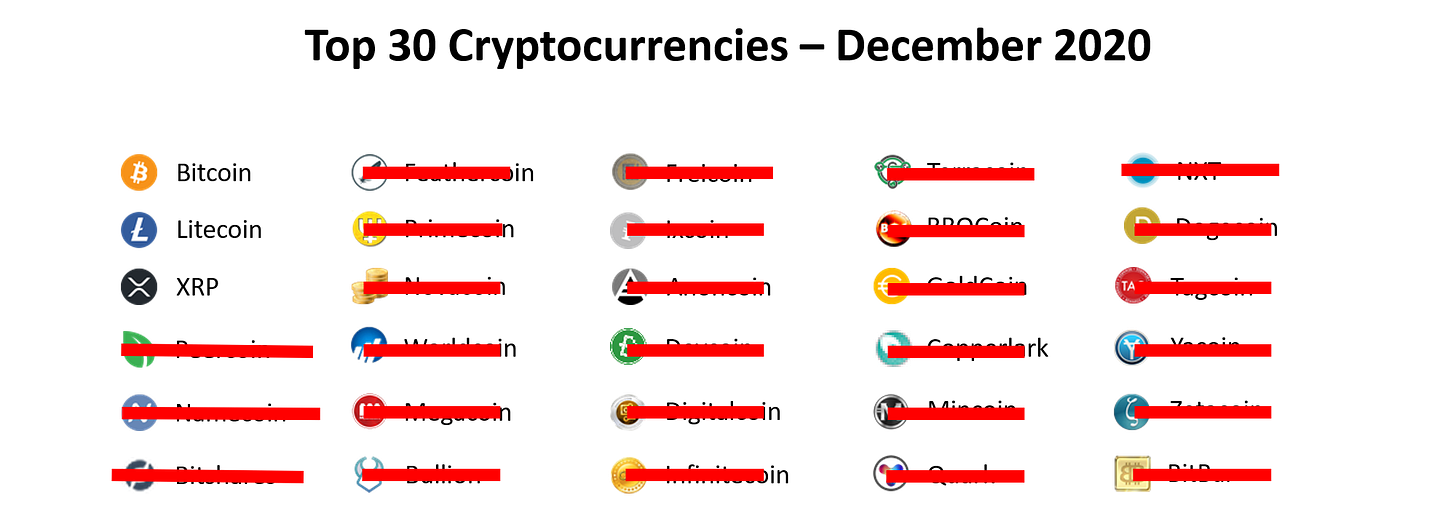

Compare the December 2017 leaders to today’s top 30, and you’ll see what I mean.

Bottom line: big altcoins are not safer than small altcoins. Old altcoins are not better than new altcoins.

Some of those fallen projects had legit tech with strong teams and a lot of momentum during their previous cycle. Some still exist today. They would have done you no favors as a portfolio asset.

Right now, you have billions of dollars worth of Bitcoin Cash hodlers thinking they’re going to get rich. I’m sure that’s how Feathercoin and NXT hodlers felt at the beginning of the last two bull runs.

From a pure investment perspective, you need to think carefully before you default into the common strategy of “mostly large caps like ETH, LTC, etc with a few small caps as speculations.”

They’re all speculations.

In a speculative market, why put money into the ones with old tech, disintegrating developer communities, no hype, and no real-world usage? Today’s leaders came from the bottom. Tomorrow’s leaders will do the same.

Look down before you look up. Start with my altcoin recommendations.

Spread the wealth

What's in your wallet?

Are you still holding large-cap altcoins that have lost their developers and users, with tokens that have no mechanism for capturing value? Are you clinging to the hope that a project that had good intentions, an innovative design, and a great team four years ago will recover its lost glory? Or that your DeFi darling will come back to life?

Some of those projects will explode and go several multiples above their previous all-time highs. We’ll also see a boom in the value of new projects with new technology or new solutions to big problems.

But nobody today knows which ones will win tomorrow.

Of the 7,000 cryptos, probably 90-95% of altcoins are worthless, dead, or headed to the graveyard.

That means you have about 350-700 great, legit projects to choose from. Plenty of moonshots, lots of opportunities.

For that reason, I spread my investments around many projects, about 50 as of this post. I let the winners run and the losers go to zero. Then I write off the losers on my taxes and keep the winners as part of my long-term financial plan.

When I lose, I get back 20-35% of my investment. When I win, I keep the gains forever (and only pay taxes when I use or sell them).

If we get that bull run everybody expects, every altcoin will boom, it doesn’t matter how big, small, used, useful, or useless it is.

On the flip side, if we don’t get that massive bull run everybody expects, you need to give yourself the best chance to catch those few tokens that survive, prosper, and deliver massive returns for years and decades. Those coins will make up for all the losers many times over.

Some people say you only need a handful of “good” alts.

I disagree. When altseason comes, it doesn't matter whether you have 5 or 50 altcoins. Your portfolio will go up.

What if we don't get that massive FOMO LAMBO MOON mania? Are you that good or so lucky that you can find those very few altcoins that survive?

You're shooting yourself in the foot by limiting yourself to just a few. Don’t set limits.

Remember maths

When all else is equal, small altcoins will give you better returns for the risk you take—even if their bigger competitor seems unstoppable.

It’s all about the bang for your buck, not necessarily some fundamental advantage. Find the fastest horse.

For example, $1 billion into Ethereum will barely budge the price while $1 billion into NXT will send it to the moon (100x at least).

Does that mean you should buy a tiny shitcoin and pray for FOMO?

No.

Some top cryptos have momentum, development, strong networks, and a lot of room to run. Most small cryptos have none of that.

(Not a statement about Ethereum or NXT.)

But some do. As long as that small project is strong, active, building, and its token solves a compelling problem in a way that captures value on the network, you can wager on its value going up—and every dollar into a small project will get you way bigger returns than you’d get with its larger competitor.

Can’t choose? Buy both

Once developers deliver products and services for commercial and retail users, you can start to separate the wheat from the chaff. That could take a little while.

Until we start getting traction and broad usage of cryptocurrencies, smart contracts, and blockchain-based products and services, you may want to play all sides. Every segment of the market has room for multiple winners. Just like almost every technological niche has more than one project that survives.

Pepsi is not the only soda maker. Aspirin is not the only pain reliever. Airbus is not the only plane maker.

You can build a lot of wealth from investments in their smaller competitors.

It’ll be years before the market sorts out the winners and losers. In the meantime, you can have your cake and eat it, too. Buy a few altcoins that play in the same space. For example, check Binance’s DeFi Index and drop some sats into each project listed.

If one altcoin dies, you win with your others. If a few stagnate, you only need one to succeed and you’ll make up for the losers many times over.

Questions

Why not take profits along the way?

Profit-taking means you gain less from your winners. At the end of the day, I want to use my government’s money to get more crypto, not use my crypto to get more of my government’s money.

Yes, I know some people use it to manage risk. I prefer to manage risk using the strategy above—putting small, equal amounts of money into each altcoin, averaging in, and limiting my overall portfolio exposure to any single token.

When it’s time to sell, I’ll sell aggressively. And if we never need to sell, all the better, then the winners will move into my broader investment portfolio.

Every penny of profit-taking eats away at my future gains. I’m looking for home runs, not quick flips. You can’t get 10,000% returns if you sell half of your position after a 3x pump.

Why do you think it’s ok to have 3-4 altcoins that do the same thing? Only one of them can win.

If you really believe only one can win, then you absolutely need to pick a few.

This is a speculative market. Nobody knows which cryptos will catch on or which ones have the best tech. Until we have a few years of real-world implementations and usage, you can’t pick winners. At best, you can make an educated guess.

With so much upside, in a market where the losers cost you little and the winners deliver insane returns, you can afford to be wrong quite often and still do very well. Most of my altcoins lag the overall market. A few died. Some returned 10,000% already, with lots of room to run.

Also, I’m not as confident as you are that only one altcoin can win. With every other technology, you have a few successful projects. Why would crypto be different?

Can you share your personal portfolio?

I prefer to keep that to myself. It’s too easy for people to criticize and scrutinize without knowing the reason behind my holding those tokens.

For example, I have XLM because it’s cheap to send, it settles quickly, and it’s embedded in the Keybase app. Lots of people take XLM. So do I.

Once bitcoin’s Lightning Network takes off, I’ll sell my XLM to somebody who can use it better than I can. Until then, I’ll keep it as a convenience. It’ll probably go up along with everything else, anyway.

It’s too easy for people to hate. I hate hate :-)

Do you have any suggestions or strategies that you like? Leave a comment!

Share this post