If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version.

In last month’s issue, I reflected on the collapse of the crypto market and what comes next.

In this issue, I had planned to focus on altcoins. Instead, I’m going to push that off to a future issue. If you have a chance, read my latest altcoin report.

Today’s issue looks at today’s investment landscape and how we choose to define the opportunities and the risks it presents.

How does it feel to be on the receiving end of the greatest pump-and-dump in human history?

The world’s governments pumped a ton of money into the world’s financial markets, then yanked it all away.

And you thought I was talking about crypto?

Nah. Too small.

Crypto is an infinite loop of pumps and dumps, one after the other, big and small, over the long and short term, again and again for years.

Traditional financial markets are supposed to offer the opposite: stability. “Intrinsic value.” Dividends. Yield. Security.

Until they don’t.

If you bought almost any financial asset in the past two years, you’re probably down on your investment.

You’ll probably be ok over the long run. I bought assets over the past two years, too. Also sold some. All within my portfolio strategy.

Some people think that’s stupid or hypocritical. Talk about a terrible investment environment, tell you most assets will take years to reclaim their previous all-time highs, and buy them anyway.

Even worse—encourage other people to buy!

Opportunity knows no price

Every asset carries risks. Nobody can predict how high or low their prices will go over any given timeframe.

Why let that keep you from an opportunity to build wealth? Buy things that go up in value or generate income. Preferably, both.

Crypto’s not the only way to do that, but it’s the only high-growth investment opportunity that you and I can easily buy. The others are reserved for the wealthy, well-capitalized, and well-connected.

As a result, it’s a very important part of my financial plan. Bitcoin is a core portfolio asset, along with cash equivalents, real estate, and the investments I hold with Personal Capital.

If you put a gun to my head and asked me what will happen to property values in every country on earth, I’d tell you we’re all going to take a haircut over the next few years. Maybe 20-30% decline in property values, with all the consequences that come from that drop. Back to even at some point, possibly many years from now.

Does that mean you should sell your house and buy it back later at a lower price? If you bought a house in the past year or two, should you feel bad about it?

What if prices don’t go down? Of if they go down only 10% or so? A lot can change in a very short amount of time.

Do you wait for that hypothetical bad outcome at the risk of giving up good things like cash flow, equity, and tax benefits that come with owning real estate?

Billy the neighbor thinks you’re getting REKT. He’s wrong.

Do you expect a prolonged bear market for stocks?

So do I! Are you selling?

Neither am I.

I sold enough in 2021 and the beginning of 2022. The choice was stocks trading at insane valuations, bonds that will lose a lot of value but at least offer some income, or crypto.

Easy decision.

Now we wait and see what happens.

Maybe 2-3 years of paper losses, with some winners sprinkled in? We’ll see. You know things aren’t looking good, you just don’t know when things will turn around, what the prices will be when they do, and how the markets will respond as circumstances change.

So, why put money into crypto?

Because no other asset class is so oversold relative to historical measures, with so much upside.

Especially when you consider macroeconomic instability, geopolitical risks, trade disruptions, and demographic headwinds that add so many risks for legacy financial markets.

No! Don’t look at the macro!

Yea, I feel the same way. It’s not pretty but we need to talk about it.

China

China is the world’s #2 economy and most countries’ largest trading partner.

Its property values keep falling. Some developers ran out of money. Some borrowers now refuse to pay the money they owe on properties that their builders delayed or didn’t deliver. Banks and local governments are trying to force people to pay.

In some places, riots have broken out. Rumors say some banks have frozen their customers’ funds and debtors have stopped repaying loans of all kinds.

Various estimates suggest up to 1% of China’s outstanding debt stands at risk of default. That may not sound like much, but nobody knows how many other financial obligations depend on the repayment of this debt.

Is China facing its version of the US’s subprime mortgage crisis? What will China’s government do about it?

Let’s hope everything works out.

Household debt

According to data from the Bank for International Settlements, as of the beginning of 2022, households in Australia, Denmark, Switzerland, and South Korea owned more debt than their countries’ entire GDPs. It’s unlikely the situation has changed much in the past six months.

If you believe BIS’s data, these countries could convert a year’s worth of economic production into cash and still not raise enough money for households to pay off their debts.

How long can people service these debts as interest rates go up and growth slows down? What happens when you factor in public sector spending?

Let’s hope everything works out.

Corporate debt

The world’s investment institutions own almost $1 trillion in collateralized loan obligations (CLOs), a type of financial product that combines high- and low-risk corporate debts into a tradable asset.

Since it’s been two years since we had any normalcy in the world’s debt markets, nobody really knows whether these low-risk debts are actually low-risk or whether high-risk debts are properly rated.

On top of that, investors own trillions more in junk bonds—nakedly high-risk debt from businesses that generally have no profits or want to invest in speculative business ventures.

Higher interest rates make it harder to finance debt. Shrinking liquidity makes it harder to generate profits. A surging US dollar makes it harder for US companies to pull profits from overseas and tougher for foreign companies to cover liabilities denominated in dollars (e.g., debt, accounts payable).

Let’s hope everything works out.

Sovereign debt

Too many governments can’t pay their debts. Something has to give.

Let’s hope everything works out.

Eurozone

The European Central Bank started raising interest rates to tamp down on inflation and stem a looming currency crisis.

The problem?

If the ECB raises rates too much, it will force Italy and Portugal into a debt crisis and possible default. (Maybe Spain and other countries, too.)

As a backstop, it created a new financial program to bail out these countries if things go south. Does that put you at ease? Especially with all of the other problems facing Europe?

Let’s hope everything works out.

The rest of it

Emerging market economies, war, COVID-19, food shortages, chip shortages, dollar shortages, energy shortages, inflation, starvation, and general human suffering.

Oh, and the US is almost certainly in a technical recession, even if the government won’t admit it. We’ll find out later this week.

Yet, you still make money. You earn an income. You have some wealth, even if it’s just spare cash from your paycheck, a pension, or savings you’ve accumulated over the years.

What can you do with that money?

Wait until the price goes up

“Macro” conditions suck and that certainly plays a role in how people spend.

At the same time, psychology doesn’t change.

When you think selling assets will give you more money than buying or holding assets, you sell. When you think buying assets will give you more money than selling or sitting on the sidelines, you buy. I do, too.

Inflation, fear, greed, the Fed, energy costs, and the things I mentioned above?

In behavioral economics, those things change the premiums and discounts people place on one asset or another.

In other words, when you’re starving, food seems far more important than whatever else you own. As a result, you’ll pay more for food when you’re hungry than when you’re not. You may even sell things you own to raise money for food.

When financial assets go up, you can’t help but want to put money in—even if you don’t have money to spare. When they go down, you can’t help but want to keep money out—even if you have money to spare.

This is an odd phenomenon.

For real things like houses, cars, and toiletries, we get excited when prices go down. For fake things like stocks, bonds, and crypto, we get worried when prices go down.

I guess how you feel depends on whether you want to buy or sell.

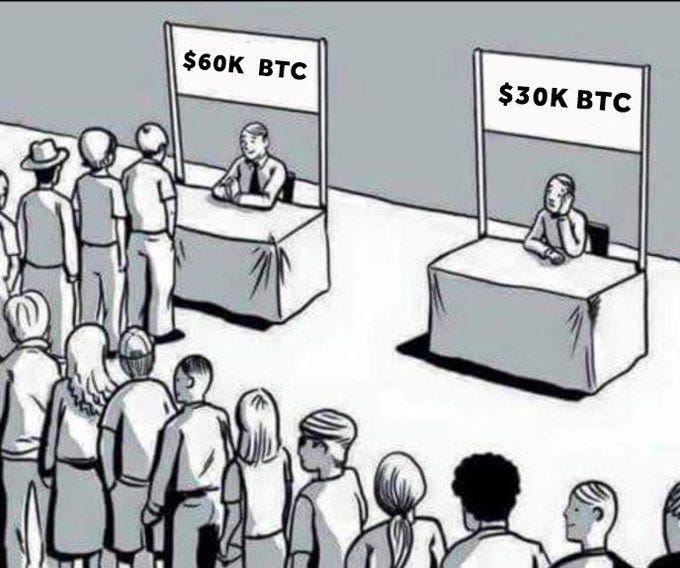

Do you think it’s funny that some people bought bitcoin at $60,000 but won’t buy it at $30,000?

Those people never wanted to buy bitcoin in the first place. They wanted to sell it for more than they bought it for.

Buying was a necessary first step.

When bitcoin’s price hit $60,000 on an upswing, they thought they could make money. When its price hit $30,000 on a downswing, they thought they couldn’t.

Immutability, censorship-resistance, permissionless innovation, open finance, anti-fragility, yada yada?

Whatever. With crypto, the market moves in a specific pattern:

Crypto flows into the hands of people who want it more than their government’s money. Eventually, the market runs out of sellers. Prices go up.

Once prices go up long enough for new buyers to think prices will keep going up, new buyers come into the market. Prices go up higher.

Once prices go high enough that people decide they want to trade it for more of their government’s money, they sell. Prices go down.

Once prices go down long enough for people to think prices will keep going down, new sellers come into the market. Prices go down more. The cycle continues.

At this point, we only need to care about whether enough crypto has flowed back into the hands of people who want it more than their government’s money. Everything else will take care of itself.

When will that time come?

We can never really know, but trading charts, technical analysis, on-chain data, data models, macroeconomic forecasts, technological and demographic developments help us make sense of the market and the circumstances around us. They give us a sense of perspective about how this pattern’s playing out.

With crypto, prices move so violently and to such an extreme that you end up with such a wide range of prices and timeframes, it’s very hard to do anything more than that.

At every peak and bottom since its creation, bitcoin’s price has gone up 50% after it flashed signs of a peak and down 50% after it flashed signs of a bottom. Wherever bitcoin goes, altcoins follow.

We can all agree that the historical “market bottom” signals already flashed. This is a fact.

That means a drop to $14,000 or even $10,000 would make sense, even if it’s well beyond the range of normal prices when you look at bitcoin’s normal historical trading band.

Let’s say you’re waiting for that drop. When will that happen? How will you know when it’s done? What signal do you use? What price?

What will you do if bitcoin’s price never goes lower than it is today?

But miners are dying

Are they?

I look at miner activity all the time. No data gives you a complete picture but one metric that simplifies overall miner behavior into a simple chart is the Miners Position Index (MPI).

MPI measures miner outflows relative to the historical average for the past year. Since miners always sell, MPI lets us see whether they’re selling more or less than they normally do at any given time.

It’s a blunt, limited tool, but it’s easier than scouring the blockchain for clues. Take a look at the pale line on this chart:

We saw some agitation shortly after the start of the Russia-Ukraine war and LUNA’s bitcoin buying spree, then again last week. Otherwise, it’s pretty much in line with the status quo. Some miners aren’t doing well, but there’s no widespread distress among the total miner population.

Some things miners have done over the past two months:

Gone out of business.

Turned off old machines.

Sold machines.

Sold bitcoin to raise cash defensively, just in case it takes a while for the market to recover.

Sold bitcoin to buy new equipment at massive discounts. They want to take advantage of plummeting machine prices before the market recovers.

Sold bitcoin to expand capacity, bring more self-miners into their networks, and move their machines to cheaper locations.

Sold bitcoin as part of a merger or acquisition where a larger company buys a smaller company and sells some portion of that smaller company’s bitcoin.

Over the past few months, some miners defaulted on loans and saw their bitcoins sold against their will, under the terms of agreements they made when prices were higher. Others repaid those loans and took back their collateral, but they may have sold it afterward, for the reasons above.

Concerns about miners seem overblown. As bitcoin’s difficulty adjusts, mining costs will go down. Miners will adjust, too. We will continue onward.

Doesn’t matter. Bear market, bro

Are you concerned that prices will keep going down? More exchanges, lenders, and VCs will blow up?

Hedge with a short position. While you lose money when prices go up, you get to keep your crypto. When prices go down, you make money and don’t have to sell your crypto.

You can do this anytime, at any price. I don’t, but I encourage you to learn how to do this. Some traders use this strategy to juice their profits but you can also use it to manage your risks.

One thing to consider, though.

What if the bear market’s already over?

If bitcoin’s price stays above $17,500, we are already in a bull market—and we don’t even know it. That seems crazy, but this is a crazy market.

On-chain and technical metrics say the market peaked in January 2021. When you look at circumstantial evidence like one permutation of the PI Cycle indicator, the Coinbase IPO, and Elon Musk’s Dogecoin shout-out on Saturday Night Live, the market peaked in April 2021. If we’re going by price, it peaked in November 2021.

Institutions and tourists mostly left in November, December, and January. New buyers disappeared basically throughout 2022. Liquidity dried up in April and still hasn’t returned. Lenders and VCs imploded. Market participants realized their largest aggregate losses in recorded history.

Isn’t that how bear markets end?

In any event, it’ll be a long time before we know when the bull market starts.

First, we need a higher high, the first of two conditions for an uptrend. Then, we need a higher low to confirm the bull market. That could take months.

How would you feel if we did what we did in 2012, 2015, and 2019? During those years, prices went up and down for months but never lower than the previous low.

At what point do you say we’re in a bull market? How high does your return on investment need to get? 100%? 200%? 300%?

If you’re sitting out the market for a little bit, waiting for things to turn around, at what point do you decide that’s happened? When bitcoin’s price hits $40,000? Once Celsius’s bankruptcy settles? After the Mt. Gox bitcoins get distributed? Fed pivot? World peace?

Some say now that we’ve removed leverage, we can get back to normal.

I guarantee leverage will come back in the form of regulated, well-managed lending platforms from Wall Street exiles, possibly as subsidiaries or branches of crypto exchanges. Maybe even banks and Wall Street firms themselves, once the US codifies its regulatory and legislative framework next year.

Nah, Mark. Institutions never coming back. Wall Street doesn’t care anymore.

Institutions were never really that into crypto.

At the peak of the market, even the most generous estimates placed institutional money at somewhere between $70-$100 billion out of a $3 trillion market.

That includes family offices, businesses, countries, funds, everything. At best, 3% of the market, give or take.

Is that really a substantial number?

We know a lot of institutional money left towards the end of 2021 and the beginning of 2022. We followed this in real-time across a series of updates for subscribers on the paid plan.

Yet, while the institutions took money out of the market, the people who ran the institutions and worked for the institutions stayed in the market. Many of them are still here.

They sold their clients’ investments because they had an obligation to do so. They bought for themselves.

The only certainty is uncertainty

While that’s nice, it’s meaningless. The Terra Luna debacle wiped out billions from diamond hands, crushed the lenders, sent the market into a panic, and precipitated a wave of forced selling unlike anything we’ve ever seen in crypto.

It’ll take a while to recover, even after prices go up.

To anybody who thinks bitcoin’s price can’t go to $14,000, look around. We still don’t know how deep the lending debacle goes. Meanwhile, the world’s governments are hell-bent on bringing down the price of everything.

The bottom is always $0. That doesn’t change when the price goes up or down. There is never any limit to how far crypto prices will fall.

Does that mean bitcoin’s price has to go lower than $17,500?

No. What if so many people have already sold that it’s impossible for buyers to find sellers at that price or lower?

In November 2021, people said bitcoin’s price couldn’t go to $100,000 by end of December.

What a silly idea.

At the time, $100,000 was more than doable. A rise of 50% in six weeks? Bitcoin can do that in its sleep. Its price has made similar moves in similar situations forever. Any price up to $135,000 would have fit within the range of normal prices.

Did that mean it had to happen?

No.

Just like bitcoin’s price didn’t go above $100,000 in 2021, there’s no reason to think it has to go below $14,000 in 2022. “Up” is still an option, as hard as it is for some people to believe.

In fact, bitcoin’s price has gone up many times in circumstances just like today’s.

Best of all bad options?

In any event, we have to accept the situation we’re in. Look at history and the behaviors of people in the market.

Today’s prices are beyond the normal range of volatility. Every previous signal of short- and long-term bottoms has flashed.

At the same time, bitcoin’s price remains below its 200-week moving average. Until now, its price had never spent more than one day below that technical level.

As a result, you may think this downtrend has to continue. Macro, fraud, regulators, etc.

Everything can change in a heartbeat.

Even if bitcoin’s price goes up 100% or more, that changes nothing. Pumps of 100% happen in every bear market. So do pumps of 50% and 25% and every percent in between.

What would you do if bitcoin’s price went up to $40,000, then down to $30,000, then up to $50,000, then down to $40,000, as you see in the grey circle on this price chart:

Extend that pattern for a few more years. Up $20,000, down $10,000. By 2025, bitcoin’s price will hit $130,000 and you’ll be up 600% on your investment.

Find another market that can realistically give you those types of returns in such a short period of time.

You may think that’s ridiculous.

Ok. Would you be disappointed if bitcoin’s price only goes to $100,000 by 2025? What about $80,000? You’ll end up with 300% gains over three years.

For crypto, that’s a letdown. For any other market, that’s insanely good.

You are the money that you seek

For those reasons, I’m still buying crypto until my plan says to stop.

Some say I’m getting REKT because the value of my cryptocurrency keeps going down.

I beg to differ. I have more cryptocurrency now than I have ever had before.

On average, my plan gets you about 30% more bitcoin than anybody who dollar-cost averages the same amount of money over the same timeframe.

(To be fair, you’d do only 5% better with my plan when you compare only from November’s peak to today.)

At the same time, I’m sitting on better returns on my investment than most traders—even after taking into account the changes in my plan along the way.

If you’ve followed my plan, you’re anywhere from up 300% to down 54% on your investment. You’re probably closer to down 30%.

Whether you’re REKT or not depends on what you want to get out of this market.

If you want an easy way to build wealth, you’re not getting destroyed at all. Quite the opposite. You already lost a ton of money by not buying at prices lower than today’s.

You can’t recover that loss, but you have a chance to make up for it as the market recovers.

If you want to sell crypto for more of your government’s money, you have it just as easy. Buy now, then sell when the price goes up. You get in at $22,000, get out at $28,000, and finish with 25% more than you started with, maybe in as little as a few months.

Even if it takes a year to get up to $28,000, your 25% gain will beat almost every other investment you can make right now.

Better yet, learn how to trade. That’s a skill you can apply to any market at any time.

Never dismiss the value of having a skill that you can apply to activities where you can make money off of your mindset, talent, and all the things that make you an incredible person.

If you do that, you won’t need crypto to make money.

Then, as you have money to put into this market, you can put it in. Grow with this asset class. Stake your altcoins. Try out new dapps and wallets. Discover opportunities to enrich your life with NFTs, Web3 interfaces, and new communities.

If you follow my plan, you’ll get better results than most traders and people who dollar-cost average, but worse results than some traders.

If you don’t follow my plan, you’ll do ok, too. Buy now and you won’t need to buy later.

While that doesn’t necessarily mean you’ll get Lambos, 100x moonshots, and eternal wealth, you’ll get a stake in the financial networks of the future.

Is that really so bad?

Relax and enjoy the ride!

Share this post