Welcome new subscribers!

In this month’s issue, I will talk about narratives, theories, and the people who spread them. If the embedded audio narration isn’t working properly, tap this button to switch over to the podcast version.

With so many bold personalities making bold statements and the cryptosphere growing into a market for everybody, every move seems huge and every action seems urgent.

As a result, it’s easy to lose perspective.

In the coming weeks and months, perspective will matter more than any change in bitcoin’s price or any altcoin pump (or dump).

More on that below.

Before I get into that, take a minute to sign up for a great, free resource that will help you make sense of the cryptosphere. It’s called DAN Teaches Crypto. Tap this button to sign up.

With DAN Teaches Crypto, you’ll get video tutorials and tons of useful links and websites that explain all the basics and a few advanced concepts, too. Whether you’re new or experienced, you’ll learn something.

The DAN team didn’t ask me to plug this service and doesn’t even know that I did so. I don’t accept paid or sponsored content, but when I find something interesting that I think you’ll appreciate, I’m happy to pass it along. Free information is everywhere. Good free information is hard to find.

There are no experts in crypto

Because cryptocurrency is such a new technology, it has few experts. Even the most seasoned professionals have less than a decade in the field. Many have only a few years.

In no other field does ten years of experience make you an expert.

Savvy? Sure.

Knowledgable? Let’s hope.

A good source of information? Yep!

Not an expert.

When you see people who have large followings or popular books, you may think they have some incredible insight that you don’t—even though they all mostly say the same thing.

For a culture that prides itself on contrarian thinking and rebelling against “the herd,” we sure do a lot of groupthink.

Why? Nobody really knows what’s going on. We all have one small piece of a massive puzzle. At best, we have some gleanings, insights, and inferences about the bigger picture.

Data models abound, but they all disagree with each other. Markets move faster than YouTube can handle. Everybody’s got their opinion.

A little skepticism goes a long way.

What makes anybody else’s opinion better than yours?

Anything is possible if you believe

For most of my twenties, I worked in Congressional politics—first as a campaign organizer, then as a Congressional aide, and later as assistant to the top lobbyist of a Fortune 500 company.

My biggest takeaway from those jobs?

No matter what the facts say, you will believe whatever you want to believe.

Eventually, somebody will come along to take advantage of your beliefs.

In politics, you can make a living doing this. In fact, there’s a whole subset of the industry dedicated to this work. It’s a skill some people practice and hone for years. Those who do it well can make a lot of money as consultants, speechwriters, press aides, spokespeople, radio hosts, and commentators.

These people train their entire lives on how to turn truth into falsehood and spin facts into fiction. They learn how to use semantics, straw man arguments, and distractions to present a false narrative or keep people from the truth.

There’s a reason they make a lot of money doing this. People will buy into whatever bullshit makes them feel good, smart, right, and safe.

Whether it’s true or not?

That doesn’t matter. If you believe it’s true, it’s true. Everything else is irrelevant.

When I got into cryptocurrency in 2017, I believed a lot of bullshit, too. Pretty much everything the “experts” said.

At that time, they said bitcoin could never crash because CME futures would bring in tons of money and Wall Street would buy up the market.

Then bitcoin crashed, dragging the altcoins down with it.

To explain the lag on the markets for the first part of 2018, they said “Asians sold crypto to buy gifts for Chinese New Year, it’ll bounce back after the holiday.”

When prices kept falling, they said “U.S. investors are selling to pay taxes, it’ll bounce back after tax season.”

When prices kept falling after that, they said “whales and Wall Street are manipulating the prices down, they can’t do this forever, it’ll bounce back.”

Once the market settled around $6,000, they said the bottom was in.

And then bitcoin’s price crashed another 50% and most altcoins dropped 90% or more.

They blamed Craig Wright, Roger Ver, governments, ICOs, scams, and whatever else they could think of.

They should’ve blamed themselves.

At the time, all of their arguments made sense to me. I bought into them every step of the way, up to the top and down to the bottom.

I believed.

Only later did I learn how this market really works.

Perhaps crypto’s thought leaders and celebrities are not as intentionally manipulative as the people who pervade our political systems, but they’re no less effective—and with the same result:

You end up believing things that probably aren’t true.

I’m sure Saifedean Ammous didn’t intentionally present a historically and culturally false portrait of monetary evolution in his famous book, The Bitcoin Standard. He probably just doesn’t know about all the discoveries historians, psychologists, and anthropologists have made about the human relationship with money and its uses over time.

Or, perhaps he dismissed them. As an Austrian economist, he’s trained in dogma and orthodoxy. Maybe he doesn’t accept ideas that contradict his worldview?

The narrative sells. It’s a good story that makes sense.

Crypto is full of good stories that make sense.

That doesn’t mean those stories are true.

Reality bites

Look at today’s stories:

Bitcoin will go to $288,000 without any major crashes because institutions will never let it crash.

Bitcoin’s price can’t go below $40,000 because Stock-to-Flow says so.

Corporations will never ever sell, no matter how much their investments go up in value or fall in price.

The bull market’s ahead of schedule so prices will go twice as high for twice as long.

The four-year cycle and all the other data models will have to get adjusted upwards because of all this FOMO, you can’t contain it. It’s a new paradigm.

March is always a bad month for the market.

Anything’s possible, but you lose a lot of perspective when you buy into those stories.

(For example, bitcoin’s price is up 20% since March 1—hardly a “bad” month for any asset.)

In March 2020, I heard the same stories, but in the opposite direction.

Seemingly everybody thought bitcoin would go to $1,000, “retrace to the 350-week moving average,” and “complete an A-B-C correction.” They said we’d have a new Great Depression and a collapse in all assets. “Deflation, then inflation.”

At the time I wrote:

Since a massive 40% crash last week, inflows into crypto exchanges tripled and buy orders rose to 72% of all bids. Bitcoins flowed from 12- and 18-month old wallets into older wallets and wallets less than one month old.

In fact, as a proportion of all HODLers, those who bought within the past week have almost tripled—and they are not selling the dips we’ve seen over the past few days. This is literally a flip of the trend from the past month.

Also, Google searches for bitcoin have gone up, which usually signals inflows of money into the markets.

In a series of posts for subscribers at that time, I showed on-chain activity that we only see before very strong, upward movements in bitcoin’s price and trading charts that showed price movements, patterns, and market indicators that matched those of October 2015, the start of the previous bull market.

Did that mean the market had to go up?

No. In that same post, I wrote:

While this probably explains why [bitcoin’s price] has gone up again, keep in mind, big whales offloaded a lot of bitcoin. It will take a while to recover.

Also, even if we go up higher than the current $6,200, you have to look out for a possible follow-up purge as miners sell their remaining inventory to capture whatever gains they can still get before the halving.

In other words, they may sell en masse because they feel like this is the last, best chance to make some fiat [before they go out of business]. If that happens, nobody can predict how low the price will go…

…[possibly] way, way lower than $5,400.

I’m still adding a little bitcoin almost every day while I take a “wait and see” approach…[because my] investment thesis is still intact...

Above $5,400? We’re ok.

Dip below $5,400 for a few days, then pop back up? No problem with that. We can also bounce off of that level or even a little below, as long as we come back up. All good.

It’s the trend that really matters to me. We need to trend up, not down. Today’s pump is a nice, refreshing break from the terror of the past two weeks, but we’re not out of the woods yet.

Yes, the famous “could go up, could go down, we shall see” analysis people seem to think I always give. But all those outcomes fell within the realm of realistic possibility. They were all rooted in facts, evidence, and observations, not data models, theories, and projections.

And nobody was talking about them at the time.

It’s not about right or wrong. Nobody can predict the future. It’s about context and perspective that’s too often lost in the din of the moment.

To be honest, I don’t make decisions based on projections and data models. That’s hard and carries a lot of uncertainty.

For me, I just want to be on the right side of the market—always accumulating when the market’s strong and building momentum, not after the price has started running away from me and could crash at any moment.

That’s how I built my plan. We don’t need to know which way prices will go because we have very clear data and history backing every decision.

In the long run, you won’t care about whether you bought bitcoin at $20,000 or $30,000.

You will care about putting all your money into the market when it’s likely to crash instead of waiting until after a crash, when you can buy everything at a discount and expect the value of your investment to keep growing forever (though not straight up).

Lines and squiggles

Over the past few weeks, I have talked a lot about bitcoin’s trajectory.

While I don’t want to ignore the altcoins, this market still revolves around bitcoin. If momma ain’t going up, ain’t nobody going up.

In my updates to premium subscribers, I pointed out several charts and data models, then drew lines and squiggles that represent everybody’s expectations about how this bull market will play out. I projected other people’s predictions, not my own, into the future to see what result we’d get if institutions continue to buy every dip, corporations never sell ever, and bitcoin’s price continues its parabola forever.

My conclusion?

When you project those expectations into the future, bitcoin’s on-chain data will soon show signals that only appear at market cycle peaks and never at any other time.

Even with this recent lull in the market, we remain on course to reach a market cycle peak at roughly $90,000 next month.

That’s not a prediction. It’s literally just lines and squiggles on a chart. It’s following the trend to its natural conclusion.

When deciding when to buy and sell, I use different data to understand the markets. No lines, squiggles, or projections, just correlations that impute everything people do with bitcoins, regardless of whether they’re whales or newbies, institutions or retail, big or small, exchange or OTC.

I look at human behavior represented as actions people take with their bitcoin. Everything else is just commentary.

My data shows we are not near a market cycle peak, but it also shows there’s no way we can continue this pace and avoid a market cycle peak sooner than everybody expects.

We can sustain this pace OR have a bull market through the end of the year, but not both. We can’t have our cake and eat it, too.

Does that mean we have to peak next month?

No. This market can turn on a dime. Or, chill out for a few months before going up again.

We know bitcoin has lost strength for months as its price went up. Premium subscribers, check out my updates since January and you will see the data get progressively worse with every passing week.

To be honest, the pace and speed of bitcoin’s rise surprised me. We’ve never seen it go straight up for this long. It’s not sustainable. Like a jet plane that’s running out of fuel, bitcoin’s price can go a lot higher, but it’s going to have to land soon.

At some point, reality will catch up to the market. The question is when and at what price.

All models are wrong but some are useful

Just because stock-to-flow, aka “S2F,” predicts $100,000 bitcoin this summer, that doesn’t mean it will happen.

Bitcoin’s price has gone 4x higher and 70% lower than S2F for weeks at a time, and has sometimes spent months at prices 50% below and 2x higher than the model predicts.

This chart shows you how much bitcoin’s price has strayed from S2F’s predictions over time. When the line hits the black line, that means its price is aligned with S2F. As the line moves away from the black line, that means bitcoin’s price is deviating from S2F.

That line wanders quite a bit, suggesting there’s a wide range of prices that fit into the S2F model.

(Either that or S2F is a bad predictor of bitcoin’s price.)

There’s no reason we can’t zoom to $90,000, hit a market cycle peak, crash to $30,000, then recover later this year—or even by summer. That scenario would fit S2F and match the same patterns we’ve seen throughout bitcoin’s history.

There’s also no reason bitcoin can’t chill around $40-60k for a few months or crash down to the $20,000s from here. We’ve seen bitcoin make those types of moves in the middle of raging bull markets, all within the range of prices you get with S2F.

“Institutions won’t let that happen.”

Says who? How do you know institutions haven’t already sold?

Some have unrealized gains of 300% or more. Do you really think they won’t rebalance into other assets? Every professional portfolio manager is trained to do exactly that with every other asset they hold. Why would they not do it with bitcoin?

When bitcoin’s price hit $40k, a bunch of influencers and so-called maximalists openly told their followers they took profits. Another wave did the same thing at $57k.

Do you really think institutions care more about bitcoin than those people do?

“But they’re all buying. Wall of money!”

We know institutions are moving large amounts of money into the market, but the market’s so much bigger now than when they started. It’s 5x bigger than it was in September and October 2020, when institutional money came in by the truckload.

That means we need 5x more money to keep the markets juiced and zooming.

Yet all the public announcements of new bitcoin buys are smaller than before. Michael Saylor’s down to $15 million. NYDIG says it has $6 billion in commitments—good for them, but a trivial sum for a $1 trillion asset.

Since February, Grayscale and 3iQ have seen more money go out out of their funds than come into them. Inflows into the Purpose ETF have fallen off a cliff this month. Chainalysis and Glassnode research into exchange activity shows new buyers tapering off their engagement while existing buyers keep upping theirs.

What if everybody who wanted to buy bitcoin already bought it? Or worse, sold it?

When’s the last time you saw an institution tweet about much bitcoin they sold?

You will always see what you want to see

An honest accounting of history and data shows bitcoin has steadily lost momentum over the past four months, despite its price going parabolic. Projected into the future, this will lead to a market cycle peak a lot sooner and at a lower price than everybody expects.

This seems crazy and totally wrong. How can an asset rise 500% and lose momentum? Mark, that’s stupid. Haven’t you seen a price chart? Don’t you understand the data models?

Fair points and I was surprised at how fast and strong the market moved over the past few months, but bitcoin doesn’t care about price charts, data models, or my feelings.

We can see shifts in momentum from the movements of bitcoin and behaviors of people in the market. Mix that with basic human psychology and specific behaviors that can move the markets, and you can make some good inferences about your risks and opportunities.

I have covered this data for premium subscribers at length over the past few months.

Does it seem odd that I’m talking about the end of the bull market when everybody else is telling you it only just began?

Maybe you see something I don’t. In January 2019, bitcoin’s price was $3,200. In January 2020, it was $7,000. In January 2021, it was $25,000.

On those dates, the total altcoin market was worth $37 billion, $53 billion, and $215 billion.

Higher each year.

Does that sound like a bear market?

Yes, everybody says this bull market started in December 2020.

That’s fine and probably fits whatever the dictionary defines as a bull market. In practical terms, prices have gone up for more than two years.

“Prices go up during bear markets, too.”

Yes, but do they continue to make higher highs and higher lows for two years? With volume increasing over the duration of that time?

All the top Google hits define “bear market” as a sustained period of time wherein prices fall.

From 2019 to today, prices went up. Not straight up, but up, then down to a higher price than the previous bottom, then up again.

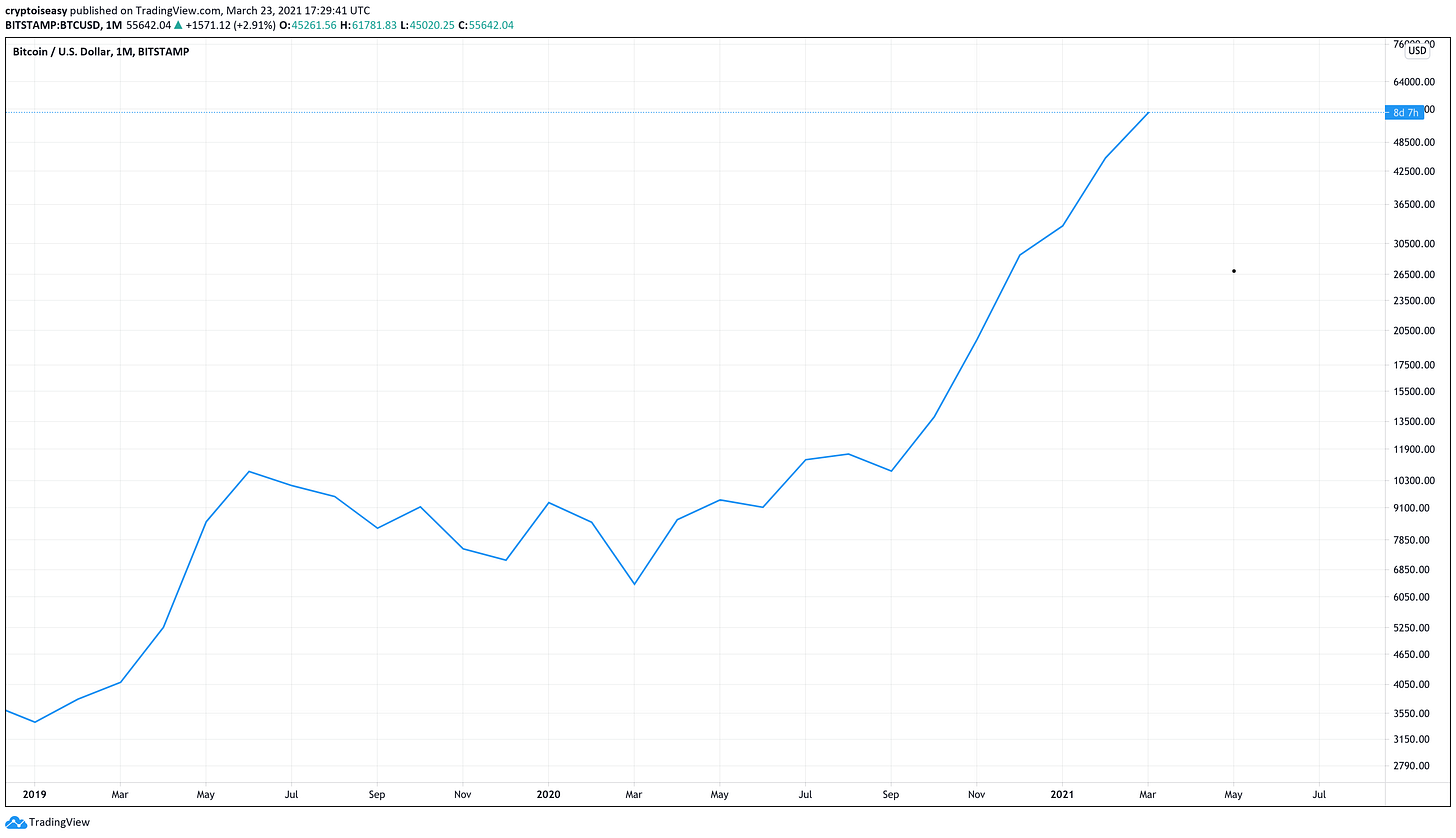

Like so, as drawn on a monthly trading chart:

Where’s the bear market?

I’m not going to argue with a dictionary, but where I come from, up is up. You can call it whatever you want.

If you want to see a bear market in two years of rising prices, that’s what you will see. Strip off the label and you may see something different.

Sometimes, a small change in viewpoint can make a big difference in your mindset.

Think out of both sides of your head

I laid out some data earlier in this issue that painted a bleak picture: bitcoin losing steam, ready to crater and take the rest of the market with it.

Don’t lose hope! We see some great things in the data, too.

Short-term HODL waves have started to widen, signaling new buyers have started to HODL their bitcoin.

The buying zone of my plan has come closer to bitcoin’s price than it has in months.

aSOPR, a measure of enthusiasm, is cooling off. Trading indicators show bearish divergences at high timeframes, suggesting the market will more likely do down than go up in the coming weeks and months.

That’s bad news for anybody hoping to cash out their chips next month, but we can’t get ahead of ourselves. For now, the trajectory is still up. On a purely technical level, bitcoin’s in a bull flag on longer-timeframe charts, a positive trading signal. We’re not near the peak yet, but it won’t take much to get us there.

Could prices chill for a bit or crash hard?

Sure. A crash or consolidation would build a beautiful foundation for a long, healthy bull run into the end of this year or even next. Maybe something closer to my prediction about how high bitcoin’s price will go?

You can’t see that if you’re locked into one side or the other, either “number go up” or “this dip is the start of a new bear market.” Life rarely plays out at the extremes.

This market is full of opportunities if you’re willing to wait and take advantage of them when they come. The gains are literally infinite. As a result, I don’t see a need to take any more risk than necessary to build wealth from owning crypto.

You may want to buy more bitcoin now, anticipating you can sell in a month or two. That’s fine, too. Nobody can deny the opportunity is there.

Not only does it exist, it’s realistic to expect you can double your investment in a month. Altcoins can do 3-4x or more over that time. Use bitcoin’s 20-day moving average as your anchor—buy when the price goes below it, HODL when the price goes above it.

(I don’t do this. Too risky.)

If this market does what everybody thinks it will, you’ll ride it to the peak, sell on the way to the top, and then buy back in after the inevitable crash.

If the market goes the other way, you’ll buy more crypto with the money you didn’t spend chasing prices upward, at a massive discount to today’s prices.

Up or down, you come out ahead.

Mark—you’re always 50/50. Take a stand!

Trust me, when my plan says to buy or sell, I will be anything but 50/50.

Until then, I’m happy to let the market work its magic.

You will always have opportunities to make money and build wealth. Act according to your conscience and instincts. Trust your gut, not your greed. In the end, everything will work out. Markets go up and down. They ebb and flow. Sometimes it’s more important to sleep well than chase after every pump or swing, or fret about every dip or drop.

If, like me, you look at a market that’s losing momentum and decide to chill and see what happens next, that’s probably the right choice for you. It fits your natural instincts. Why fight it?

If you look at a market that’s heading to its natural peak and decide you want to make some extra cash from flipping cryptos, go for it! Why deprive yourself of an opportunity to make money?

As of today, bitcoin’s price can realistically go up to $90,000 or down to $11,000 and fit patterns we have seen throughout bitcoin’s history.

We remain on a path to $90,000 by the end of April and we can tumble to $11,000 before I even consider rethinking my investment thesis around bitcoin.

Everything else is normal volatility.

Yes, massive volatility across a wide range of possible outcomes. Welcome to crypto!

You already won

If you’re in this market, you’ve already won. You own a stake in the financial networks of the future.

If you hold bitcoin, you can expect its value will grow substantially over the long run, if you’re patient enough to let it grow, bold enough to buy when seemingly nobody else is doing so, or savvy enough to avoid those rare, big, cycle-ending crashes.

If you hold altcoins, you only need one or two to succeed and your returns will far exceed anything you could’ve gotten with bitcoin.

Based on many surveys, it’s safe to say you’re among only about 15-20% of the world’s population. You own a source of wealth that’s immutably yours until you choose to give it away, and you bought it at a price that’s trivial compared to its future worth.

Whether this market goes up or down, you win. Whether this altseason continues or not, you win.

No matter what happens, you win—as long as you don’t sell.

As always, keep some fresh cash or cheap credit handy for whenever bitcoin’s price enters the buying zone of my plan. At that time, you’ll buy bitcoin and altcoins at will.

Whenever that happens, you can expect the market will go down not much more for not much longer. “Not much more” meaning 50% or less, “not much longer” meaning a few months at most—which sounds crazy, but for this market, those are not extreme swings.

What happens if bitcoin’s price keeps going up at this pace?

Prepare to sell everything. Premium subscribers, I will keep you posted every step of the way.

Nobody else will believe the market could possibly peak this early and at such low prices, but the data will be crystal clear. These moments happen rarely and don’t last long—only four times in twelve years, each time for a few weeks at most. You don’t want to wait for the inevitable +70% crash that follows.

If you missed my exit plan, read it now.

As of today, we’re not near the market cycle peak but you don’t want to wait until we start to see the warning signs. A lot can go wrong on your way to the exit.

Prices will go haywire, with massive swings from day to day, hour to hour. Exchanges will go down. Smart contracts will fail. Fees will explode.

Tuck this advice into your back pocket and take it to heart. You may not need it now, but you will eventually. All good things come to end.

But that end is not today. We still have plenty to look forward to.

Relax and enjoy the ride! the ride!

Share this post