In last month’s issue, I talked about the meaning of our work (before the next upswing makes everybody forget about it).

In this month’s issue, I’ll reflect on predictions and some bigger-picture themes that will play out in 2023 and the longer term.

Predictions are easy when you make them up

One year ago, I gave a prediction article to Luckbox and Bitcoin Magazine.

Both publications got the same draft, but their editors revised it in different ways (sometimes to convey a message I didn’t intend, especially as pertains to altcoins), so I’ll provide both versions:

In a nutshell, I predicted something kinda like what we went through in 2022—a terrible time for crypto but a great investment opportunity for us.

How did I know?

I didn’t. I made it up.

Predictions are always nonsense, but it’s fun to speculate. I did that last year with those articles. I also did it in 2020 with my Special Issue: How High Will Bitcoin Go?

Do you want to read the 2023 prediction that I gave to Luckbox magazine? Read it here:

(Bitcoin Magazine didn’t ask this year.)

As with my other predictions, use it to visualize risks, identify opportunities, and get some perspective about what will cause things to happen in the future. Don’t make any decisions based on them.

Nobody can be right or wrong about things that haven’t happened yet. Even in hindsight, good people can disagree about facts, causes, and the significance of the outcomes—and whether the things happened at all!

Sometimes, you end up being right in spite of yourself. Even the worst poker player can make a gutshot straight draw.

Other times, you expect a perfectly reasonable outcome that doesn’t happen. You flop trips but lose your stack to that gutshot straight.

Right and wrong are closer than you think

Anyway, for the first four months of this year, I thought my 2022 prediction was way wrong. I said as much in the April 2022 issue.

Then, May brought disaster. UST collapsed, triggering a cascade of misfortunes.

Maybe my 2023 prediction will go the same way? Start in one direction, then veer in a totally different direction and end the way I predicted?

I guess we’ll see. Could go the other way—start with something that matches my prediction and end with the opposite.

Dammit, Mark, always with the 50/50 analysis!

True.

If it makes you feel better, my U2R data model says the price will go up eventually, and I put a lot less effort into U2R than any of my predictions. Does that count as strong convictions loosely held?

Markets shift on a dime

In April 2022, we saw a confluence of price, stablecoin activity, movements of bitcoins, and macro conditions—a toxic brew that created dangerous conditions for the lending platforms, people who borrowed against their crypto using those lending platforms, and any private deals related to those positions.

Do you remember this video or any of the other content I posted in April and May?

In hindsight, you might think the market had to collapse.

Why? Risk abounds in all financial markets. Often, they resolve themselves peacefully or never come true.

We only knew the market had cooled off. “Bearlish,” as I put it, in the middle of a three-month upswing, waiting for more shoes to drop, hoping they wouldn’t, and recognizing that even if the market tanked, nobody could say how bad things would get.

As it turns out, very bad.

You can point to many reasons that this market fell apart so drastically. Excessive leverage, bad bets, speculator fatigue, rate hikes, US regulators, and so on.

While that certainly didn’t help, I’d propose a different cause:

Fraud. Blatant fraud.

Not the ever-present pump-and-dumps. Not yield-bearing protocols subsidized by speculators. Not well-meaning developers whose experimental financial technology failed (or worked exactly as designed, but with bad consequences).

Just plain old human fraud: 3AC, Celsius, FTX, and other entities that lied about their businesses and stole other people’s money.

We hang the petty thieves and praise the great ones

Which brings us to the biggest of the big fraudulent frauds, Sam Bankman-Fried.

Everybody knows what happened now. Very simple story:

FTX took user deposits to pay off Alameda’s bad bets and fund FTX’s expansion.

“FTX experienced a bank run against illiquid assets that lost value too quickly.”

—People

Umm…

FTX is an exchange, not a bank.

There should never be a bank run—your crypto should always be there!

The terms of service even say so.

It’s like if you left your car with a valet. Later that day, you saw the head of the valet company drive off in a car that looked just like yours.

When you asked for your car back, the valet company said they couldn’t find it and didn’t know what happened. They’re sorry, they’re just really bad at running a valet company, they’re pretty sure your car’s there somewhere, and as soon as they find out what happened, they’ll testify in front of your Congressional committee.

Later, you get a note from the head of the company. He says your car’s gone and he’s “sorry he screwed up.”

While that may be true, it’s not an excuse.

It’s theft.

Get the story straight

Such are the perils of centralized, off-chain agreements that nobody can verify and trading positions that can’t unwind in an orderly way.

Perhaps if these arrangements had started and ended on the blockchain, everything would’ve turned out differently. You can’t defraud a smart contract.

For that reason, we invest in protocols and the tokens that power the financial networks built on those protocols—not the businesses that exploit those protocols for their own gains.

We do this for our security, portfolio growth, and a stake in the financial networks of the future.

Poor “macro” conditions may tamp down on the speculative enthusiasm you need for FOMO LAMBO MOON SUPERCYCLE. Still, the bet is that we’ll get better returns from owning a stake in projects that have good protocols and tokens designed to capture value from their growth.

Those tokens have as much value as any other asset you own. As they mature, some will see massive appreciation and long-term, durable wealth you can draw from for years.

Plan accordingly.

If you’re interested in seeing my portfolio strategy, tap this button.

All in how you describe it

Does it seem odd to say digital tokens have value?

If blockchain is a technological innovation and cryptocurrency is a monetary innovation, then tokens are a financial innovation. They represent the value that protocols capture from large pools of capital and investment.

That you can exchange those tokens for your government’s money or other goods and services?

Bonus.

This may seem bizarre to a lot of people.

Surely, every asset that could ever exist was already created, right? There can never be any other form of value than the forms we already use, right?

Exactly, Mark. Altcoins are just like Dave and Buster’s tokens or Chucky Cheese points.

That’s a sweeping oversimplification that applies to some, but not all, altcoins.

Outside of Dave and Buster’s, your tickets and reward points are useless. They have no cash value, can’t be resold, and can only be spent on over-priced prizes from a single company.

Unlike Dave and Buster’s tokens, many altcoins run on immutable, open-source protocols with global fungibility that give you trustless, instant settlement of transactions and permissionless access to build businesses and applications.

They’re financial networks. Tokens are the mechanism for capturing and exchanging value within those networks.

Sounds crazy. Certainly crazier than buying shares of stock.

Mind games forever

Or is it? Maybe stocks seem “normal” and “intrinsic” because we’re used to them. After a few centuries of usage, people assume they’re worth something.

What did stocks sound like when they were first invented?

Let’s go back to the 16th Century, with the first sale of ownership stakes in the Dutch East India Company.

You can imagine the conversation between Young Johan and Beatrice when they tried to explain the idea to their British aunt and uncle, Lady Sally and Lord Morton.

“Ye giveth thy money to the business. They give you a piece of paper in return, then do whatever they want with your money.

Sometimes they pay you nothing. Sometimes they give you a penny or two every few months. Sometimes they die. But if the business does well, you can sell that piece of paper to somebody else for more than you bought it for.”

Today, nobody would describe stocks that way.

Few people would be able to describe stocks at all, because 90% of stockholders don’t know what they’re holding or how it works. It’s just so common, they accept it. They don’t ask questions.

We believe stocks have value because people make money off of them and sometimes we do, too. People we trust tell us that they’re valid investments. They’re part of our pension funds and retirement accounts. TV and radio shows talk about them. We have laws and government agencies to regulate them. Some of us get them from our employers in return for taking a lower salary.

We need to believe in stocks. Our entire financial system depends on this belief.

Make them believe

Seemingly nobody believes in crypto anymore. Not even many people who subscribe to this newsletter and read this post.

That’s our challenge to overcome—the lack of belief in this asset class as an investment.

Some think we need to explain to people how this stuff works. Once people understand it, they’ll commit.

“Crypto didn’t fail, the centralized entities failed” and “scammers and criminals use the technology, but crypto’s not a scam or a tool for crime.”

I don’t know if that matters as much as you think.

We don’t use computers, cars, savings accounts, dishwashers, and pens because we understand how they work. These things make our lives easier, better, and more fulfilling. They make our businesses more competitive and our households more productive.

What does crypto do to make people’s lives easier, better, and more fulfilling?

Fast money with little effort

Global, immutable proof of ownership over your creations (e.g., NFTs)

Cheaper ways to sell things to other people

Sense of community and belonging

Access to money and capital

Freedom from censorship and capital controls

As long as crypto can deliver these things at scale, we don’t need to explain anything. The technology will speak for itself. People will want to use it, have it, and advocate for keeping it.

The problem is, the technology isn’t ready to deliver most of these things at scale.

Laws first, then money

That will come, possibly sooner than you think, from advancements in ZKproofs, rollups, layer 2 protocols, better smart contract platforms, simpler wallets, more robust developer tools, and more developers.

New projects like Ease.org, Cypherock, and Harpie will make crypto more secure and easier to use without creating centralized off-chain entities.

Ledger’s new touchscreen wallet, which packs a ton of functionality into a smartphone package, might revolutionize storage and interaction with smart contracts.

Improvements in protocol design and implementation will bring down the cost, complexity, and clumsiness of today’s blockchains.

First, we need to make it through the regulation and litigation stage of crypto’s development. FTX all but ended institutional interest and gave a lot of people a reason to keep their money out of crypto.

After all, if you can’t trust the #2 exchange and the de facto face of the crypto industry—our one-time “savior”—how can you trust anything in crypto?

“Price go down” and higher interest rates drove off the fast, easy money crowd. Now, everything seems like a fraud, a sham, and a waste of time and money.

Governments will clean that up with laws and enforcement actions. Some good people will get crushed, but hopefully few (ideally none). We’ll be left with fewer scams, more responsible participants, and more trustworthy businesses.

Then, Wall Street will enter.

Legacy financial firms will buy DEX tokens or create their own DEX tokens as registered securities. They’ll launch new altcoins and set up lending businesses, just like VCs, except they’ll manage risks appropriately and present a more professional image.

They’re already aghast that so many crypto companies literally printed money and still failed. Think of the opportunity for anybody who can do it the “right” way.

With time, people will forget the exchange shenanigans and Ponzi schemes. Aunt Sally and Uncle Morton will realize the crypto businesses failed but the protocols persist.

They won’t know how or why, but they’ll know there’s something interesting going on.

Cryptocurrency technology and user experience will mature to the point that it fails as much as the legacy financial system (possibly less). Better yet, it will offer safe, easy ways to do things the legacy financial system can’t do.

This is the next challenge. Not education. Not utility. Not bull markets.

Build trust, deliver something great, and wait for prices to go up long enough that people think they will keep going up.

The rest will take care of itself.

Don’t verify, trust

Let’s not get ahead of ourselves. That’s tomorrow’s market. A whole lot of sentiment will have to change first.

A tall task when our present commentary is dominated by naysayers, dooms-dayers, and haters.

Now that Tony on the TV has started selling pillowcases, Priya in the Park’s going viral telling you that crypto’s a scam that will die. Billy the Neighbor capitulated in May after losing his money trading LUNA during the death spiral and only just sold his Tesla stock at a 60% loss because he wants to get out “before the next crash.”

Samantha Down the Street puts a little into bitcoin each month because her boyfriend tells her to, but she never checks her CoinGecko app and she’s out of altcoins because YouTube told her to wait for the bull market.

That leaves you, me, and the Bitfinex’ds of the world.

Hey, Bitfinex’d and all of your friends, do you know what would be great?

Facts, evidence, and data to validate your accusations, preferably before they come true.

Anybody can make a list of entities and hurl insults at people. If your list is big enough, you will always be right about something. If your insults are vague enough and directed at enough people for a long enough time, you’ll hit on something eventually.

Anybody can point out shady stuff. Businesses can stay shady a lot longer than you think (sometimes, forever).

When you mix your good points and observations with misleading, out-of-context video/audio clips, conspiracy memes, circumstantial observations, speculative theories, “crimes” that aren’t crimes, and outright slander, it’s hard for us to appreciate the valuable contributions you make to this space.

We need you to balance out the moonboys and remind us of the risks that come with crypto, not shame people with aggressive, obnoxious attacks that make everybody else feel scared, confused, and angry.

Stop crying wolf. Just show us the damn wolf.

We need you to give us data, not conjecture. Evidence, not reminders of bad things that happened in the past. Facts, not misreadings of on-chain transactions and legal documents.

Proof would be nice, too. Do you want us to verify everybody else, but trust only you?

Perception is not reality

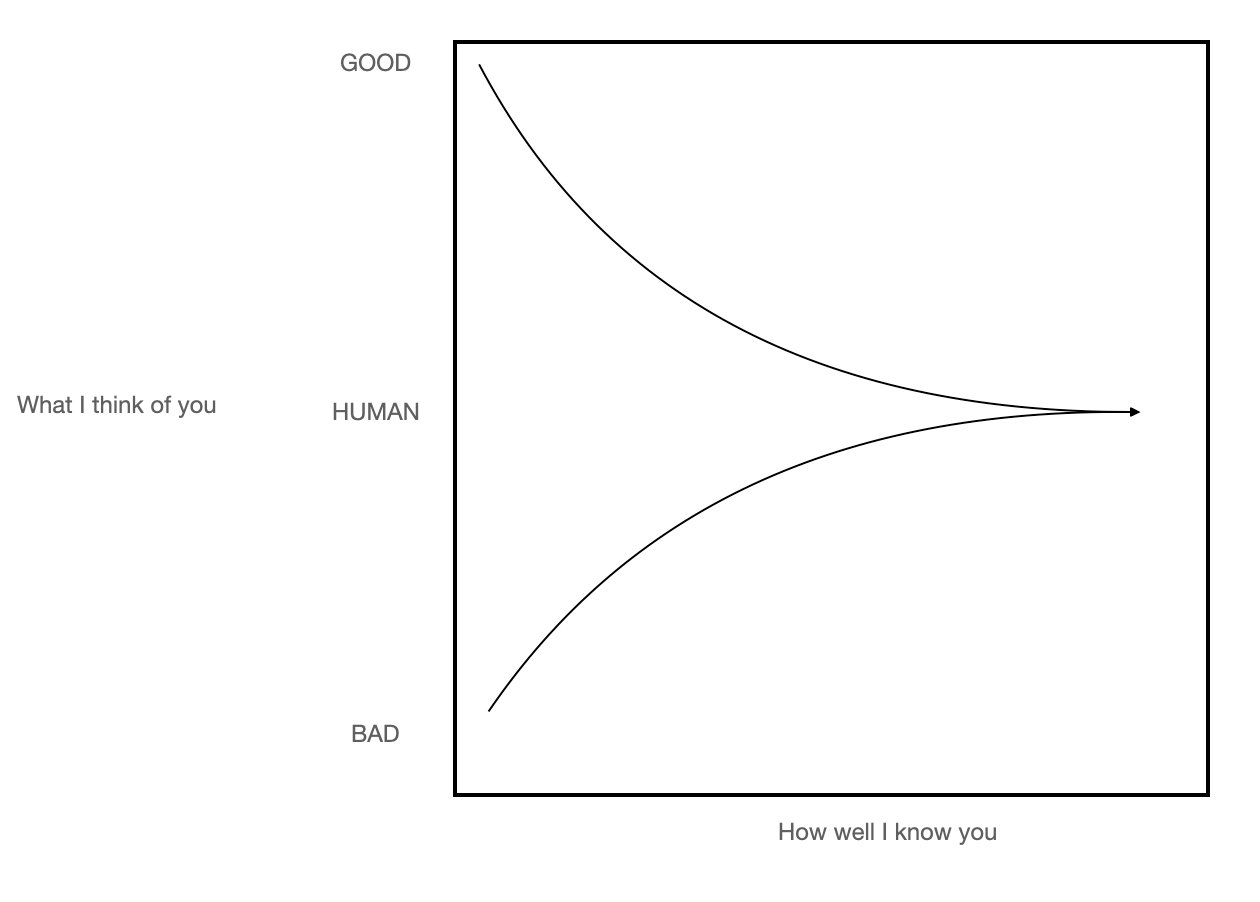

Rather than look for people who can “call” the market or “suss out” wrongdoing, accept that we don’t know what we don’t know.

It’s natural to hate and vilify, praise and exalt. Does it matter?

A good teammate can tell you about the other players, your team’s game plan, and what you can do to play your best game. They can’t predict the outcome of every touch of the ball, but they can tell you what’s going on and warn you about some potential outcomes.

Trading charts, technical analysis, on-chain data, data models, leading indicators, macroeconomics, fundamental technological developments—all these things help us make sense of the market and the circumstances around us.

These inferences let us make better decisions. What you do with that information depends on what you want to get out of this market.

Huge windfalls?

Buy now or after the next crash. Sell once you have the windfall you want.

Fast cash?

Wait until altseason, buy random altcoins, then sell them after their prices go up. I’ll tell you when altseason’s coming.

More of your government’s money?

Learn how to trade.

Some crypto for long-term HODL with $100 you can afford to lose?

Find a casino and have fun. If you win, put a little into bitcoin or one of the altcoins from my altcoin reports.

Wealth from owning a stake in the financial networks of the future?

Stake your altcoins, contribute to protocols and liquidity pools, and follow my plan.

If you chose to dollar cost average, you’re down 51% this year and down 45% since I published my plan. If you had followed my plan, you could be down that much at the extreme, but you’re probably closer to down 20% and possibly up as much as 200%.

With my plan, you’ll also get alerts when bitcoin’s price enters and exits my buying zone.

If it were that easy . . .

Sometimes, I wish I were a trader making predictions.

When they’re right, they get to take credit for it. “As I predicted, we hit my targets.”

When they’re wrong, they get to blame the market. “Trading is all probabilities, nobody can predict the future.”

For now, I’ll continue to make up stories for free and give you analysis and insights for a small fee.

This market can give you a wide range of outcomes at any moment.

Correlations come and go. When you buy and sell, you need to consider taxes, financial goals, technological savvy, investment timeframe, opportunity costs, the risks of holding cash, the good things you can buy instead of crypto, and most importantly, what you want to get out of this market.

Even then, you can’t know how anything will turn out. Only Twitter psychics know and they won’t tell us until after it happens.

We live in uncertain times.

Embrace uncertainty. If not for that uncertainty, you would not have this opportunity.

Relax and enjoy the ride!

Share this post