Nobody likes to see the market fall. Don’t panic!

In this month’s issue, I will talk about market peaks, downturns, risks, opportunities, and a little bit of the global macroeconomic picture. If the embedded audio narration isn’t working properly, tap this button to switch over to the podcast version.

When prices go up, you never feel like you have enough money in this market. You always feel like you should’ve put more money into it. So you do.

Such is life in a parabolic upswing, a move so powerful and lengthy that we have only seen something similar once in bitcoin’s history: November 2012 to April 2013, when bitcoin’s price spent six straight months going up.

If bitcoin’s price is above $58,780 at the end of April, it will mark the record-breaking seventh straight month that bitcoin’s price went up. Doesn’t seem likely but you never know. If we do that, you won’t have to read this issue.

Did you sell yet?

The top is not in

$65,000 bitcoin did not represent the peak of the market cycle.

Possibly a local top, one of the smaller peaks within a larger market cycle. The jury’s still out on that.

People can compare the Coinbase IPO to the CME Futures launch. They can find fractals in two monthly candles that match the ones that ended the 2017 bull run. They can point out many patterns in 2017 to justify whatever viewpoint they want.

Trust me, we did not hit a market cycle peak.

How do I know?

Catch my April 9, 2021 update, wherein I explain. You only need to watch the first few minutes to see all of the ways we did not hit a peak on any realistic measure of “peaks.”

People obsess about 2017 but that’s only one year out of twelve. What if 2017 is the anomaly? What if it’s the outlier—therefore a bad reference?

As of April 23, 2021, the entire crypto market has fallen 24% since bitcoin’s price hit $65,000. Catastrophic for other asset classes, trivial for crypto.

A further drop could take bitcoin’s price down to $26,000 and not even break the bigger macro uptrend we started in March 2020.

This chart shows what it will look like if bitcoin’s price went to $26,000:

That move would not only retrace to the golden fib level on a monthly trading chart—a very strong price level—it would also provide a beautiful foundation for a longer, stronger, more durable bull market than you could ever imagine. It would flush out speculators and flippers, get at least some institutions to take their money elsewhere (which is a good thing), and move bitcoins back into the hands of people who believe in it.

That would bring strength back into the market—people who have a high threshold for when they’ll relinquish their bitcoins and the conviction to persevere through any downturn.

Likewise, a 60% drop in the altcoin market would bring it back its previous all-time high market cap of roughly $400 billion without breaking its long-term multiyear upward trajectory. Take a look:

Under that scenario, altcoins will flow into the hands of stakers and true believers, people who want the projects to succeed and will commit their wealth to seeing that happen—or at least move to people savvy enough to recognize the potential of these new financial networks over the long-run.

Crashes create opportunities.

Are they painful? Yes.

Are they healthy for the market? Yes.

Is this one hypothetical? Yes.

Let’s not get ahead of ourselves. This market’s been known to pull a 180 in either direction—right when you least expect it.

We’ve known for a while that the market’s been running on fumes, needs to refuel, but hasn’t done that yet. It has persisted despite losing strength with every pump.

Only time will tell whether this most recent drop starts a larger fall or marks yet another short-lived pullback before another parabola begins. May’s almost here—perhaps another zoom starts then?

But the Pi Cycle crossed!

Yes. And everybody said, “meh, it has to be wrong.”

What does that tell you about indicators? People will believe whatever they want, regardless of what the indicators say.

Pi Cycle cross is supposed to be the signal for market cycle peak. It crossed. Everybody dismissed it.

I don’t make decisions based on the Pi Cycle but I like it because it serves as a nice, clean, easy-to-use catch-all for the various metrics that compare short-term price movements with long-term price movements. You can dig through a bunch of indicators or get the same info from the Pi Cycle quickly in one glance. Much easier to use the Pi Cycle.

Dismiss it at your peril.

When short-term movements go way more extreme than the general overall long-term trend, you need to pay attention. On the way up, you can notch that as one piece of data to suggest the market should fall (even though it might not). On the way down, you can use that as one more reason the market should rise (even though it might not).

Just wait until bitcoin’s price drops to a seemingly impossible $26,000 and alts get slaughtered. Then everybody will look back and say “the Pi Cycle was right!”

But will that be true?

Did you know there are at least seven Pi Cycle indicators? And they all cross at different times?

In this video, a mathematician found seven other combinations of short- and long-term price movements that catch the market cycle peaks from very different directions.

Perhaps the Pi Cycle is not as much of a concern as everybody thinks?

When the Pi Cycle crossed, we saw none of the other “peak” signals. Of all the data models people use to identify market cycle peaks, only the Pi Cycle triggered.

(Technically, only one of the various permutations of the Pi Cycle.)

Sometimes, the market just gets ahead of itself. Bitcoin’s price can drop 50% or more in the middle of larger uptrends. We’ve seen that happen more often than we’ve seen a Pi Cycle cross!

Altcoins can fall even further—sometimes even in the middle of a raging altseason, as we’ve seen in recent months. The difference is, they recover fairly quickly during the zooms of altseason. During the lulls, they can take weeks or months to get back to even.

This is a volatile market full of massive risks and massive rewards. When the upswings bring 10x gains and the downswings bring 80% losses, buying and selling at the wrong time can hurt you.

That’s the nature of investing—you will never get the timing just right. You can, however, position yourself to benefit from shifts in momentum and sentiment.

Your true enemy is complacency. Bad decisions hurt, but complacency kills.

Don’t worry (unless you’re in a hurry)

It’s crypto. We get +50% drops or long, extended sideways consolidations now and then. Tough to stomach, but also the price we pay for getting into an explosive, dynamic market. We haven’t had one of those events for a long time. We may not even get one this time.

Once you separate volatility from risk, these movements don’t seem so bad. If you’ve followed my plan for bitcoin’s bull market, you’re up at least 600% on your investment even after this most recent pullback. Some of you have far bigger gains.

You can’t get those kinds of returns without expecting huge drops along the way, nor can you expect to see your portfolio double every other month forever.

Past consolidations have lasted up to six months and previous crashes have reached up to 60% along the long path to the market cycle peak. Only after you get to a market cycle peak do you have those 80% crashes and never-ending bear markets so many people fear.

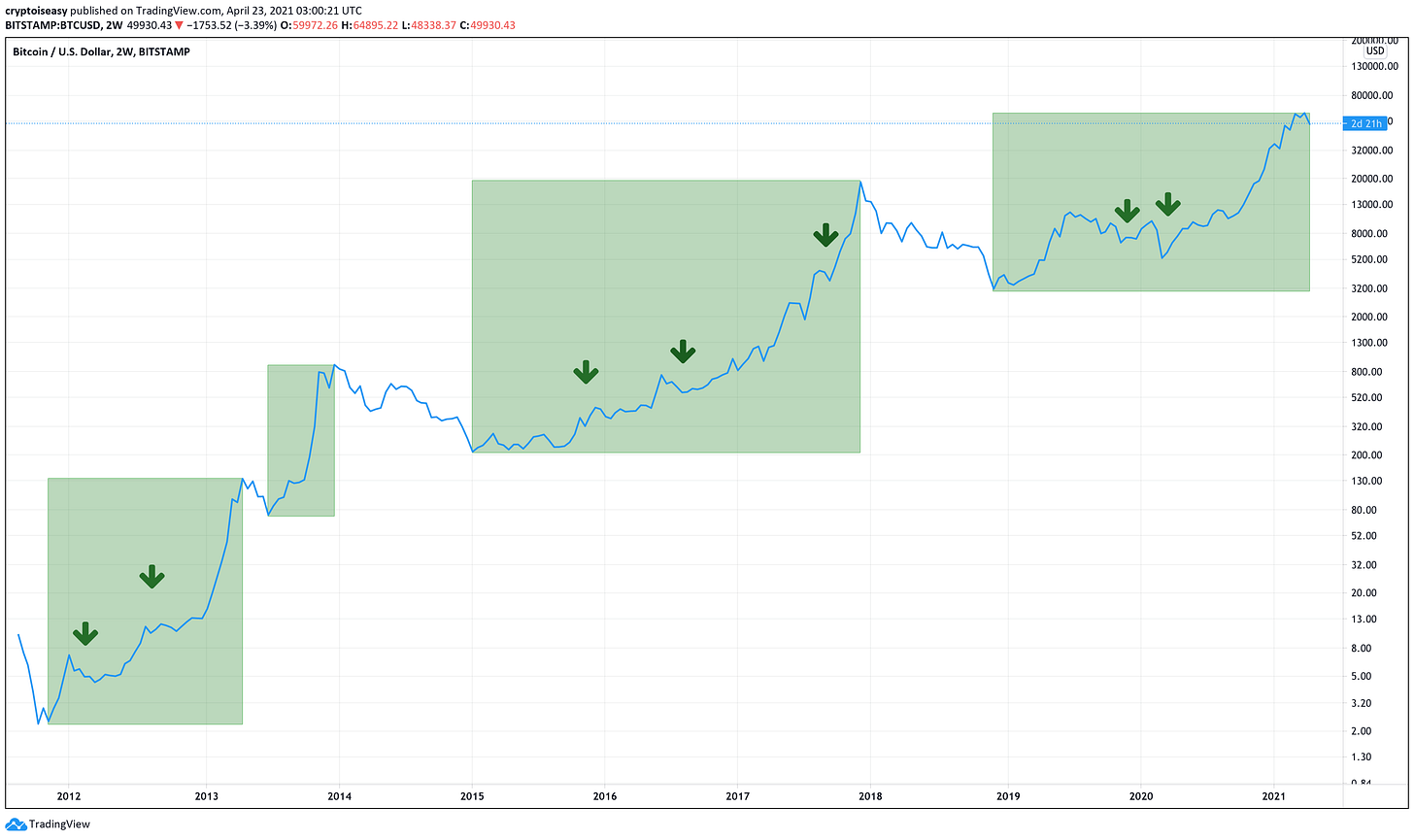

Seven times in twelve years, we’ve had crashes of more than 40% during bull markets. Take a look, with bull markets shaded green based on market cycles (not technical analysis).

For those who lump the April 2013 crash with the larger run from October 2011 to December 2013, you can add that to the list of crashes larger than 40% (it was over 80%). So, eight not seven crashes of 40% or more within a larger uptrend.

Sometimes, the market meanders for a few months after those crashes, gets everybody worried, and then it takes off seemingly out of nowhere. Or even just mosies around, period, without a big crash.

We went sideways from February to May 2012, August to December 2012, December 2015 to May 2016, August to October 2016, and April to June 2020—each time in the middle of a larger bull market.

Some (like me) would include November 2019 to January 2020 on the list of sideways moves, with the assumption that the market would have gone into another boom period right then if not for the March 2020 financial crisis.

Yes, if you want to make 10x by the end of May, you may worry. While it’s still possible to turn that trick, it seems less likely with each passing day.

Over the long term, these shifts are normal. Anything down to $26,000 makes sense. Nothing fundamentally changes when the price drops. Same risk, same opportunity. Often, less risk and more opportunity!

Altseason ended?

Not yet.

During DeFi summer, we saw altcoins run hard while bitcoin barely went up. Huge moves, shitcoins going wild, scams pumping everywhere, every new project treated like the next bitcoin.

Sound familiar?

I look at altseason as the proportion of the market captured in bitcoin as opposed to altcoins. For all of 2021, altcoins have outpaced bitcoin, driving bitcoin’s dominance from 72% to 51% over that time.

This chart illustrates that move. When the line goes up, bitcoin dominates. When the line goes down, altcoins dominate.

While it seems altcoins have tanked a lot more than bitcoin, only some have. Overall, altcoins still have a historically high share of the market relative to bitcoin.

Generally speaking, altseason ends when bitcoin pushes back against the altcoins. For premium subscribers, I cover specific levels that matter.

This ebb and flow does not reflect anything about the long-term investment potential of altcoins or any single altcoin. All altcoins are speculative, even Ethereum. Not a single altcoin can justify its valuation on any reasonable metric, they are all either massively overvalued or massively undervalued.

Altseason is fun but I wouldn’t make any investment decisions based on what happens during altseason. Some of my dead coins did 1,000% or more this year. During altseason, that happens.

Most of the top 30 altcoins have few users, few developers, and no purpose. Many small and new altcoins do only one of two things: make money for the founders and early investors or copy-cat other crypto's success, with a healthy dose of paid shills and fake hype.

A rising tide lifts all ships.

As long as you’re winning, nobody cares about what’s going on behind the scenes or what risks you’re not paying attention to. We won’t get to see what’s really happening until altseason ends. Only then can we separate the wheat from the chaff.

Nobody realizes everything else is screwed up

While crypto can seem stressful, consider what’s going on in the wider world. What risks are you missing because the stock markets are booming, economies are recovering, and asset prices keep going up?

Real estate prices have zoomed in every large country. Does this reflect a new bubble or simply asset inflation from cheap credit and massive money printing?

Junk bond yields keep going down, now at record lows. Sovereign debt remains a negative-yielding asset in real terms. Equities keep rising despite bearish divergences on all long-term timeframes and way too many businesses that have no profits. China’s financial system shows signs of stress.

And you’re worried about crypto?

Now economies are opening up and every major government seems to crave more stimulus. Seemingly no government wants to protect the value of its money.

According to US government sources, consumer prices rose slightly over the past year. Cars, trucks, food, and gas drove the increase. From personal experience, I know housing construction materials have gone up significantly, too.

Does this reflect supply chain disruptions, the weaker US dollar, and global trade problems? Our country imports a lot of those products and the inputs we need to produce them.

Or is this inflation?

To have inflation you need money circulating around the economy. Otherwise, you can’t have inflation, the money doesn’t actually go anywhere, therefore it can’t drive prices up.

As of March 2021, the velocity of money remains low, as shown in the circle.

As long as that remains the case, it’ll be hard to get true inflation, the traditional inflation that makes everything too expensive for people to buy. You simply don’t have enough money circulating through the economy—it’s all trapped in savings accounts, home equity, and financial markets.

But if we’re already seeing prices rise without an increase in the velocity of money, what will happen once we do see an increase?

Meanwhile, the US dollar has gone up every month this year and treasury yields went parabolic from August 2020 to March 2021. Look at the move I circled on the 10-year yield chart:

While stronger USD and Treasury yields can sometimes tamp down on consumer prices in the US, keep excessive speculation in check, and boost demand for non-US products and services, it puts a crunch on emerging market debt.

Because most EM debt is priced in dollars, when the dollar rises, emerging markets need more money to pay their debts. At the same time, investors use higher yields to justify rotating into T-bills rather than much riskier EM debt.

As a result, emerging markets need to raise taxes, grow their economies, or cut spending just to keep up with payments. Those are tall tasks for any government, and in any event can lead to supply chain disruptions and domestic unrest. Not good for the global economic recovery.

To keep the situation from spiraling out of control, the US Federal Reserve pledged to weaken the dollar.

All stablecoins are denominated in USD, backed by USD, valued in USD.

Yet, they’re booming. USD stablecoins have gone from $33 billion to $78 billion market cap since the beginning of the year.

Will a weaker dollar drive demand for high-interest savings, yield-farming, and DeFi platforms? Will it cause people to shift to non-USD options like DAI or any of the new algorithmic stablecoins that seem to come out each week? Force institutions to bump up their allocation to crypto?

Or will it give smart money one more reason to stay away totally?

What happens next?

In February and March, everybody was talking about how we were about to have a supercycle, shatter all records, and rewrite all data models. We were way ahead of schedule, finally mainstream, destined for $288,000 this year, and institutions would never let the prices fall.

Since then, nothing has changed except the prices have gone down (and not much by historical standards).

Coinbase remains a publicly traded company. Lots of big businesses still have crypto-related products and services. The market remains higher than it was at the start of February.

DeFi is still buggy, complicated, and expensive. NFTs still have amazing potential that few see yet. Peter Schiff still hates bitcoin.

You may have taken profits or cashed out already. While you risk missing out on big gains, you can always catch crypto later when you have a better buying opportunity. Possibly, sooner than you think.

If haven’t done that, use this lull as an opportunity to reevaluate your overall financial portfolio, crypto and beyond. For my thoughts on that, read my portfolio strategy.

What are you doing, Mark?

Nothing.

While bitcoin’s price has cooled off a lot, it hasn’t fallen into the buying zone of my plan.

We also haven’t reached a market cycle peak. And it’s been a few weeks since I found a new altcoin that excites me.

As a result, I’m not buying or selling. Just letting the market do what it does.

Does that mean I will suffer if the market crashes further?

No. I will use any potential crash as an opportunity to buy more crypto. Already, bitcoin’s price has come closer to the buying zone of my plan than it has since October 2020. It won’t have to fall much further before I have to buy more bitcoin (and when I buy bitcoin, I buy altcoins, too).

When will I take profits?

Only when we start to approach a market cycle peak. Premium subscribers, you’ll know when that time comes.

As long as you have fresh cash or cheap credit, you win no matter which way the price goes.

Up? The value of your investments will rise.

Down? An opportunity to accumulate an even bigger stake in the financial networks of the future, at a massive discount.

Sideways? Chill until bitcoin’s price enters the buying zone in my plan. That will be an opportunity of a lifetime.

Appreciate your good fortune!

If you bought crypto before December 2020, you took advantage of the best risk-adjusted opportunity on earth when seemingly nobody else did. Take pride in having the vision and fortitude to take a leap of faith in a novel asset class.

If you bought crypto in or after December 2020, you played the crypto casino and won. Congratulations! Enjoy the results. We still have a lot of great things to look forward to!

In next month’s issue, I’ll talk about Web 3.0, the creator economy, and the overall global financial situation.

Relax and enjoy the ride!