With the crypto market in a downturn, this month’s issue looks at the main driver of the next leg up: Web 3.0 and the creator economy. Also, a reminder of the macro trends that frame the global financial system.

If the embedded audio narration isn’t working properly, tap this button to switch over to the podcast version.

A long way to fall

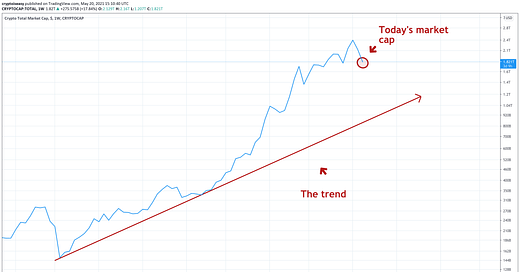

The entire cryptocurrency market has fallen 40% since peaking in April.

Some call this the start of a bear market.

Really?

The total crypto market cap can drop another 50% and not even break the upward trend that started last year.

Take a look at this chart, with late 2019 thrown in as a bonus:

Does that worry you?

If it does, then don’t look at what’s going on in traditional markets.

No safety anywhere

Stock dividends dropped to 1.38% annualized, continuing a multi-year trend downward.

At the same time, all long-term trading charts of major US stock indices show bearish divergences, suggesting momentum has started to fade.

On top of that, the record pace of retirements should lead more Americans to take money out of retirement accounts and draw pensions from funds that have money in the stock market.

Savings accounts return almost no interest. In real terms, they’re money-losers.

Negative-yielding debt dropped from $18 trillion to $13 trillion this year, which sounds good but also makes it more expensive for Europe and Japan to finance their governments’ spending.

Additionally, China's financial sector is showing signs of stress.

Meanwhile, junk bond rates have fallen to 4%. In other words, investors now accept 4% interest on debts that will probably never get repaid, when just a few years ago, even 8% would seem like a stretch.

Not like US treasuries do any better. This chart compares both:

Emerging market debt offers marginally better risk-adjusted returns, but most people can’t access that market, and what happens if the dollar rebounds? If that happens, emerging market economies will face higher debt payments and lower commodity prices, a double-whammy for any country that needs dollars to repay its debts.

Meanwhile, SPACs have started to implode as unprofitable businesses fizzle out and zombie corporations proliferate.

Real estate prices keep going up in almost every large economy, financed by larger and larger mortgages that fewer and fewer people can afford. In the US, median household income rose 2.6% last year but median housing prices rose at more than twice that pace (5.6% over that same time period).

Supply chains remain strained with businesses unable to get the supplies and materials necessary to make money and pay back their loans. Rents are still too high for too many people. Jobs haven’t come back the way everybody expected.

And you’re worried about crypto?

Gumwads and rubber bands

For now, central banks, 401(k)s, and pension funds can prop up poor-performing investments with steady infusions of cash. Never underestimate the power of government money printers, passive investors, and laws that force trillions of dollars of productive capital into low-return investments.

The world’s financial system is held together with gumwads and rubber bands. Ok for now, but when does anything actually get fixed?

What happens as boomers continue drawing money out of their retirement funds? When a market crash spooks people into safer assets? When monetary stimulus finally exhausts its diminishing returns? When the first pension fund declares insolvency? When the next recession puts a generation of homeowners behind on their mortgage payments?

When you hear talk of traditional investors embracing bitcoin, it’s not just because they love self-sovereign money or freedom from evil “fiat” money.

It’s because they realize what more and more people are starting to realize every day:

There are no low-risk investments anymore.

Safe assets lose money. Risky assets offer crappy returns.

Is it any wonder investment funds have started buying real estate and rich people are hoarding cars and jewelry?

Traditional financial investments suck. Nobody gets fair compensation for their risk anymore. You can forget about cash flow.

And you’re worried about crypto?

Sure, crypto looks bad, but have you seen the other guy?

Prices of raw materials and unfinished goods have gone up 50% or more since the start of the year.

Accordingly, the US consumer price index jumped over 4% year-over-year as the prices of cars, trucks, food, building materials, and gas rose significantly.

To the naked eye, it seems like inflation.

When you look at the data, it seems more like a supply shock. It’s too much to get into here, take this anecdote instead.

Lumber and cement prices shot up a lot this year. That didn’t happen because the government printed more money, it happened because there’s a global shortage of trees and sand. Without trees, you can’t produce lumber. Without sand, you can’t produce cement. To produce either at scale, you need lots of both, delivered to a production plant at the right time in sufficient quantity to fill the orders.

That’s not happening.

Shipping and trucking companies don’t have enough capacity to transport all the goods merchants want them to.

For some, COVID-19 and the 2020 financial crisis forced cutbacks and now they don’t time or money to buy the equipment, ships, and trucks they need to meet the new demand. For others, demand is simply too high, they don’t have the capacity to haul all the things their customers want.

Meanwhile, ship, truck, and train manufacturers suffer from the same problems their buyers do—they can’t get enough raw materials fast enough to make more ships, trucks, and trains.

On top of that, a freak accident in the Suez Canal caused several weeks of delay in global deliveries, which is bad enough, but now global ports can’t handle the volume of ships trying to offload cargo.

Asia has a shortage of microchips. Persistent drought is crushing US farmers and ranchers. China and the US still haven’t figure out how to unwind Trump-era trade restrictions. Factory wait times are the highest since 1987.

Online businesses have started converting empty urban office spaces into warehouses for deliveries. They pay more for rent and labor, but it costs less than shipping from a central facility.

In other words, shipping is so expensive that people are now moving their businesses instead of moving their goods.

And you’re worried about crypto?

Some call this phenomenon a temporary disruption in supply chains—which is a hell of an understatement. In any event, how “temporary” is temporary?

If you think rising prices are bad, just wait until we get inflation

When you combine dwindling inventories with supply shortages, you get a squeeze on prices. Add in a sinking dollar, Chinese financial troubles, and transportation bottlenecks, you can expect to see rising prices for finished goods, commodities, and any product that’s priced in dollars or needs to move a long distance to get to market.

Some people consider rising prices a sign of inflation.

In one sense, it is. In the traditional sense, it’s not, it’s simply the market dynamics.

Inflation happens when the creation of new money pushes prices up rather than market forces like supply and demand. That’s happening in financial markets, but not yet in the real economy.

To get true inflation, you need money to flow through the economy. That’s not happening.

Look at M2, the amount of money in bank and savings accounts.

Still very high, which means people aren’t spending all the money that the government is printing. Instead, they’re hoarding it.

At the same time, the velocity of money remains very low.

That means money’s barely changing hands.

Until this changes, you can’t get inflation in the traditional sense. Money isn’t circulating enough to push prices up for consumer goods like food and clothing.

That’s not a good thing. That’s a bad thing.

If prices are already rising without money flowing, what do you think will happen once that money starts flowing again? When all that idle cash starts moving?

That’s when you get real inflation, the type of price increases nobody can escape by cutting down more trees or digging deeper into the earth.

And you’re worried about crypto?

Make way for the creator economy

Out of sight from the traditional financial system, cryptocurrency has quietly birthed a new economy: the creator economy.

Investors, artists, performers, writers, entertainers, and content producers can now monetize their creations in ways never before possible.

With NFTs, creators now have a technology that lets them patent, copyright, license, distribute, and earn royalties on their works without forking over their profits to sponsors, patrons, and distributors.

They can simply embed their creations into verifiably unique, cryptographically secure assets and release those assets to a global audience instantly, directly, all at once, on whatever terms they choose.

Think about every patent. Every composition. Every work of art. Every YouTube video. Every movie. Every medical discovery.

Trillions of dollars in value finally removed from the grasp of Apple, Sotheby’s, YouTube, Netflix, and big pharma.

Today, that value flows through legacy systems that pay creators a fraction of the value of their work.

Tomorrow, that value will flow across vast global networks, directly from creators to those who want their creations.

Perhaps they will create new subscription models for fans and followers? Auction their creations to the highest bidders? Mint branded tokens as collectibles for VIPs or in exchange for access or benefits?

Cryptowriter uses CryptoFinney NFTs to bootstrap its platform and pay its writers. When writers submit content, they get a Finney Coin NFT they can redeem for a branded CryptoFinney. Each CryptoFinney can be burned for special or rarer CryptoFinneys, sold on AtomicHub, or stored as a collectible on the WAX blockchain.

Or, writers can forgo the CryptoFinney and instead sell or save the Finney Coin themselves.

Unlike a paycheck, writers own these NFTs as unique digital assets that represent their contributions to the community. They can do with them whatever they like—deposit them into DeFi protocols for interest, auction them off for cash, or fractionalize them on platforms like DODO NFT for income.

NFTs produce enduring value from a few lines of computer code, secured by the blockchain and exchanged with WAX tokens.

Where are the sponsors, advertisers, and underwriters?

There don’t have to be any. Nobody will have to pay 10% to Substack for each subscription or hope YouTube’s algorithm gets them enough views to make a few bucks.

They just need to build a community and reap the rewards.

In the real world, scientists, engineers, and inventors sacrifice their time, compromise their vision, and give up their patents to businesses. Artists struggle to find galleries that will take their work, let alone pay them for it. Musicians give up almost all of their profits to production companies and distributors.

As Kanye West said, “and a white man get paid off all of that.”

Most would agree that’s a fair deal. You need somebody to put in the time, money, and labor to protect your rights and connect your creations with people who value them.

With cryptocurrency, the blockchain will take of all that. Just as Netflix and YouTube made Hollywood’s business model obsolete, the creator economy will make Netflix and YouTube obsolete.

Web 3.0—the value layer of the internet

But that won’t happen until builders finish the infrastructure that supports the creator economy: Web 3.0.

Our modern internet depends on gatekeepers to funnel traffic and consolidate users into communities.

Web 3.0 replaces them with open, trustless, permissionless networks that everybody can access without an intermediary.

Imagine being able to serve YouTube videos directly from your own personal storage account under your control. Imagine developing an app or API that allows a global network of creators and consumers to find, share, and pay for content people store on their personal devices—or perhaps a business that redistributes unused storage and underutilized content to people who need it at a fraction of the cost of today’s centralized platforms.

While this may sound mundane or redundant, it solves two big problems with today’s internet:

Internet companies extract rent or payment from creators, advertisers, and users. This raises costs and stifles innovation.

People can’t move content from one platform to another. You have to export or download content or connect platforms with APIs, and once you move, you risk losing the community you’ve built.

With Web 3.0, smart contracts and cryptocurrencies handle the storage, processing, serving, and curation of content. Private wallets allow you to post or view content across websites. Everybody who connects with you on one platform can stay connected with you on all your platforms.

Businesses rise and fall but an Ethereum address lasts forever.

You wouldn’t care about Twitter banning your favorite Tweeter or fussing with multiple profiles and payment systems across lots of different platforms. You won’t need to use your credit card (and the private information it contains). You won’t need to connect Stripe or PayPal to your online commerce website (and pay them 3-5% on each transaction).

You will only need to download the right app or find the right blockchain.

Web 3.0 also serves a deeper, more human need:

The need to control the things we own.

We like to reap the rewards of our own efforts and to take ownership over our lives and the things we care about.

Our legacy systems do the opposite. Somebody else reaps the rewards of our labor.

Read more about Web 3.0 in this article from Diana Chen.

Great, Mark, but that’s the future. Today, the market’s tanking

True. We spent many months waiting for the other shoe to fall. Now it has.

Since December 2020, bitcoins have moved from strong hands to weak hands as OGs, so-called maximalists, and institutions sold to people who just wanted to make money flipping their bitcoins for more government money.

If you missed that, watch the first six minutes of my most recent update for a very quick summary of some of the key trends I’ve pointed out over the past few months.

Yet, despite weakness creeping in with every new all-time high, prices kept going up. People made a lot of money. Maybe you did, too.

You could’ve played blackjack at your local casino. Instead, you bought bitcoin and altcoins. It worked out for you.

Until it didn’t.

While you may fear the end is near, the data suggests otherwise. Sometimes, the market moves too fast for its own good. It needs to cool off for a few months.

Many people saw the value of their portfolio rise a lot very quickly—in some cases, 500% or more. It’s hard to sit on those types of gains. After all, you can’t pay your mortgage with bitcoin.

If you sold, I don’t blame you.

I didn’t sell because I know where this road leads. My plan has very specific rules for buying and selling. I stick to it.

Anybody who followed my plan should have gains on bitcoin of 300% to 500% after this pullback. That means the market will have to drop more than 75% before you have any capital at risk.

Depending on what altcoins you hold and when you bought them, you may have even bigger gains—despite this pullback.

While we’ve had some opportunities to buy, we haven’t had any reason to sell yet. Premium subscribers, I’ll let you know when that time comes—if it ever does.

A new prosperity

Look at the global economic situation, the death of low-risk investments, and governments unwilling to fix the problem (and in some cases, pledging publicly to protect the status quo).

Now compare that to the potential of Web 3.0, the creator economy, and decentralized financial protocols to unlock massive value and yield vast efficiencies in the way we create, distribute, and monetize “things.”

Which has more upside?

Too many people don’t have the money they need to be happy. They don’t have the life that they envision for themselves and they can’t get it from the legacy financial system.

Governments have destroyed passive yield-generating investments. Commodity prices have made common goods more expensive. Automation and robotics have taken jobs that pay a decent wage. Banks have all but stopped lending to small businesses.

A whole generation of people depend on an economic system that can no longer support their needs.

Unlike past generations, they won’t need to rally against the state or petition for change. They won’t need to protest, demonstrate, or legislate.

They will simply, peacefully, quietly choose an alternative that serves them better than their governments, banks, and legacy businesses—and maybe even make them wealthy for doing so.

Come for the money, stay for the revolution.

That is the future we can look forward to.

Today, we continue to buy our stakes in the financial networks upon which that future will be built.

Tomorrow, we will reap the rewards.

Relax and enjoy the ride!

Share this post