I’m starting to think 2020 is the year of awareness.

Awareness about race. Money. Politics. Power. Inequality. Identity. Public health.

And technology.

While not as visible or visceral as those larger issues, the world’s collective response to COVID-19 created a new awareness about the value of digital technology. This awareness could have a profound impact on the spread of cryptocurrency.

Over the short term, it will not matter. Prices reflect the daily battles of bulls and bears. Today’s issue looks at the bigger context, a larger shift within the cryptosphere.

It’s the shift from people like you and me to people like your boss and your parents.

Prepare for the early adopters

I report to baby boomers and I have friends who work for baby boomers. I know people in finance, as well as business owners and executives. Also, I work for the U.S. government, which is led by some of the world’s least tech-driven leaders.

Everybody is using the internet for work this year. Not just email and Powerpoint, but videochats, online training, screen sharing, Slack, Zoom, cloud storage, you name it, they’re doing it online, remotely, virtually.

Guess what’s happening?

They’re realizing with a little training and some small changes in habits, they can save a lot of time and money without losing too much productivity. Some even like it.

For many, banking from home is a life-saving convenience. Video conferences are cost-effective ways to connect with friends, family, and colleagues. Virtual paperwork really is easier than ink pad signature stamps. Downtown real estate really is too expensive. My millennial subordinates really can be productive without coming into the office.

You might not think these people matter for cryptocurrency. They embody the legacy system. They don’t care about cryptographically-secure, time-stamped, distributed digital ledgers, nor do they think about the flaws of fiat money and inflationary central bank policies.

Yet, these people have money and power. They run our businesses and government. They hold as much as $70 trillion worth of assets, depending on what survey you believe.

And they are no longer skeptical about digital goods and services.

Inevitability is a selling point

This year, the demand for virtual services has exploded.

While some of this demand will subside as life goes back to normal, some will stick.

Some routine doctor visits and most consultations, many meetings, and almost every clerical or paperwork process will migrate to a digital platform. Companies will shift some positions to permanent telework. Mortgages and many routine financial transactions will settle using secure, internet-based commercial platforms. Companies will replace their payment processors with lower-cost, more nimble platforms like Stripe.

Even governments will change the way they deliver services and manage their money systems. Everybody wants to get rid of patchwork legacy systems, paper checks, physical banknotes, and layers of databases. China is testing its digital yuan. The U.S. Federal Reserve accelerated progress on its digital dollar.

None of these shifts need to include blockchain technology. Most won’t. That’s not the point.

The point is more and more people recognize the flaws in our commercial and financial systems.

COVID-19 has broken the status quo and governments have not offered any alternative. Meanwhile, DeFi has shown that you can manage financial systems without governments. Bitcoin has shown you can send money to people without banks. Altcoins have shown you can use money systems to solve social, political, and business problems.

True, on a small scale. This is a young technology, still developing.

But as a person in finance told me, lots of his clients have a sense that crypto “is the way everything’s going.” More people understand that crypto is not about creating a new Venmo, but rather, building global, permissionless networks that all people and businesses can use.

Of course, it helps that rich people and investment funds started buying bitcoin as a way to gamble on the governments’ recent money printing. But those people won’t stick around. They’re mostly not interested in building the financial networks of the future, they’re just hoping bitcoin will boom and make them more money. If that happens, they’ll sell. If that doesn’t happen, they’ll sell. They’ll only stick around long enough to find out which result they’ll get.

We can take those people for granted. If anything, their money will push bitcoin into its next bull run.

It’s all those other people that will send bitcoin to those lofty, mythical prices everybody predicts, along with the mainstream adoption everybody wants. Normal people who believe this new technology will fix problems with the traditional financial system. Angry people looking for a way out, latching on to this new technology. Old people staking a small claim to bitcoin as part of their legacy or retirement portfolio.

It will all seem more real because cryptocurrency has come so far since the 2017 boom. Many projects now have mainnets, dApps, and real usage beyond trading. Wall Street veterans now run crypto funds and crypto-related businesses. Universities teach blockchain. Some governments have crafted legal frameworks to protect and promote cryptocurrency.

Inevitability is a very compelling concept.

That’s great, Mark. Wen moon?

Does that mean bitcoin will get a massive rush of money and innovation tomorrow?

No. It takes time for people to wrap their heads around what’s going on. Awareness does not mean action.

Wall Street has only just started to corner the market for their clients. The lightning network hasn’t caught on the way anybody expected and DeFi platforms still have operational, security, and regulatory issues to fix before most people (including myself) consider locking up their money in smart contracts.

Your average person is worried about their job, their family, and so many other problems. Even if they had money to spare, they probably aren’t going to put it into bitcoin. That’s something other people do. It’s too risky.

If you want that big, massive, life-changing bull market that sends prices into the stratosphere, this is a good thing.

You need people to commit to this market. They need to care so much that they’re willing to suffer through 30-40% crashes, threats of government bans, failures with DeFi protocols, faulty oracles, high transaction fees, and the general complexity that has characterized cryptocurrency over the years.

Growth needs to come from conviction.

The good news is, conviction has entered the markets. If you’re a premium subscriber, you have seen the data validating that statement. If you’re not a premium subscriber, I don’t want to digress too much, I hope you’ll take it on faith that what I’m saying is true.

For the past few months, bitcoins have flowed into the hands of long-term HODLers and institutional investors—people who are willing to ride the market up and down. Based on past behavior, you’re not going to get a lot of selling pressure from them until prices go very high, very quickly, and they start pulling their money out of the market.

Meanwhile, miner inventories continue to dwindle, as shown in the Bitcoin Miners Position Index and the cut in block rewards.

Sellers are leaving the market. Bitcoins are flowing to people with strong hands.

When will new buyers arrive? I don’t know, but Google Trends shows worldwide searches for bitcoin have gone up steadily since December 2019. In the past, that’s signaled future growth.

What about altcoins?

This part of the market remains driven almost exclusively by individual investors and users, aka “retail.” Only a handful of altcoins have enough liquidity for institutional investors looking to make an investment of any significant size on the open market. They may buy alts in private deals, but you and I will never know about it.

Still, the alts have seen strength over the past year. Sentiment, activity, and interest in altcoins has gone up steadily for months.

While this hasn’t shown up in price yet, it will soon. A lot of amateur investors are selling the pumps now, so it’s hard to get a lot of momentum. That will change soon because the people buying either have conviction around these projects or enough savvy to ride the ups and downs without selling.

But bitcoin still leads. Altcoins make up barely one-quarter of the crypto market and almost no institutional investors can buy them, except for their personal use. You need to follow bitcoin. Where bitcoin goes, the market follows.

Where’s bitcoin going?

Probably, up.

Private bitcoin funds have seen record-breaking growth this year. These funds only allow accredited investors, and they’re raising money like crazy. Already, registered bitcoin funds hold 3% of the world’s bitcoin. Who knows how much more is sitting in cold wallets and private accounts?

It’s not just investors buying bitcoin. Traders are accumulating, too.

In May, derivatives platform Bakkt saw more physically-settled futures contracts than cash-settled contracts. It’s one thing to trade paper derivatives for kicks. Once you take custody of bitcoin, you usually intend to use it.

All my contacts in finance are buying for themselves and their clients. These guys are not selling at $10k and shorting “all the way down.” Yes, they hedge their bets with futures or options—but they do that so they don’t have to sell their bitcoin. They’re managing risks, not betting against themselves.

While Crypto Twitter and your Telegram group brag about shorting the top, the smart money is loading up on cheap bitcoin.

Meanwhile, you, me, and the OGs continue to use and accumulate. We don’t worry about who sold the pump or got rekt. We’re not timing the markets. We have strength and conviction.

Our strength and conviction will send bitcoin to the moon.

It may not happen overnight, but it won’t take much new money to cause that boom everybody expects.

No place to go but up

Smart money knows something that’s easy to forget when you’re in the cryptosphere. What is that?

Crypto is tiny.

Sometimes, the numbers seem big. Binance is worth $2 billion. Coinbase, $8 billion. DeFi contracts hold over $1 billion worth of ETH. Brave browser has 13 million daily users. Bitcoin has almost $180 billion market cap.

Millions and billions. These seem like such big numbers.

In reality, those numbers are tiny.

Morgan Stanley makes $10 billion each quarter. BNY Mellon, Blackrock, State Street, Fidelity, and other medium-size Wall Street firms make somewhere between $12-18 billion each year.

Global investment portfolios include about $40 trillion worth of assets, possibly double that amount. The U.S. alone has more than $22 trillion in assets held by registered investment institutions, which does not include personal wealth and foreign accounts.

Plus, you can add some of the new money that countries just printed.

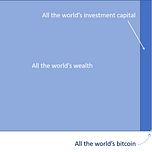

If you charted bitcoin on a pie graph of the world’s wealth, you wouldn’t even see it (I tried). I had to find another way to visualize it, with this image:

The rectangle represents the world’s wealth ($1 quadrillion). The dark blue stripe represents the world’s investment capital ($40 trillion), and the yellow pixel is bitcoin’s slice of the pie. Tiny, even at $10,000.

And what about altcoins? Why don’t I include the alts?

Because they don’t register at all. Bitcoin takes up about 66% of the market, with another 10% in stablecoins. Altcoins make up the remainder—barely 24% total.

People drive markets

So why has bitcoin’s price leveled off? Why are so many people still selling and shorting the market?

Because money doesn’t drive markets. People do. As long as people want to cash out or play the market, it doesn’t matter how much money’s sitting on a bank ledger or in a safe deposit box.

Who’s cashing out? Who’s buying in?

That’s what matters.

Does it seem odd that the so-called bitcoin maximalists and true believers keep selling/shorting at $10k (or so they claim), while financial professionals accumulate hundreds of thousands of bitcoins?

Isn’t traditional finance supposed to crush bitcoin while maximalists carry the torch? Why are the pros buying while the "true believers" are selling?

It’s all about mindset.

There is no reason to play day trader when we have such amazing things to look forward to.

I keep my eyes on the data from Glassnode, Delphi Digital, newsletters, and other research services. That’s where you can learn about what people are doing to drive the markets. You can see where bitcoins are moving or what altcoins are getting inflows and usage. You can spot those big, huge shifts in the market and the behavior of people in the market.

Growth in lightning network, Ethereum 2.0, the latest mainnet launch or altcoin partnership—those things will matter, in time. For now, it’s all about people. Who’s buying, who’s selling, who’s using.

Even if fundamentals mattered, how can anybody assess them now? All assets are topsy-turvy. Valuations and metrics are falling apart. Correlations seem to have collapsed. Common sense seems to have disappeared.

Worldwide, investors hold $12 trillion of negative-yielding bonds and they’re almost certainly going to buy more over the coming years.

The U.S. government flooded the market with dollars . . . only to see the price of dollars go up. In fact, USD has gone up 17% over the past two years and shows no signs of slowing down. What do you think will happen when oil markets recover and everybody suddenly needs petrodollars again?

Residential real estate prices in the U.S. keep rising even though 25% of workers have lost their jobs. The stock market’s on course to recover all of its losses.

None of these things make sense. Are we embarking on a new reality or are people just slow to catch up? I don’t know.

If it’s hard to make sense of traditional assets that have long price histories and well-established metrics, how can anybody expect to measure the “fundamental” value of cryptocurrency?

Stay diversified

For that reason, it’s important to stay diversified.

I know it sounds terrible to say, especially when everybody’s telling you this is the best time to buy bitcoin and I’m showing you all this bullish data and analysis.

For all we know, it could take years for bitcoin to get where we want it to go, even if its price goes up. Meanwhile, you will need fiat to pay bills and buy things.

Also, if you keep all your wealth in bitcoin, you will miss chances to invest in other, possibly better opportunities. Any private companies that are raising money now and have strong balance sheets, teams you can believe in, and good products or services—those companies will dominate the next decade. You can get a 1,000x return from owning a small stake in one of those companies, with no volatility and (in the U.S.) tax advantages to boot.

Also look for traditional investments, maybe even business ventures.

Bitcoin’s price will probably go up a lot, but it will certainly crash on the way up. Unless you’re a premium subscriber, you will never know whether that crash will mark a typical 30-40% correction on the way to a market cycle peak, or the beginning of one of those multiyear, 80-90% bear markets that suck the life out of you and your money.

Yes, I have a plan, but plans aren’t predictions. The world is changing quickly and drastically. You don’t want your whole financial fate tied to bitcoin. My plan has a contingency that will force me to exit at a loss if necessary. I don’t want to do that. I’m sure you don’t want to do that, either. If you put too much money into this market, you will find it very hard to leave if crypto really does fail.

On the flip side, if we get the 10-100x returns everybody predicts, you won’t need to put much money in now. You can look forward to a life-changing, once-in-a-generation windfall. A 2% investment could double your net worth. How greedy do you need to be?

Just because Stock-to-Flow says bitcoin will go to $288,000, you can’t ever know how long that will take or what might happen along the way. The model could fail. My plan could fail, too.

Never put all your eggs in one basket.

Over the next few years, I expect to see crypto move from a tiny, niche commodity to an established, robust asset class. Today, people are suffering from economic uncertainty, personal hardship, and pandemic disease. Massive social and political movements are sweeping the world. Crypto isn’t really on people’s minds.

We have the good fortune to own a small stake in the financial networks of the future. Let’s hope others will join us, in time.

I suspect they will. Meanwhile, relax and enjoy the ride.

Recent Articles

Check out some other articles I’ve published recently:

Blast From the Past

I dug up an article I wrote about a year ago, “The Myth of Millionaires and Bitcoin.” Still hits the mark.

You might enjoy it. Tap the button below to read it.