In last month’s issue, I reflected on predictions and some bigger-picture themes that will play out in 2023 and the longer term.

In this month’s issue, I’ll talk about monkeys, recession data, crypto market trends, and the separation of money and the state.

Money is always and everywhere a social phenomenon

When researchers trained monkeys to redeem tokens for food, the monkeys didn’t just trade those tokens for vittles.

They also sold them for sexual favors and stole them when the researchers weren’t looking. In one instance, a capuchin tried to pawn off a slice of cucumber as a coin—perhaps the first documented attempt at counterfeit money in the primate kingdom.

Are we really so different than those monkeys?

After thousands of years of research, philosophers and economists still debate what characteristics make money desirable.

Do we need inflation? If so, how much? Should we use specie as backing? Does it work best in digital, with paper, or as a commodity? Should it represent an asset or a debt? What’s the best way to create and distribute it?

For them, it’s not enough that people can trade it for the things they want. Utility is not sufficient. Communities can’t decide on their own what they use as currency. Somebody in charge has to decide that it’s worth something.

The first recorded instances of money come from ancient temples and administrative buildings.

These records best resemble modern ledgers—a list of contributions to the temple or its merchants. Each thing was usually measured in bits of metal.

In the modern sense, a price.

Authorities set the terms, e.g., 1 bit for a basket of wheat, 2 bits for a small fish, 3 bits for a big fish, and so on.

Historians believe this was either a system of rewards, a way to account for individual productivity, or a substitute for the actual commodities they represented. Possibly all three.

Form and fungibility varied from one place to another, but generally, this money was more like Dave & Buster’s tokens than the cash we use today.

Modernity beckons

Somewhere along the way, we moved from bits of metal to numbers on a screen, from clay tablets to tablets made of plastic, metal, and glass. Units got smaller or larger, more or less portable, and easier to divide evenly and exchange with each other.

Technology changed, but function didn’t.

For our primate ancestors, a substitute for food. For our ancient leaders, a reward for industriousness or a measure of status. With modern technology, numbers in a spreadsheet and pieces of paper with fancy pictures on them.

We believe that our governments will protect this money, even though we have no control over their actions and only a vague notion of what consequences may come from their decisions. Many of us think we have some control over its use, when in fact we have only as much control as our governments will allow.

Our governments use elaborate financial engineering and market interventions to manipulate its value, all to control your behaviors and perpetuate the belief that it means anything more than what you can buy with it.

Yet, when you try to redeem a $20 bill with the Federal Reserve, they will give you a $10 and two $5s.

I can empathize with the people of 15th-century Europe when they gazed up at the massive public buildings, gilded chapels, and high arrogance of the Catholic Church.

Church authorities believed anarchy would ensue if not for religion to control the people, tell them what is right and wrong, and validate those who own wealth and control the system.

A few brave souls proposed to separate the church and the state.

Some had selfish motives, others had noble goals, but the result was the same: religious freedom.

This freedom gave rise to new liberties and innovations in thought, psychology, philosophy, and spirituality. It gave humans new outlets for creative expression, happy relationships, and psychic joy.

Finally, anybody could live a fulfilling life without conforming to a single religion—or any religion at all.

A new religion

Perhaps we can say the same about cryptocurrency? Once we separate money and the state, we can unlock new liberties and innovations in economics, justice, governance, and commerce.

I suspect if bitcoin maximalists are honest with themselves, they will recognize the religion that they have built around bitcoin.

What is religion if not strength of belief? What other institutions of humanity have persisted forever across time, distance, and culture? What other concept of the world encourages people to aspire to something better?

Religion needs no backing. It needs only faith.

In their religious fervor, bitcoiners created a type of money that inspires a strength of conviction and belief that’s every bit as strong as the mainstream’s adherence to any government currency or any other asset that humans perceive as valuable.

Like the Catholic priests of old, the legacy financial authorities look down on this.

After all, they've already figured everything out, how on earth could anybody have any notion of money other than what they say it should be, right?

Monetary policy must revolve around central banks, just as the sun and stars must revolve around the earth. You can see this with your own eyes! They have charts, astronomers, and professors who say it’s true, so it must be true.

Who are you to question their authority?

Mark gets people REKT again

With the sudden burst in crypto prices, you may already be eager to trade your tokens for more of your government’s money. To trade your stake in the financial networks of the future for a bigger share of today's closed systems of control. To buy back into the government money monopoly.

That makes sense.

Your financial and monetary authorities have stated openly that they want to make you poorer, take away your jobs, and crush your profits to preserve the value of their currencies and perpetuate the status quo.

Like the priests of the ancient temples, they have all the power. “Don’t fight the Fed.”

Besides, you have bills to pay, things to buy, and mouths to feed. You can’t eat financial liberty.

After all, everything’s going to collapse. Risk assets will get crushed. Take a flight to safety.

Are you sure?

Since May 2022, the crypto market has behaved exactly as it has at the bottom of every major market bottom. Remember this graphic?

Now look at this:

It’s cool, Mark, Imma still take profits, bro

Sounds good. Whose profits are you taking?

I took profits in 2018 and 2019. Most of my altcoins went up 100-400% at some point during that time. I sold half after 2x-3x gains.

Huge regret. I missed out on a lot of permanent upside to avoid a temporary downswing. Some of my altcoins are still up more than 1,000% (even after crashing more than 90% from their all-time highs).

That’s a lot of gains I lost from de-risking.

By the end of 2019, I learned my lesson, but only after I paid my government 35% of my gains, forked over more money in exchange and transaction fees, and missed out on all of the growth from that moment to today.

At the time, it felt responsible. Brilliant, even.

In hindsight, I lost a lot of money. I should've stuck to my portfolio strategy.

For whatever reason, I thought I needed to treat crypto differently. Everybody said taking profits is the safe thing to do. Risk management! Sell 50% on the first double.

It’s tough to squeeze the most juice out of this market when you’re always selling on the way up.

Never sell?

To be clear, I'm not saying you should never sell.

I happen to agree with Dr. Richard Smith, who said “90% of risk management is knowing when you’ll sell before you buy.”

After all, what's the point of having this crypto if you never use it? At some point, you're going to trade it for goods, services, or your government’s money. That’s the whole point.

Sell anytime you want, whenever you need money. Just like you’d sell a couch, your time and labor, or anything else.

When will I sell?

When my plan says to do so.

Hopefully, never, but if we see the two signals that I put into my plan, I’ll exit 100%.

Until then, buy low and grow. Set aside cash for whenever bitcoin’s price goes into the buying zone of my plan. Recognize when the market goes up a lot, it will come down a lot. Let the market rise and catch it when it falls.

If you’re following my plan, you could be down as much as 50% but you’re probably close to even and possibly up as much as 350%.

Compare that to dollar cost averaging. If you did that instead of following my plan, you’re down 25% since November 2021 and down 22% since I published my plan.

(These numbers are rough estimates.)

If you traded the market, you may have done phenomenally better but you're probably doing far worse.

With my plan, you’ll also get alerts when bitcoin’s price enters and exits my buying zone.

Today, my plan says to set aside money for the next opportunity. That opportunity may come at any moment—possibly by the time you read this issue.

2023 cryptocalypse?

Mark, we spent all of last year going down. Did you see this scam pump? Don’t be like the sheep! Even Teeka Tewari says not to buy cryptocurrency, that this will be a terrible year.

Seems reasonable. More terrible than 2022?

Sometimes, markets can surprise you. One year ago, a whole bunch of people said we'd be in a recession by now. Now they're saying that a recession will come next year.

What happens if next year comes and there’s still no recession? Or, what if we’re already in a recession, we just don’t know it yet?

Headlines tell you everybody’s getting laid off even as the economy continues to create more jobs with each passing month.

You and I have expected a recession since the US economy reached full employment (generally considered 4% unemployment or less). Within five years of reaching full employment, we have a recession, like clockwork, as you can see in this chart.

We reached full employment at the end of 2021. Expect a recession by 2026, if not sooner.

We see something similar with yield curve inversions, when long-term bonds yield less than short-term bonds. Every time that happens, we get a recession within two years. We’ve had an inverted yield curve since February 2022. Expect a recession by 2024, if not sooner.

Unless you use the old definition of recession, “two consecutive quarters of negative growth.”

If you use the old definition, we had a recession in 2022. Does that count? It used to.

For all we know, another recession has already started. The way the US labels these things, it only does so in hindsight. We won't find out for at least another six months whether the economy is in a recession today.

Macro analysis is confusing!

Whether we’re in a recession or not, we have higher interest rates and more economic stress now than we did last year. So there's no reason to expect anything will get better before it gets worse.

The question is, how much worse? Enough that we need to upend our financial plans?

The economic data says . . .

Any objective measure of economic activity looks really bad for the US.

While that may not matter where you live, it’s not good for the world. The US has the biggest economy and more than one-quarter of global wealth. Wherever it goes, the rest of the world follows.

Many forward-looking indicators are so dismal that you only see comparable readings after a financial crisis—and we haven't even gotten the financial crisis yet!

How can anybody make sense of it?

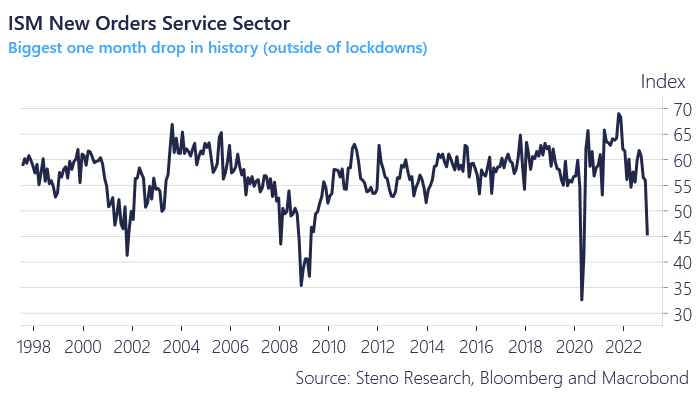

For example, ISM new orders, a measure of demand for manufactured goods. Look at the drop last month.

This is the first time we’ve seen a drop that severe outside of a recession. All other times the metric moved below 50, the economy had already shrunk and the Fed was cutting rates. Today, the opposite is happening.

Does this mean manufacturers are done for? Did they save enough money during the boom of 2021 and 2022 that they can weather the pullback?

Or US household debt. It just reached its all-time high, just as rising interest rates make that debt harder to service.

Once you adjust for disposable income, household debt has almost reached the same level it did for the entirety of the 2010s.

(Note, this data accounts for the way those higher rates increase the payments people make when they pay down their debt.)

Even if it makes a big leap, it still reaches 2011 levels at best.

Does this mean US households are on the brink of massive default? Or are we just getting back to normalcy?

We’ve known for months to expect great deals on cars in 2023.

Already in the US, used car prices have cratered. It’s a worse year-over-year drop than anything we saw during the Bush recession, the Global Financial Crisis, or the COVID crash.

Delinquencies have started creeping up, too. The most recent data shows late payments trending back to pre-pandemic levels.

On the other hand, dealerships still sell cars as quickly as they get them.

That’s already changing as buyers disappear and inventories grow, but we still have a long way to go before we get into the historical danger zones.

Does that mean imminent collapse? Do dealerships have enough cash and solid inventory management practices to manage the transition back to a healthy market?

Housing?

Mortgage applications have tanked and buyers are canceling build orders at the highest rate ever. That’s bad for builders and a sign of falling confidence and tighter household budgets, but it also holds back the supply of new homes.

That’s good because 2023 will see a glut of failed Airbnb rentals, unnecessary beach houses, and homes that the soon-to-be-unemployed will need to sell.

Also, home equity is still at a historically high level and fixed-rate mortgages are historically low. People with houses have less incentive to sell and more reserves to dip into during times of hardship.

Wages keep going up and the US population continues to grow and get younger. People need to live somewhere, and if this recession lowers the prices for goods and services, anybody who keeps their job will see an increase in purchasing power from the money they make, while housing prices should continue to fall for the foreseeable future.

Does that mean the housing market needs to collapse? Or, can we go back to the long-lost days when anybody with a decent job and good credit can afford to buy a house?

The world economy isn’t looking much better. Global Credit Impulse, a measure of new household and commercial debt, has never looked this bad on a 12-month forward projection.

Yes, it’s worse now than when the US housing market was emerging from the subprime meltdown, China’s exports had only just started to recover from their 2008 collapse, and Europe was in the throes of a debt crisis.

Does that mean we should expect a similar fate? Or, that we should expect a recovery because that’s what happened the last few times we saw such extremes?

I’m glad I don’t write a “macro” newsletter

Messy, messy stuff—and I left out a lot of other data that’s just as confusing!

Does it matter that every previous time we saw the terrible readings in those charts, the Fed was lowering rates, but today it’s still raising rates? Does that make the prognosis better or worse?

Also, what happens if the Fed sees these same leading indicators and decides to change its behavior in advance of the consequences predicted in these charts? Can we avoid the same fate as previous times?

Are these readings a warning about the future or the result you get when you go from an artificial, globally-coordinated pump-and-dump back to “normal” on historical benchmarks? Are they statistical quirks or durable findings?

We shall see.

Sometimes, fate intervenes.

You spend 2022 expecting a European energy crisis, so you stockpile supplies. When an unusually warm winter comes, you end up with a massive surplus. Crisis averted.

Last year, Pakistan and Egypt seemed destined to default on their sovereign debt. They may still, but thanks to government interventions and outside assistance, they've pushed off the day of reckoning—perhaps, forever.

China’s real estate sector is being held together by gum wads, rubber bands, and a whole lot of government support. Maybe that's enough?

On top of that, the federal reserve has facilities and liquidity programs they did not have before 2020. Do these facilities and programs change the dynamics, our expectations, and the Fed’s ability to respond to changes in the markets?

Challenge the assumption

What if the underlying cause of economic insecurity and instability isn’t a change in monetary policy? What if the cause is the legacy financial system itself?

Why is this system unsustainable without extensive government intervention and market manipulation?

If chimpanzees and capuchins can use simple tokens to satisfy their natural desires, why is it such a struggle for humans?

What have our religious, er, I mean, financial authorities done to make this so complicated?

It’d be nice if we could test monetary and economic theories in the real world. Or, build alternative systems that do not depend on human intervention, financial engineering, and accounting gimmicks. Or, if they do, they do so in a public way that people can choose or choose not to accept.

With crypto, we can do this.

Maybe we don't need PhDs in lab coats dispensing tokens to primates or high priests throwing us rewards for doing their bidding.

Wouldn't it be nice to find out?

Isn't it time we tested the assumptions that our economic experts take for granted? Can't we use this new technology to validate centuries of human thought, invalidate archaic assumptions, and perhaps create new avenues of discovery and exploration?

Blockchain and smart contracts let us test new concepts with scientific precision in the real world. This is impossible with legacy technology.

Mark, why are you talking about monkeys and economics? Just tell me if the bottom’s in, and what crypto prices will do next!

I talk about that in my updates for premium subscribers. If you’re not on the premium plan, upgrade your subscription now.

When you subscribe to the premium membership, you get regular updates on the market, commentary on altcoins, and technical, on-chain, and fundamental analysis.

Don’t stop thinking about tomorrow

While bitcoin’s price remains uncomfortably low against historical benchmarks, it’s behaving as it normally does at market bottoms. In fact, if bitcoin’s price stays above $15,600, the bull market started more than two months ago.

That may sound crazy, but that is the literal truth, even if it doesn’t feel that way.

Fortunately, it will be months, possibly years before people agree on whether cryptocurrency is in a bull or a bear market.

If you’re making your decisions based on whether or not bitcoin is in a bull or bear market, take a step back and look at the situation.

We just broke a small falling wedge, a bullish pattern. If that pattern completes to its expected target of $26,000, it will break a much larger falling wedge, with a target of $55,000 within the next year or so.

In May 2022, we saw the first signs of behavioral capitulation. In June 2022, we saw all of those signs.

In November 2022, we lost the #2 crypto exchange and bitcoin’s price fell barely 20%—a trivial move.

Over the past few months, we’ve seen positive growth in new addresses, short-term HODLer behaviors, and accumulation patterns. We’ve also seen bottom levels on almost every on-chain metric.

A drop to $14,000 still makes sense, but if you're waiting for that to happen, you could be waiting forever, as I explained in a recent post, Is $14k bitcoin the new $100k bitcoin?

Does that mean you need to buy crypto now?

No. You never need to buy crypto. Why would you trust your fate to a speculative financial experiment?

Know what you’re getting into

When you buy crypto today, you’re not getting cash flow. You’re not earning profits and dividends.

You’re getting a little bit of the wealth that these global, decentralized, open, permissionless protocols will deliver to humanity in the coming years.

(With some altcoins, you’re also getting rewards from staking, delegating, validating, or participating.)

This is a bet on the future, not today. Choose now whether you want crypto or more of your government’s money. That decision will shape everything.

If your goal is to use crypto to make more of your government’s money, there’s really no reason to follow my plan but you may want to upgrade your subscription anyway.

In my updates to premium subscribers, I sometimes point out some very simple, obvious trading opportunities. I also share signs and signals that can help you identify opportunities and risks as market conditions change.

Whatever you want to get from this market, I’m happy to continue sharing my perspective, insights, and knowledge.

For the intrepid few who can brave the challenges that this market brings, who can weather the ups and downs, who can navigate the rough waters that lay ahead, the next few years will be easier than you think.

What happens to centralized entities doesn’t change the value of the decentralized protocols they’re using. Sometimes, it proves their worth.

The market can go up and down 50% at the peaks and at the bottoms. Also, at every price in between.

It’s nice to have lines on the chart as guideposts. It’s great to have data to help us make sense of what people are doing. It’s useful to have metrics and models to help us conceptualize the madness and absurdity of humanity.

We need a leg up on the chimpanzees and capuchins. We need an alternative to the legacy financial system.

Let’s not get so wrapped up in charts and dot plots that we forget where this journey leads:

Freedom.

Relax and enjoy the ride!

Share this post