In last month’s issue, I looked at narratives and why reality matters more than facts, charts, and projections.

In this month’s issue, I reflect on cryptocurrency’s relationship with the legacy financial system.

If you want to hear an auto-narration instead of my voice, head over to the Medium version of this post.

What if modern finance is just an exercise in risk management and our financial leaders don’t have nearly as much control as they—or we—think they do?

Economic research does not have any experimental controls. It all works in theory, but once you go beyond very basic, broad principles, it always seems to fall apart without some government program or intervention.

No monetary policy can account for all of the variables that make markets. Nobody can account for all the changes, disruptions, vagaries, known unknowns, and unknown unknowns.

Why worry about having all the right answers? Why try to predict the future? Appreciate the circumstances and act accordingly.

If you’re on the paid plan, you know what the situation is now and what scenarios we can expect. We win no matter what happens next.

For that reason, I’m still following my plan.

If you’re following the plan, you’re up as much as 400% or down as much as 45%, but probably sitting on 10% gains with cash to spare. If you’ve dollar cost averaged that whole time, you’re down 7% on your investment. Most traders are doing worse.

Mark, seriously? Echo bubble, macro, Credit Suisse, US banks, China real estate! Get out of crypto!!!

Yea. Good luck picking your winners and losers!

You can also do well with a nice balance of assets, not just cryptocurrency. If you’re curious about my approach, read my portfolio strategy.

Choose your facts wisely

As people in the US discovered this month, even the safest assets and most trustworthy institutions can fail. Risk abounds—sometimes, in the most unlikely places.

Today, it’s US banks and Credit Suisse. Next month, maybe CLOs? Commercial real estate? Japanese bonds?

Yet, we still have money. What shall we do with it?

For the past six months, I’ve done cash, crypto, and bonds.

I figure it’s better to win sometimes than risk your fortune on a “strong conviction loosely held.”

You can make up for bad timing. Complacency kills.

US equities are still high against historical benchmarks. People are looking for an earnings recession, a real recession, a big crash, or at least a drop in earnings-per-share or P/E ratio back to something more in line with historical norms.

Can you trust conventional metrics like EPS and P/E? Wall Street did record amounts of buybacks in 2021 and 2022. Those buybacks artificially boosted share prices. Did those buybacks artificially elevate those metrics, too? Do these metrics seem elevated because they fail to incorporate changes in how businesses reward shareholders?

Does that even matter? Most companies issue more new shares than they buy back each year. Even after the buybacks, your equity is usually getting diluted (though you benefit in other ways).

This should skew the metrics in the opposite direction, right? Does that mean EPS and P/E might actually understate the value of a stock?

Man, this stuff is confusing!

You find only what you look for

No wonder it’s so hard to predict the future. We don’t even know what’s happening in the present!

The point is not about stocks, but about using data as a basis for your decisions. Or, more generally, what you select as your facts.

Are you sure your chosen metric still says what you think it does? As circumstances change, can you still apply it in the same way that you did before?

What about unemployment? Are we measuring that correctly?

Since 2020, we’ve seen a boom in people using the Internet and the gig economy to make extra money on top of their day jobs. Does that skew the employment data?

What about demographics?

The US population is shrinking and we’re getting older, sicker, and less productive—until you include immigration.

Once you do that, US demographics look great. Our population is growing and we’re getting younger, healthier, and more productive.

Do you include immigration because it reflects our present reality or do you strip that out because immigration policy can change in an instant?

What about inflation data? A few months ago, the US Bureau of Labor Statistics changed how it calculates some of the inflation metrics.

What does that mean for the Fed’s analysis and their decisions? Can we still compare today’s changes with the changes that happened in the past under a different calculation?

The National Bureau of Economic Research changed its definition of recession a few years ago. Under the old definition, the US had a recession in 2022. Under the new definition, the US may never have another recession again.

By one measure, Western banks are strong and resilient. By another measure, Western banks are on the verge of collapse.

And you think you’re going to find somebody who can figure everything out?

Go with what you got

With all that uncertainty in the data, its construction, and its significance, how can anybody make heads or tails of anything?

The Fed says it’s going to follow the data. What does that even mean? Economics is not a science. Data only tells you one part of the story.

Still, it’s better than nothing. Would you prefer to get your information from whatever the social media algorithms decide you should see?

With crypto, you can find lots of data. Way beyond whatever fractal or on-chain metric just crossed your screen.

I’ll continue to use that data to go beyond the day-to-day and look at the market from many dimensions so that we can put together a picture of what’s really going on and what we need to look out for.

We will never have all the pieces of the puzzle. Only in hindsight will we know what to do, and by that time, we won’t have a chance to do anything about it.

That’s the beauty of this asset class and this investment opportunity: the uncertainty.

It’s the only reason we can take a small amount of money and turn it into an outsized stake in the financial networks of the future. Once the market decides who wins and loses, that opportunity is gone.

Embrace uncertainty. Treasure doubt. Act with conviction, not in the belief in any one outcome, but in the belief that you have a sound strategy and realistic expectations.

They’re on to us

At the rate that cryptocurrency is growing, we may only have a few more years to get ahead of everybody else.

Billy the Neighbor ditched his trading career for his old day job but he’ll be back after BTC hits a new all-time high. Aunt Sally and Uncle Morton pushed off their retirement “until the stock market recovers” but they’ll be back, too, once their financial advisor suggests a 1% allocation to bitcoin “because it’s safe now.”

Even the International Monetary Fund knows what’s coming. Did you read its report on cryptocurrency?

In that report, the IMF said it has no standards for how to define, classify, regulate, and assess risks related to cryptocurrencies. Its nine-point framework proposes ways for its members to, in their words, “effectively mitigate the risks posed by these assets while also harnessing the potential benefits of technological innovation.”

You may be wondering, how can the IMF put out a framework for something that it can’t define, classify, regulate, or assess risks for?

The framework itself should accomplish all those things, but until somebody actually does what the IMF proposes, we can only guess.

No matter. They get it. They see what we see.

In their report, they acknowledge how quickly crypto technology is evolving, how poorly governments have adapted to its usage, and how significantly it will change modern finance and the way that money moves. They worry about what it will mean for their members.

Institutions like the IMF are modern-day versions of the priests I mentioned in the January monthly issue.

They’re aware that they will lose their authority and credibility if crypto can serve people’s needs better than they can.

At least they’re trying to do something constructive about it.

Their report doesn’t say anything about you, your needs, or your welfare. It’s all about their needs. They have a job to do. You are not important.

It’s dawning on them

While frauds and FOMO can make you forget about crypto’s true purpose, I won’t. Cryptocurrency is money for you, not the elites.

As such, you can understand their disdain for cryptocurrency.

Put yourself in their shoes.

You engineered a whole financial system that works better than any other. You already know everything you need to know to manage it properly. You conquer crisis after crisis. How could anything useful possibly come from any approach other than your own?

Our financial authorities have only just started coming to terms with an uncomfortable realization:

Cryptocurrency gives people choices and opportunities that the legacy financial system can’t provide.

Ten years ago, it was a funny little concept. “It’s useless except for blockchain,” they said.

Then smart contracts came along and they said it’s useless except for blockchain and fundraising.

Then they said it’s useless except for blockchain, fundraising, and stablecoins.

Then they said it’s useless except for blockchain, fundraising, stablecoins, and swapping assets.

How long until they say cryptocurrencies are useless except for blockchain, fundraising, stablecoins, swapping assets, and monetizing ownership rights? Incentivizing global data storage and distribution platforms? Fractionalizing the value of real-world objects? Securing massive, global pools of capital that anybody can tap into for whatever purposes they want at any time?

The stories we tell each other . . .

We need cryptocurrency to be useful. After all, our narratives have failed.

Bitcoin as an inflation hedge?

Failed. Its price is up only 500% since the pandemic stimulus. US real estate is up 50%, manufactured products are up 40%, gas is up 60%, the S&P 500 is up 70%, and gold is up 25%.

Obviously, you should’ve bought a house, car, gas, index funds, or gold to protect yourself from inflation.

Bitcoin as a store of value?

Failed. Its price is higher now than it was in 2017, 2018, 2019, 2020, most of 2022, and almost every day of its existence. Obviously, you can’t protect your purchasing power with bitcoin.

Bitcoin as money?

Failed. Nobody spends it, saves it, or trades with it. You can’t even take out a loan against your bitcoin! Obviously, nobody exchanges bitcoin for things.

If that makes no sense, shame on us for believing in narratives based on facts. Never works, does it?

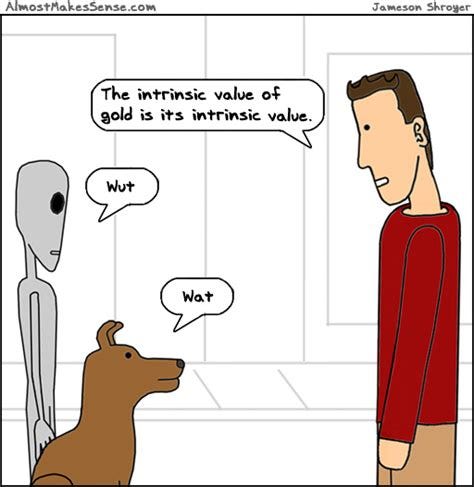

Not Intrinsic

At a Congressional hearing earlier this month, Federal Reserve Chairman Jay Powell wondered why any cryptocurrency has a price higher than zero because none of them have any intrinsic value.

What is intrinsic value?

US car prices went up 40% since 2020. Did their intrinsic value suddenly go up 40%? If not, then what does intrinsic value have to do with price?

US bond prices crashed last year. Did their intrinsic value collapse? If not, then why do financial assets need intrinsic value?

Maybe cars cost more and bonds cost less because they have no intrinsic value, only the price that people will pay for them.

I don’t know, I’m just a bitmoji.

While I don’t believe in the concept of intrinsic value, if I did believe in it, bitcoin’s intrinsic value would be clear:

Bitcoin allows you to send money electronically to anybody, anywhere, anytime, in any amount, without restriction, without giving away your sensitive personal information, without putting your assets in another person’s control, with certainty that your transaction will go through and every payment you receive is authentic and valid.

Nothing else does all of those things.

Whether it’s worth $28,000?

I’ll let the market decide. I’m convinced that my properties are worth way less than what I could sell them for, but the real estate market says otherwise. Who am I to judge?

Anyway, why would the financial elites care what I think? I don’t even have a master’s degree.

But these are all facts, not reality. Reality is only what people believe. Crypto hasn’t done enough to make people believe in it.

Yet.

You are the change that you seek

That will change once we have applications and interfaces that common people can use. Developers and engineers have made a lot of progress over the past few years and their work hasn’t stopped just because token prices went down.

Read Web3 Academy and ToolsForCrypto newsletters to learn about some of the things they’re working on.

While they work, we also need to play our part.

The rest of the world sees cryptocurrency as a monolithic technology. It does one thing, but nobody really knows what that thing is.

Maybe we can stop talking about principles, innovations, and esoteric economic concepts. Maybe we can cut down on the infighting, too.

Bitcoin is great money, but that doesn’t mean somebody else can’t have a better one. Ethereum has a lot going for it, but that doesn’t mean somebody else doesn’t have a better way to do smart contracts.

Let’s embrace the diversity of thought and initiative around cryptocurrency.

Yes, you know better than everybody else, but let them figure that out on their own.

It’s possible along the way, they discover something that you never thought of—a concept, approach, design, or application that you never would have discovered if you had shut them down, yelled at them, or tried to belittle and curtail their work.

Not everything is a scam or a fraud just because it fails.

Not everything is great just because you believe in it.

Live and let live

Surely, with all the intellectual capacity floating around the cryptosphere, we can venture to find refined and nuanced opinions.

Cryptocurrency unlocks financial innovation and experimentation in a way that was never possible before. Concepts that were once wildly experimental and purely hypothetical can now be tested in the real world. Monetary theories can be applied in something other than a textbook or a dissertation.

Let people experiment, ideate, create, test, bend, mold, break, hack, attack, stress, screw up, and do all the things that make humans amazing creatures.

The markets will figure out what works and what doesn’t.

It’s not our job to tell people what they can use cryptocurrency for. It’s cryptocurrency’s job to give people something they can use it for.

Does that mean you’ll get rich from a 100x moonshot on “the next bitcoin?”

Maybe, though that window is closing.

Start with the altcoins I have in my Altcoin Reports. They’re all legit projects doing interesting things. The sky is the limit.

Also, make sure you read my list of Top 100 Altcoins—Which Will Survive Through the Bull Market.

Still above $0

I wonder how Chairman Powell calculates an “intrinsic value.”

What’s the intrinsic value of the $300 billion the Fed created “just in case” banks need it? Can you put a price on the full faith and credit of the US government? Is it more than what you get from waving a magic wand?

With so much of the stock market’s behavior linked to government policies and central bank actions, can we truly assess the actual value of stocks? Or anything else?

So many of our modern monetary concepts revolve around the actions of governments or central banks. Do we know if they would work in the absence of governments and central banks?

Operating in a vacuum

Once removed from a world where a single entity controls the value of money, do these institutions matter anymore? Does their expertise still apply? Are those decades of research and analysis still relevant?

Much like scientists needed to re-examine the laws of physics once Einstein published his theory of relativity, perhaps economists need to re-examine the laws of money now that we have monetary systems that do not involve centralized entities.

Imagine you spent a lifetime developing the skills and knowledge to run the world’s largest economies and manage crises that threaten the safety and prosperity of entire nations.

You work hard and do your job well. Then a whole bunch of people tell you that you suck. They go off and create a new technology that will make you obsolete and undermine everything you are trying to do.

You and your peers gave them 13 years of economic growth. After the world’s economies shut down for COVID, your strong actions won back millions of lost jobs and saved thousands of businesses from collapse. Your leadership steered the economy to unprecedented prosperity, navigating a European debt crisis, Chinese currency meltdown, pandemic outbreak, and whatever’s going on now.

Deep down inside, wouldn’t you ask yourself, “why don’t they appreciate me?”

Wouldn’t you feel hurt and threatened? Wouldn’t you feel the need to defend yourself or prove that your way is better?

Your reaction might be to lash out, belittle, or patronize them. It’s not your fault they don't appreciate the good things that you’re doing. It's not your fault that they don't understand how things work. They’re foolish and dumb. So ungrateful!

Especially when you’ve been taught for years that money must be backed by government decree. Your government requires everybody in the country to use your money to pay their debts and taxes, therefore it is backed.

Now somebody comes along with a new kind of money that’s backed by immutable properties, functional utility, and massive social networks—but all you see are scams, frauds, and misfits spouting debunked economic theories.

Wouldn’t you feel a little insulted? Wouldn’t you worry about the tragedy they’ll encounter when they discover they’re wrong?

If you read my book, Consensusland, recall the latter part of the book, when Quentin talks to the governor. I wrote the governor's character to capture the mixture of arrogance, conviction, indignation, and condescension that you see from today’s financial authorities.

Are those financial authorities much different from the Catholic priests of Renaissance Europe who worried people would never get into heaven without doing what the Church said they should do? What good is the Church if anybody can get into heaven just by being a good Christian? How can the Church stay relevant if people start their own congregations anywhere they want and worship god on their own terms?

What if they find faith in a religion other than Christianity?

Give to Powell what belongs to Powell

If the legacy financial system is really good as they think it is, then they should not feel threatened or insulted.

They have no need to worry about cryptocurrency. They can have the full faith and credit of the US government. We can have the network effects and computational certainty of decentralized, permissionless financial protocols.

Crypto’s growth doesn’t have to undermine their authority. Their credibility doesn’t need to suffer as a result of our success.

Why do we have to pit one against the other? Why can’t we have one financial system that does not have any of the constraints of the legacy financial system, and a separate financial system that does not have any of the constraints of cryptocurrency?

Then we can collaborate wherever they overlap or complement each other.

Think about all the amazing ways that partnership could transform modern finance for the better.

You don’t think crypto could use people with decades of real-world expertise, a wealth of practical knowledge, and an insider’s perspective?

Isn’t it possible that we could learn a lot of really great things about how money works? How cryptocurrency can create more durable, stable monetary systems that do a better job of pooling capital, distributing it to where it’s most useful, and enabling all of us to have better lives, cheaper goods, more productive services, more profitable businesses, and more secure finances?

Why not bring in experts from the central banks to work on cryptocurrency projects? Let them share their knowledge and expertise.

Why not offer to work for the European Central Bank? Let us share our knowledge and expertise.

What about a non-governmental organization for cryptocurrency development?

At the very least, a forum to exchange ideas, publish papers, and collaborate on new projects that combine the best elements of cryptocurrency and the best elements of the legacy financial system.

Surely we can learn something from each other, if we try.

Good luck with that

Unfortunately, I don’t think anybody will try.

The establishment sees cryptocurrency as a threat to its authority. Cryptocurrency advocates see the establishment as a threat to their integrity.

Maybe the next step is not proving, validating, and demonstrating use cases.

Maybe the next step is finding shared goals that everybody can rally behind.

These are things I am mulling over. What do you think?

While it would be nice if the legacy financial system and cryptocurrency industry found common ground, let’s not get ahead of ourselves. We’re beneath them. We’re barely worthy of their acknowledgment, much less their respect.

When Martin Luther posted his 95 Theses, the Pope didn’t say, “oh, great ideas, I’ll take that under advisement. Maybe there’s an opportunity to reflect on what I’ve done to cause your frustration and work together to bring greater spiritual fulfillment to the people of this Earth.”

No. He had Luther arrested, banned his works, and kicked him out of the church.

I don’t think the world’s financial pope, Chairman Powell, will do anything as drastic. At the same time, we can’t expect him to reflect on why cryptocurrency might offer an appealing alternative to the legacy financial system. He’s certainly not going to read this newsletter.

As Max Planck wrote:

Truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Keep those legs moving

As a result, we need to continue what we’re doing. Let the lobbyists advocate for us. Let the developers build. Let the entrepreneurs and community leaders lead. We’ll support them with our time, money, and encouragement.

Stake your tokens. Participate in governance decisions. Run a node. Validate transactions. Mine crypto. Contribute to liquidity pools. Buy it. Sell it. Use it.

If you’re not on the premium subscription, upgrade now. You’ll get:

🔍 My crypto market analysis

🧐 Altcoin reports

📚 My plan and strategy for acquiring bitcoin and altcoins during bull and bear markets

📈 Technical and fundamental analysis

👀 Regular updates on what’s going on in the market

Look for a new altcoin report for premium subscribers within the next few weeks.

No matter what happens in the legacy financial system, I will continue to share my observations, strategies, and analysis. We’re all in this together.

Relax and enjoy the ride!

Share this post