Happy halving, everybody.

This is the third issue of Crypto is Easy. It’s pretty long but I have a lot to say! If it seems like too much, follow me on Medium and Twitter. I’ll break this update into smaller bits of content, probably with some elaboration, that I’ll publish over the next few weeks on different platforms.

As CIE subs, you get the whole thing one post—before everybody else does.

In this issue, I’ll talk a little about bitcoin and altcoins, and finish with a larger discussion about the global financial situation and why too many people are getting ahead of themselves.

Mindset is everything now

I know some of you may have gotten a little spooked by the 20% drop in bitcoin’s price since Thursday. Right now, bitcoin’s price is $8,600.

These types of swings should not matter. If this really is the start of that big bull market everybody thinks it is, you’re going to see many, many more swings of 20% over three days. Sometimes, you will get a 20% drop in one day.

On the flip side, you will have times when the price goes up and feel like you have to buy more. Like it’s getting away from you and will never come back.

You might already have felt that sensation when we popped over $8,000 at the end of last month. Maybe you were kicking yourself that you didn’t buy more when bitcoin’s price crashed, like you missed the boat or you made a mistake.

You can’t think that way.

Yeah, if you’ve followed my plan for bitcoin’s bull market since I posted it on from March 30, 2020, you would’ve bought bitcoin between $6,400 and $7,800. My earliest readers know I picked up some more bitcoin during and right after that big crash in March—despite worrying that price would keep going lower and preparing to exit the market.

It’s natural to fear missing out. Even more natural to fear losing money.

To really make the most of this bull market, you need to act in spite of your fears.

It’s possible that bitcoin will drop back down into the buying zone in my plan. If that happens, people will freak out. It’ll be worse if the price drops below the red line, that line in the sand I’ve talked about before.

Stick to the plan. Courage is not the absence of fear, but the ability to act in spite of it.

Stay courageous.

So . . . do we buy now?

My plan is for spotting opportunities and managing risks. Investing 101. Decision-making 101.

If you want to dollar cost average, you’re going to do great. My plan will do better, but if you follow it perfectly, you will go long periods of time without buying. With dollar-cost averaging, you can always feel like you’re getting a piece of the action without taking much risk.

Like they say about poker, bitcoin is a whole lot of boredom punctuated by moments of terror and ecstasy.

That said, it is never a bad time to buy bitcoin.

Just keep in mind, bitcoin’s price can crash from any price at any time. The higher it goes, the more likely it will crash. You don’t want to wait until the price goes way up.

That’s why I stick to my plan. It’s based on data and history, human behavior that we’ve seen for 11 years.

If you’re not a premium subscriber, you may want to sign up now. You’ll see that plan and also get premium content, free crypto, and both of my books.

What’s the goal?

Ride this thing up, buy at the very best opportunities, and sell before all those greedy people, HODLERS, and fake maximalists sell out and crash the market.

If we NEVER sell, all the better. That means bitcoin will have succeeded.

Altcoins?

Some of you have emailed me about alts and alt season, which I appreciate. Premium subscribers can expect a video from me about alt season soon, as a follow-up to the brief highlight I offered in the video I just posted.

As for altcoins, they’re all speculative, even ethereum and XRP, and they tend to move in the same direction as bitcoin, so I don’t follow their prices. These long-term plays will take years to develop. Many will die along the way.

Except for Chainlink, none of the big ones interest me and there are way too many small ones to cover.

That said, I’m starting a list. Send me any alts you want me to look into.

Several people have asked for my portfolio or recommendations—I hear you. One day, I may share.

Why don’t I post more often?

Time.

I will always keep you informed when the markets move in a way that might affect my plan or if there’s something going on that I feel like you should be thinking about. Right now, there’s no action, we’re waiting for the dip.

A real dip, not one those 20% drops like the one we just had, those moves that send Twitter in a frenzy. I’m looking for those 30-40% crashes that we should see 6 or 7 times before we get to the market cycle peak.

Make sure you’re subscribed to my YouTube channel. I plan to better utilize that outlet, rather than spam your inbox.

You can also follow me on Medium and Twitter, where I post content about how cryptocurrency and blockchain technology will change the world. CIE focuses more on what’s going on with the markets, looking at the big picture rather than the daily news.

Why we stick to the big picture

To really make the best decisions, you have to understand what’s going on around you—that larger world of which crypto is a small part. If you focus only on what’s in front you, only the day-to-day, you will not see the opportunities lying well ahead. You’ll worry about things that can easily change and neglect the things that can’t. You’ll assume a problem is permanent when it’s temporary and assume temporary problems are permanent.

I do this. We all do this.

In this newsletter, and all the great content other people put out, you get a different viewpoint so you can see the world in a more informed and honest way.

Not because I’m better informed or more honest than anybody else, but because you have enough perspective to recognize what really matters to you. Otherwise, you end up with with somebody else’s thoughts, chasing somebody else’s goals.

Like, for example, the people who bought oil contracts and silver in April.

Silver plays no role in modern finance and we have enough oil above ground to last six months under normal economic conditions, far longer if economies remain shut down.

Over that same time period, those same people also bought stocks of companies that have no customers or revenue.

Yet these are the same people who think we’re crazy for buying bitcoin.

Perception is reality

My political science professor once told me “where you stand depends on where you sit.”

We all come to the world with our own biases, usually trying to justify our gut decisions with some sort of logic or rationale. Our beliefs make us take a certain position. Our circumstances make us seek a certain outcome.

I do it, you do it. We all do it.

At this moment, you see a lot of contradictory statements from mainstream economists, financial analysts, and everybody else. The cryptosphere has lots of people who have only a very basic understanding of how markets work, but they all seem very confident in their opinions.

Each of these people has a certain viewpoint. They may or may not be right.

Some look at crumbling financial markets and a big drop in economic activity, combined with massive government intervention, and conclude we’re going to get hyper-inflation and a global depression.

Others look at crumbling financial markets and a big drop in economic activity, combined with massive government intervention, and conclude we’re going to get a modest recession and V- or U-shaped recovery.

They can’t both be right.

Prepare for a great depression or a mild downturn?

As fearful as people might get about the horrific economic data, there’s no reason the world has to fall apart.

Possible?

Of course. So many people have lost jobs and businesses over the past two months. Economic output has fallen off a cliff. Some national currencies have already crumbled. It’s hard to imagine we’ll ever recover.

Keep in mind, those big, deep, long-lasting financial crises do not come from short-term downturns in economic activity, even if those drops are significant. People are resilient and economies tend to adjust more quickly than you’d think.

Those devastating, multiyear, civilization-threatening collapses happen when “safe” assets lose their value quickly.

Why?

Because in modern economies, safe assets form the basis of all financial activities. Households, businesses, and governments create all sorts of financial arrangements based on an assumption of low risk. Countries build economies on that assumption. Banks and financiers do trillions of dollars in business on that assumption.

When that assumption fails, everything else does.

There’s a reason crashing oil prices don’t threaten the global financial system. People know it’s risky and volatile. They factor that into their decisions. Nobody will ever pool oil contracts into collateralized loan obligations. Mortgages? No problem.

Safe assets, not risky assets, screw everything up.

In 2008, it was U.S. houses. In 1929, it was U.S. and British stocks. In 1873, it was railroads and gold.

At the time, people saw these assets as sure bets, assets that could never crash. When they did, all hell broke loose.

Outside of those three events, we have had many economic downturns and plenty of regional financial crises. Terrible events that nobody should ever want to live through, but none of them destroyed the global economic order.

You can have pain, hardship, and turmoil without systemic failure. People suffer, then recover. Life goes on.

In fact, most economic pullbacks last about a year or less, but most of the world’s largest economies haven’t seen that type of pullback in a decade or more. And none of those pullbacks were confronted with a massive, coordinated intervention at the beginning.

Choose your history wisely

Twitter obsesses over 2008 and 1929, but I’d like to highlight one other historical event that’s worth noting.

In 1948, the U.S. economy went negative. At the time, many feared the country would have a new Great Depression.

Instead, they got a one-year recession. Really bad, but not the economic carnage most people predicted at the time.

How much of those fears came from people’s mindset, rather than the actual reality of what was going on? How much of today’s fears come from a similar mindset?

Back then, the U.S. had not seen a major economic downturn since 1937. That was over a decade prior and it came when the U.S. thought it had finally recovered from the 1929 crash. For most people, that 1937 dip was the most recent memory of a bad economy. For some, it was their only memory.

For us, our most recent memory is the 2008 financial disaster and the European debt crisis that followed. That was over a decade ago, and it came when the U.S. thought it had finally recovered from the dot-com crash and 9/11 attacks.

Could we be psyching ourselves out like everybody did in 1948?

I’m not saying we won’t get a new great depression. I’m saying we don’t have to get one.

Yes, national currencies could go haywire, wars could break out, and lots of horrible things could happen. The world can change at any moment.

But you can say that any time.

As I wrote in last month’s issue, some countries could default on their sovereign debts. Other “safe” assets could fail, too.

If that happens, all bets are off. Things would get really ugly, really quickly.

We have lots of people working hard to make sure that doesn’t happen. How do you know they won’t succeed?

Unemployment—bad, but not predictive

When 25% of your country loses their jobs in two months, like the U.S. just did, you should panic. I can’t imagine worse news, nor what it must feel like for people suddenly out of work.

People talk about the unemployment during the Great Depression, but it took three years for unemployment rate to peak. Once it did, the economy recovered.

According to The Balance, unemployment rose 8% to 16% to 24% from 1930-1932, then fell steadily for the next decade.

We are already at the Great Depression peak. Does that mean will will see unemployment triple over the next three years, like it did at the start of the Great Depression? We will get 70% unemployment?

Unfortunately, it’s possible, but who’s to say that has to happen? We already hit the same peak as we did in 1932, when the employment rate started to improve. Why can’t that happen this time?

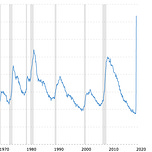

Historically, unemployment tends to LEAD recessions and recoveries. The rate hits bottom right before a downturn, then peaks after the economy recovers.

It’s an inverse correlation, as shown in this chart from Macrotrends:

Low unemployment often masks underlying problems, like U.S. real wages flat since 2017, U.S. manufacturing in a recession since 2019, U.S. banks short on capital for months, and falling retirement contributions among U.S. workers for years—before coronavirus was even a thing.

Recovery happens in spite of high unemployment.

But trends sometimes end. Our present situation is unprecendented. Very, very scary. I worry about it all the time.

Think out of both sides of your head

As scary as the present is, remember the future is full of possibilities, not certainties.

Your doctor prescribes acetaminophen because in the past, it reduced fevers in almost every person who took it. Sometimes, it doesn’t work. Does that mean you should not listen to your doctor?

No, it just means life doesn’t always turn out like you expect, even if data and common sense seem to predict a certain outcome.

For example, almost everybody believes the U.S. real estate market will drop. After all, nobody’s buying, everybody’s losing their jobs, lenders keep dropping out of federal programs, forbearances have skyrocketed, renters are skipping out, and banks are bracing for a wave of foreclosures.

So why have my property values gone up 5% since the beginning of March? I would expect to see 5% gains in a normal year. To do so in six weeks is pretty significant.

Why would prices go up in the midst of crashing financial markets and pandemic disease? When nobody’s touring houses and lenders are cutting back on loans? When the entire market is in a sort of stasis and fear?

Wall Street Journal says new home listings plummeted.

What happens if that trend continues? If people decide to stay in the house they own? If they recently refinanced to a low rate they might lose if they move? If their employer extends telework so they don’t feel the need to move for work? If empty nesters let their unemployed kids move back home instead of downsizing? If retirees delay the purchase of that condo? If renters go back to work and make enough to cover rent again? If they don’t and government keeps paying the rent?

If that happens, the supply of available houses will shrink. They may not keep up with demand—even if both fall. Combine that with all this new money the Fed is throwing around, we might see real estate prices continue to go up.

Or not.

If trained, highly-educated experts with decades of experience can’t predict the outcome, what makes you think you or I can?

You don’t like central banks. You need them.

The European Central Bank has spawned so many memes over the years, I can understand why people think it’s a laughing stock. Central banks in general get a bad rap.

Do you realize they’re the biggest source of stability for the world’s financial markets? That our modern complacency stems from central banks doing too good of a job at keeping the system moving?

I realize some of you live in Europe. For this section, I hope you’ll indulge me in a discussion of the U.S. intervention. As the U.S. remains the largest single economy on earth, this intervention essentially puts the world at the mercy of the U.S. government.

(Sorry about that. Not my fault!)

Since the 2008 financial crisis, the Fed has developed the infrastructure and authority to buy out all sorts of debt. As part of its coronavirus relief package, U.S. Congress expanded those authorities and created a bunch of new government programs.

For an example of how these programs work, take the Main Street Lending Program. Small businesses can get loans of up to four years and $25 million. The Fed buys 95% of the loan from the bank, leaving the bank at risk for just 5% of the loan value. Banks, of course, get to collect a small fee from the Fed for participating.

In other words, the Fed is paying banks to make bad loans to businesses that will fail.

This is an Austrian economist’s worst nightmare. It’s also exactly the kind of thing your average person finds really shady.

Of course, if you own the business getting that bailout loan, you probably feel differently. If your job depends on that business, you definitely feel differently.

And for everybody else who lives in an economy that thrives on businesses staying open and people paying their bills, you need the intervention.

You have to weigh those moral hazards and market risks against the hazards and risks of a global financial meltdown. Thanks to coronavirus, the world lost about 5% of its GDP—and that’s just the start.

How do you make up all that loss?

You can’t.

But you can try to staunch the bleeding before the patient dies, in the hopes the patient can recover. No doctor would refrain from giving the Heimlich because he or she doesn’t want to “reward” another person for careless eating.

What else needs a bailout?

Municipal bonds, corporate debt, auto loans, mortgages, you can run down the list. Messari already did, and it’s a lot to scroll through.

I’m certain our central bankers understand the political and economic risks of their actions. I very much doubt they want to nationalize the debt markets.

What’s the alternative? Let everything fall apart?

In 2008, the Fed bought out lots of debt (albeit six months too late). By 2014, it had unwound all those bad loans and undone all those drastic actions.

Who’s to say it can’t do that again?

But inflation!

Inflation is not bad.

That’s a taboo thing to say in the bitcoin community, but it’s true.

A little inflation encourages lending, investment, and economic activity. When money holds its value, people don’t want to spend it. You need people to spend money to keep the economy growing.

Inflation helps asset holders and people with fixed debt arrangements. As they gain equity, they can borrow with more collateral or sell assets for more money. Those gains move into the financial pipeline or get spent on goods and services. This money either recirculates to other people or boosts the value of property.

The problem is, inflation destroys the value of labor and savings. Your work and money continually lose value over time. As a result, it gets harder and harder to keep up, much less get ahead.

That’s why inflation is sometimes called a stealth tax.

Most people have only their work and their money. If they own a house, it’s the only asset that benefits from inflation—but barely, once you consider the taxes, mortgage costs, and maintenance expenses. Half of people have some retirement investments, but not enough to really matter.

In other words, inflation helps the few at the cost of the many.

The solution is to own assets that produce value. That way, you benefit from inflation. Your property will go up. Your debts will be easier to pay. Your businesses will generate more cashflow.

While you may not gain purchasing power as your money loses value, you do gain wealth from your productive assets. As long as people don’t have an alternative source of money OR inflation happens slowly enough they don’t realize, governments can inflate money forever.

Bitcoin is that alternative source of money that will protect you from inflation.

But, negative yields!

Negative yields don’t make sense. They’re not sustainable.

At least, I used to think so . . .

As long as investors continue to believe governments will pay back their debts, investors will continue to lend money to them—even at negative interest rates.

Some legitimately believe in the safety and security of sovereign debt. Some buy expecting to sell when rates go even more negative. Some (like me) use them counterbalance other investments as part of a diversified portfolio.

On the flipside, central banks control how much these bonds are worth. While they can’t change the face value printed on the bond note, they can reduce its value through inflation and devaluation.

A lot of people think this is a bad thing.

Bitcoin doesn’t care—it’s programmed to gain value as long as people use it. Nobody can devalue bitcoin.

But, who will pay!

We will all pay.

But that would happen whether or not governments intervened. How would you like your suffering—deep, sudden, and widespread or shallow, lengthy, and contained?

What if all this government spending is not enough? Worse, what if it can’t get into the hands of the people who need it, quickly, in the way you need it to?

For example, take one fairly small program, the U.S. government's Paycheck Protection Program (PPP). Designed as risk-free loans for small businesses to cover payroll costs, the initial $349 billion in funds ran out in just 13 days.

While the news raged about the 0.2% of funds that went to huge, publicly traded companies, nobody realized 95% of small businesses did not get any money from the program.

U.S. Congress has approved another $310 billion in funds for the PPP program.

It’s not enough.

Eventually, money runs out, even if you can conjure it up at will. At some point, you need real economic activity to get that money flowing around the economy, get those debt markets back in shape, and generate real profits and new wealth.

Each new program makes it harder and harder to get that healthy economic activity.

All the worse when some of the beneficiaries use loopholes to pocket their bailout money at the public’s expense.

Bitcoin doesn’t have loopholes.

Re-opening the economy will not work

Some say reopening the economy will get everything back to normal.

These people do not understand how pandemic disease works, nor how humans respond to pandemic disease.

No matter what rules you set on social distancing, movement, and worker/customer safety, we will see more infections, hospitalizations, and deaths as economies reopen. It may also freak people out as they see more of their friends, family, and coworkers dead, dying, and permanently disabled over the coming months.

While many people think reopening the economy will get it back to normal, I am not one of them.

Many workers will not want to go back to dangerous jobs (especially in the U.S., because they have another 2-3 months of unemployment benefits to tide them over). Many people will not want to go to restaurants and public events knowing they could catch COVID-19.

You will see more sick workers calling out, more experienced leaders dying, more disruptions to factories and supply chains simply from people catching COVID-19 on a massive scale. This will drag economies as much, possibly more, than lockdown.

Some people in the U.S. point to Sweden as a model for keeping the economy open while dealing with coronavirus. Sweden’s own central bank predicts its economy will lose 7-10% GDP, among the worst of all developed nations. Meanwhile, its death rate is among the highest. Its own coronavirus chief told the press almost every part of the Swedish response failed.

Not the model I would want to follow.

True, the world has ramped up production of medical supplies, tests, and personal protective equipment while accelerating vaccine development and disease tracking. We are learning more about the disease with every passing day. Our capacity to handle the disease in May 2020 is much better than it was in January 2020.

This lulls people into a false sense of security. Yes, lockdown is hard. Yes, most people who get COVID-19 are fine. Losing your job and business is terrible. Everybody wants to get back to normal.

On the other hand, this disease spreads as easily as the common cold and kills 10-20x more efficiently than the flu. Despite lockdowns, social distancing, and massive ramp-up of medical countermeasures, more than 60,000 people have died in the U.S. over the past two months. That’s already more than all flu deaths over the past SIX months.

If you take the middle range of estimate of mortality, which is just the middle of all the (very wide-ranging) estimates I’ve seen, we should expect about 500,000 Americans will die from coronavirus this year. That’s the same death rate as cancer (0.15%).

In reality, that number should go much higher because COVID-19 spreads so quickly and seems to reinfect people at a much higher rate than other infectious diseases.

I suspect everybody will change their tune as more people suffer from the virus, more hospitals close from the financial strain of treating mass casualties, and more parts of the workforce get sick or hospitalized.

At that point, it will be too late.

I don’t know if reopening is going to be worse for the economy than staying shut. People with drug addictions and mental health issues have had a terrible time with the lockdown. Kids’ social and emotional development have suffered greatly. Lots of businesses are on the brink of closing (if they haven’t already gone out of business).

And, people need to work.

I’m sure the idea that it’ll all be over and we’ll get back to normal and the economy will recover, that’s part of the thinking that goes into a lot of the decisions people are making now.

If anybody thinks that everything will be better in a few months, they’re probably going to discover a different reality.

People pin their hopes on a vaccine, but that will take a while and may not end up very effective. Once we can test and trace everybody, then isolate all people at risk, we can really get the economy moving—but we don’t have enough tests and besides, do you really think voters will go along with that?

Government crypto to the rescue?

You may have heard that Congressional Democrats tried to use the coronavirus relief package to get the U.S. central bank to create a digital dollar. That would make the U.S. the third country to move to a national cryptocurrency, after China and The Marshall Islands.

Does that mean the U.S. government wants cryptocurrency?

No, but it does mean cryptocurrency has gained legitimacy among some policy makers.

Members of Congress have introduced 32 crypto bills since 2019. Almost half of them tell the government to investigate terrorism, money laundering, and trafficking of humans and drugs.

Does this mean Congress thinks cryptocurrency is for terrorists, sex traffickers, drug dealers, and money launderers?

No, but it does mean those are Congress’s biggest concerns right now.

I would not read anything more into it. Congress is largely clueless about all this stuff. As I wrote last year, U.S. Congress Will Pass Blockchain Bills as Soon as Somebody Tells it What ‘Blockchain’ Means.

With enough education and persistent lobbying, they’ll come around. Unless bitcoin goes to $100k or China’s blockchain poses serious competition with the U.S. dollar, cryptocurrency will remain at the bottom of the legislative priority list.

Don’t underestimate the chances of that happening, though. Facebook published a white paper and the U.S. government flipped its wig. We got emergency hearings and a Presidential statement.

All that from a press release.

It doesn’t take much to get politicians to act when there are votes and money at stake.

Speaking of Facebook . . .

When Facebook first announced its plans to create the Libra cryptocurrency, I loved the idea.

(Not Facebook, but the idea of a corporate cryptocurrency.)

For more about my thoughts at that moment, read my July 2019 post, Why Libra is Different Than All the Other Cryptocurrencies.

After relentless pressure from governments, Libra Association watered down the project. It’s no longer a game-changing, paradigm-shifting effort that will challenge long-held notions of privacy and monetary sovereignty.

It’s just another way for a centralized entity to move money from one customer to another.

Libra will no longer be permissionless and will have comprehensive anti-money laundering protocols. It will allow law enforcement to see personal transactions and enable countries to enforce sanctions over coins in the network.

It will also give users stablecoins denominated in their local currency, rather than an independent currency backed by a basket of financial assets.

Why do they even bother with blockchain?

Score: Government money monopoly 1, people 0.

China leads again

As mentioned earlier, China continues to push forward with its central bank digital currency and plans to launch its Blockchain Service Network (BSN), dubbed "the blockchain of blockchains.”

You can imagine my surprise when I read that BSN will connect with public blockchains like ethereum and bitcoin. If that’s true, every person in China will soon have only one degree of separation between the yuan and bitcoin, as well as a framework for using cryptocurrency as part of their normal, daily lives.

And you wonder when we’ll get mass adoption?

I doubt a billion Chinese citizens will all suddenly buy bitcoin. China will control every aspect of BSN, undoubtedly blocking swaps of yuan with any currency, national or digital.

But you never know, right? If the Communist Party thinks pumping bitcoin’s price will undermine the U.S. dollar, they just might loosen the reigns. Or perhaps their developers will create exclusive linkages with Party-sanctioned blockchains that trade publicly.

Even if that doesn’t happen, BSN will give cryptocurrency a greater sense of legitimacy—or better yet, inevitability.

When doing research for a series of posts about conversations we have about crypto, one person said the most effective argument he’s made is “this is the way everything’s going.”

The inevitability of cryptocurrency is a very powerful argument.

Also, don’t discount the potential for China’s digital yuan to get other countries to do the same with their own currencies. In a post-bailout world, voters may like the idea of a national currency that their governments can send directly to their wallets rather than to the banks and financiers.

India catching up?

Around the same time the coronavirus pandemic crashed financial markets, the Supreme Court of India overturned the country-wide banking ban against crypto.

According to Coindesk, Indian exchanges saw massive new volume soon after the announcement.

From my contacts in India, people really worry that banks will run out of money and the government will confiscate their wealth.

Cryptocurrency solves that problem. You can expect people will use it.

So, we now have the two biggest countries on earth with better access to cryptocurrency than ever before, just as prices are starting to rebound and people are losing faith in traditional assets.

Buy the substance, not the hype

If it seems like the stars are aligning for cryptocurrency, you may be right. But let’s not get too far ahead of ourselves.

We can all be victims of our own mindset.

When your mindset is governments are bad, fiat money is bad, and people and government are not worthy of your trust, then times like these are going to skew your expectations in favor of bitcoin.

While everybody else is hyping the halving and BRRR memes, I like to dig a little deeper so you can make the best decisions about bitcoin and altcoins, rather than buying into the hype.

When I got into crypto in late 2017, I bought into every “mainstream” narrative. Chinese New Year. U.S. tax season. $6k is the bottom. Bakkt. China. Halving.

Some of those terms may not make sense to you if you’re new. They’re just excuses people used to explain the ups and downs of bitcoin’s price and the wider market.

People get wrapped up in these stories, but bitcoin’s simply a computer code. Everybody else turned it into digital gold and store of value and the coin of freedom and whatever else they think it is.

Satoshi modeled some aspects of bitcoin around gold because it helped him explain the concept of miners and scarcity.

In fact, the word “gold” appears in only one sentence of the bitcoin white paper:

“The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation.”

Bitcoin is not gold. Its price and behavior have no correlation to anything that happens in the traditional financial markets. Its code works under all economic conditions. Its network continues to grow. Its development community continues to expand.

That is all that matters.

For that reason, I stick to an investment thesis, rather than a narrative. Otherwise, it’s too easy to get lost in the moment. It’s too easy to lose perspective.

As an investment asset, bitcoin serves as a hedge against the collapse of the traditional financial system. Also, its price goes up over time.

Plus, you can send bitcoin to anybody, anywhere, anytime, in any amount, instantly, without ever taking a single bit of personal information about the other person. No other technology can do that. Not a reason to invest, but a nice perk!

Money for everybody

Best of all, bitcoin is accessible. Anybody can get it and use it.

Unlike most assets, you can buy a tiny bit of bitcoin. You can keep buying a little bit more and a little bit more. You don’t need permission, just a willing seller.

You also have a lot of guys like me who can look inside the market because of the transparency of bitcoin’s blockchain, as opposed to digging through quarterly reports and financial statements that hide everything bad unless the people in charge think they’ll get sued or jailed for hiding the truth.

Bitcoin is public, open, and anybody can claim a small stake in its network. That has massive social value regardless of anything going on in the real world.

It’s rare to find an asset of any kind that anybody can buy and use at any time. And it’s crazy to think that only you, me, and a small number of other people realize this.

Over the next few years, many more people will realize this.

China and India matter not because they have people and money, but because it’s easy for their people to move their money into bitcoin and other cryptocurrencies.

Does that mean bitcoin’s price will explode?

Probably, but maybe not. Anybody can create a money system that’s better than bitcoin’s. Some altcoins may have already done so.

Also, don’t be so sure that people in the traditional financial world won’t get their shit together, or that the world’s financial leaders won’t regulate cryptocurrency in a way that destroys its special role. If you don’t know what I mean by that, read my book, Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency.

Stay diversified

That’s why it’s important to stay diversified, not just in your investments but also in your mindset. Think out of both sides of your head. Set realistic expectations, plan for one outcome, prepare for another.

It’s tempting to want to put as much as you can into bitcoin, because it will probably do very, very well. Some altcoins will do even better.

Also think about what other opportunities you will lose with your wealth locked up in crypto.

Think about how you would feel if you needed to pay for something or buy something beyond your means, or if you had a family or medical emergency. Most people will not accept bitcoin as payment—and you wouldn’t want to give it up, anyway.

Could that change?

Yes, of course. If we do get hyper-inflation, nobody will want your government’s money. You’ll need alternatives to cash. Balance is crucial in times of uncertainty.

For me, that means sticking with my plan. So far, so good. If it continues to work the way it has so far, we will always buy bitcoin at the best price at that moment, when it’s not likely to go too much lower and very likely to go a lot higher.

As a result, we can keep our cash free for other opportunities or emergencies. We can let the rest of the world boost the value of our bitcoin while we use it as we like (or not at all).

I’m not saying we’re always going to buy and only see the price go up. I’m saying we’re going to make the most of every bit of bitcoin that we buy.

Once we get to the peak of this market cycle, we will avoid the crash and recycle our gains into other assets until the market settles and all those greedy, selfish people leave. At that point, we can start accumulating more bitcoin again.

At least, that’s the plan.

Meanwhile, don’t sweat the ups and downs. In this market, a 15-20% swing means nothing, it’s just noise.

In the real world, people are struggling terribly and the global economy is on the brink of collapse. In the bitcoin world, everybody’s hyped about the halving and $288,000 bitcoin and whatever else makes people think they’ll get rich.

Don’t worry about those 15-20% drops. It’s crypto, that’s something you’ll see many, many times.

Worry about the things that really matter—your health, your friends, your family, and the things that are important to you.

Those things can disappear in an instant. Cryptocurrency will be around for a very, very long time.

Thanks to everybody who’s reached out to me. I didn’t realize how many of you are new to crypto, and I really appreciate that you’ve chosen to check out what I’m doing. It means the world to me. We’re small but growing.

Until next time, relax and enjoy the ride.