In this month’s issue of Crypto is Easy, I’ll offer my perspective on the cryptocurrency markets and the overall investment environment.

I’ll also talk about the significance of the U.S. presidential election on prices and some ways governments can help or hurt crypto’s growth. Then I’ll offer my expectations for COVID-19 and the world’s economies. Last, I’ll share what it all means for crypto and what I’m doing to prepare for the next stage of this bull market.

For the first time, I’m also posting the audio on YouTube. Tap the image below or scroll down to read the text version, below.

Nothing to fear but fear itself

The U.S. presidential election takes place in a few weeks, marking the first time two people older than 70 will challenge each other for the office.

The world will soon find out who will head its largest economy for the next four years, with ramifications for every country’s fortunes.

Some people think the outcome of this election will sway the markets, as in, all the markets—stocks, crypto, gold, currencies, bonds, you name it.

I’ll believe it when I see it.

Smart money knows presidents have little impact on the economy or any major asset class. The world’s economies, stock markets, bond markets, and commodity markets show no correlation to any U.S. political party or president.

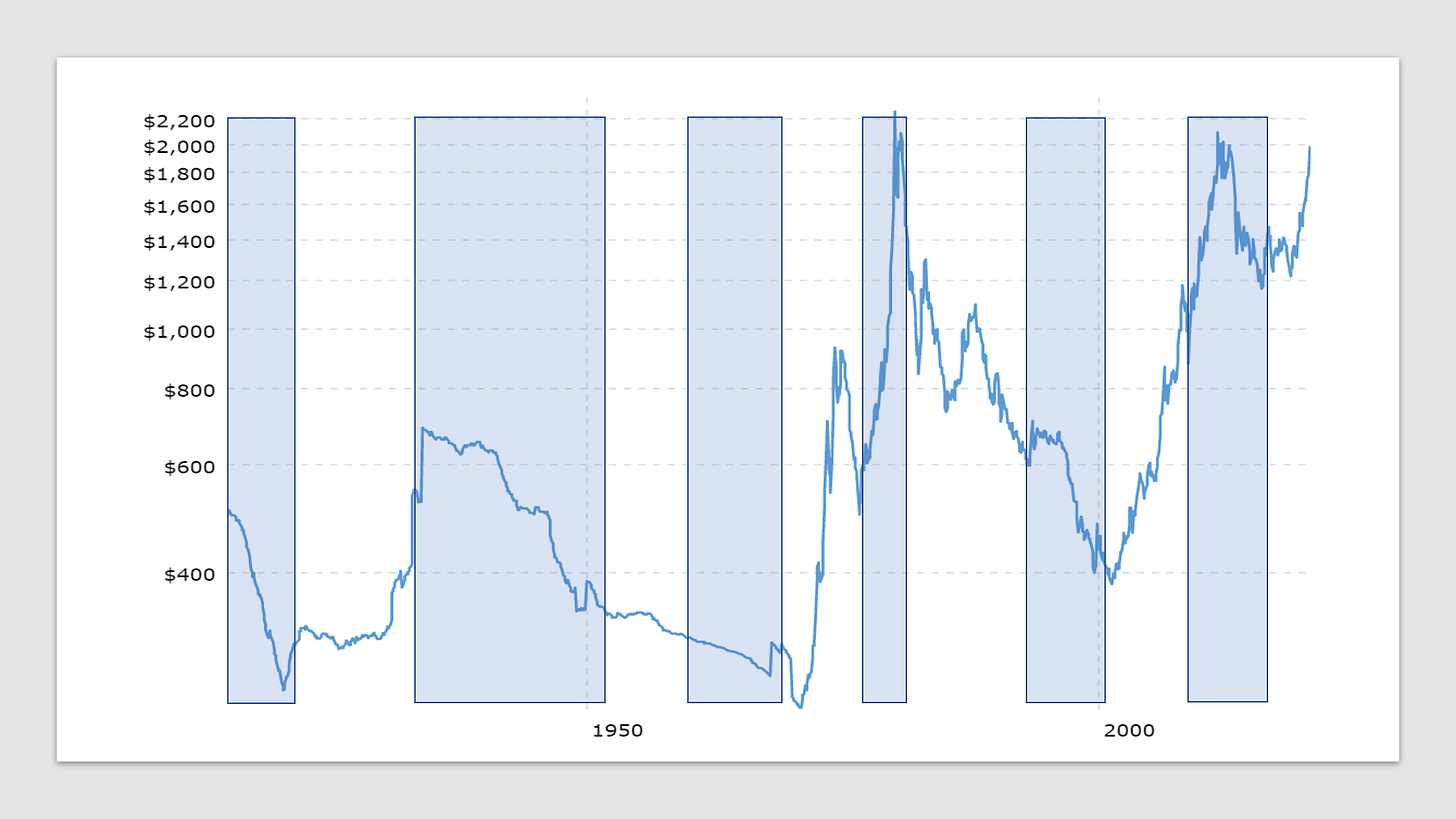

In the charts below, I shaded the years of Democratic Party rule in blue. The years of Republican rule have no color.

Can you find any correlations?

GDP

Dow Jones Industrial Average (proxy for stock market)

Gold

I don’t see any. Do you?

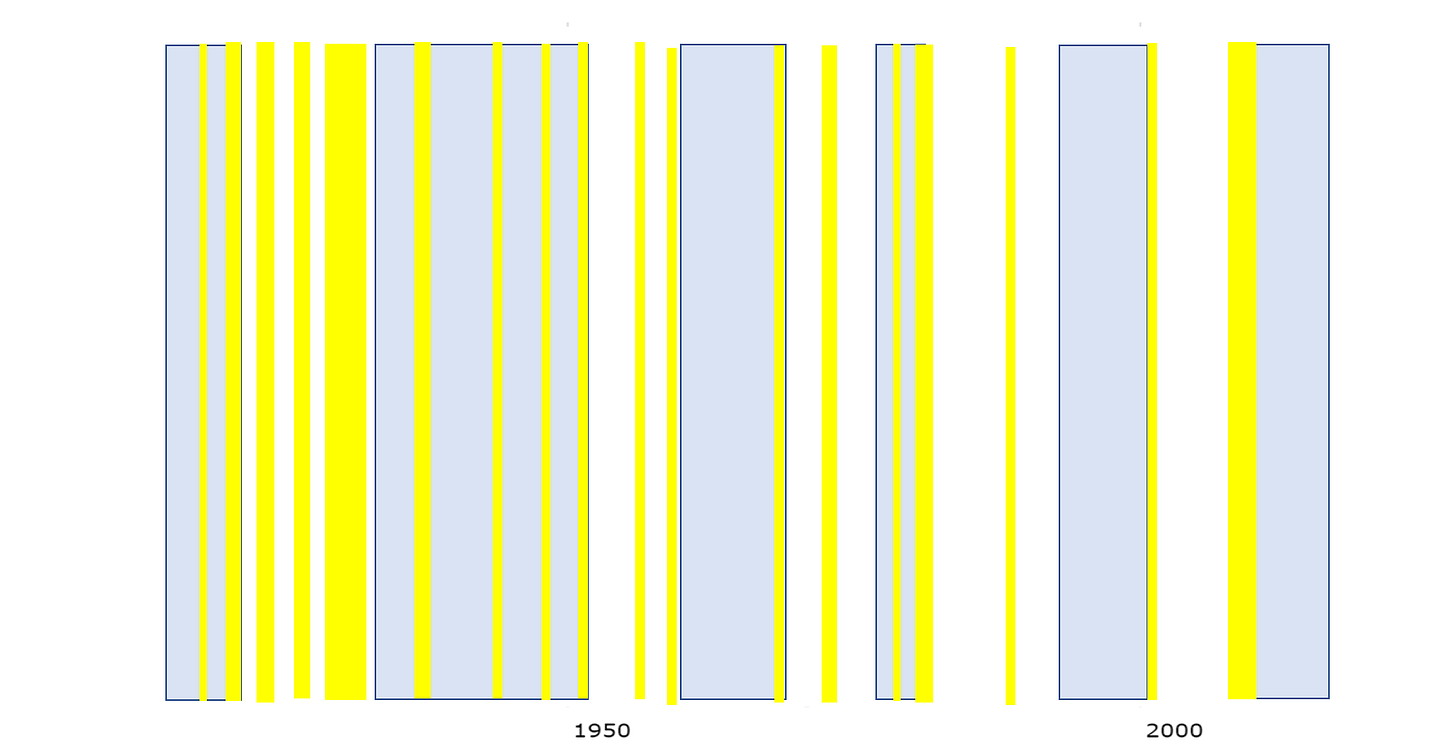

Recessions don’t correlate to a political party, either.

Look at this image, which overlays recessions (yellow) with political party control over the past 100 years.

Lots of yellow stripes, regardless of which party holds the presidency.

Yes, in my lifetime, all three recessions have come under Republican administrations. I suspect this is simply because we’ve had Republican presidents for more years than Democrats. As a result, Republican presidents have more chances to get a recession.

Whoever wins this election, the U.S. will continue the path it’s been on for decades: more power for the wealthy and well-connected, government programs that lack funding, a patchwork healthcare system, crumbling roads, and schools that taxpayers refuse to pay for—all of it financed by debt and subsidized by workers.

Thus continues an American tradition that may seem completely common in your country, too:

Perpetual disappointment in government, leaders who fail to deliver on their promises, and governments that never seem to do enough—or, depending on your view, always do too much.

Until now (maybe)

Cryptocurrency gives us an alternative to the chaos and conflict of politics.

With cryptocurrency, we don’t need to wait for an election or pray our central bankers make the right decisions. Our fate doesn’t depend on somebody else’s ambitions.

No matter what party holds political power, our blockchains will always do what they’re programmed to do. When one stops working, we can move to another, as we might switch car brands or jobs. When whales consolidate power and control over a network, we can abandon them.

When a coordinated few set up roadblocks and competitive moats to exclude us from their prosperity, we will not need to revolt, protest, fight them, or start social movements. We will simply find a different app, a better protocol, or a laptop with a decent internet connection and good computing power.

Like the rich people and special interests that hold such sway over our politicians, we will get to vote with our money. Our freedom is our choice.

The separation of money and state

Once monetary systems free themselves of government control, we will have a chance to innovate, adapt, and unleash the power of free markets and human ingenuity—or, support those who do, with the expectation we will benefit from their hard work.

As long as we are allowed to do so.

As such, governments have a big role to play. Will they allow this new technology to prosper?

Perhaps we should reflect less on any specific policy and think more about how our leaders feel about financial freedom, privacy, and innovation.

Do they see opportunity in open, permissionless financial networks and trustless, censorship-resistant social organizations?

Will they support financial inclusion at the risk their citizens will switch to a currency that their government doesn’t control? Can they envision a world where choice and diversity don’t undermine consensus and governance?

Do they want people to exchange goods and services with everybody, not just the people of their own race or nationality?

Assuming you find a politician that does, are you willing to vote for that person if you don't like the political party they’re affiliated with?

Change your leaders before Wall Street does it for you

Over the coming decades, today’s nascent blockchains will blossom into massive financial networks that capture enormous amounts of value, money, and commerce.

This growth will not happen in a vacuum. Somebody needs to set rules and boundaries, and governments will have to play some role in those decisions.

Traditional finance knows that. These big, special interests don’t care about who holds power. They’re happy to work with anybody that can get them what they want.

Cryptocurrency will make them obsolete—unless they can get ahead of it and make it their own.

I know nobody in finance who fears cryptocurrency. Some plan to get out with what they can take before cryptos take over. Most want to hop on the train before it leaves the station, and they’re happy to let governments help them get where they want to go.

In Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency, I discuss many ways they will try to shift the playing field for cryptocurrency in their favor (probably against you).

One way they’ll do this is by lobbying governments for laws and regulations that drive money, access, and power into their hands (not yours). As blockchain technology grows, it will force all of us to make trade-offs between freedom, choice, security, and public welfare.

Everybody wants the good without the bad. Unfortunately, life isn’t that easy.

For example, in most countries, financial institutions have to screen or report suspicious transactions. DeFi protocols can’t do this—they’re just computer codes. Yet, governments still need to investigate and prosecute criminals.

Will they target developers? After all, devs build the platforms and protocols. They have the keys. They control the front-ends.

What happens if governments hold developers liable for problems with their code or if somebody uses it for evil purposes? This will raise barriers to entry and create new risks for anybody trying to innovate—possibly making the costs and risks so high, only a deep-pocketed or well-financed entity can do it? What good is an open, permissionless system if only an elite few have the resources to participate in them?

Sometimes, businesses sponsor this work. Why should they have to follow anti-money laundering laws and antiquated regulations like 50-year-old banking laws and the 80-year-old financial regulations? At no point do they touch their users’ money or custody any investment product. How does the public benefit from censorship-resistant, private financial networks if anybody can cut us off from accessing them?

If you own a DeFi governance token, operate a node, or stake/delegate to validators, can governments hold you responsible if the platform breaks the law? You didn’t have anything to do with that, you simply joined the network. And yet, you own a part of that network and a voice in its decisions. Should government expect you to know every section of the legal code—and every way your decentralized, leaderless organization broke it?

Or, do regulators throw their hands up and say “everybody needs to use a custodial wallet from a registered financial institution because it’s the only way we can regulate the industry” and let the banks and other traditional financial institutions corner the market.

Do governments force their citizens to turn over private keys? Limit who can develop cryptocurrencies with licenses, registrations, and certifications?

When you argue about fiat vs. bitcoin, traditional finance laughs. It’s happy to make money on both.

Six Conversations We Need to Have About Cryptocurrency Now (But Won’t)

Hate government at your own risk

With so many ways for powerful, well-connected players to steer crypto into their hands, I’m amazed how many people still worry about crypto bans.

Don’t fear the bans. Those never work.

Fear the lobbyists. They always work.

Somebody needs to create the tax laws, privacy protections, intellectual property frameworks, and regulatory structures that govern what people do with cryptocurrency, even if only to say “nobody can torture you for your private keys.”

Each decision creates an opportunity for somebody to screw you over.

Today’s conversations revolve around monetary authority and the particulars of securities laws.

This is no longer tenable. The pace of innovation is too fast. The spread of novel applications is too swift.

Facebook was easy to intimidate. It’s a big corporation with lots of money at stake.

Random Joe’s altcoin project is not. Its team is spread across several continents. Its investors are anonymous and the work happens in obscurity—until one day, a Tweet or Medium post sparks a rally.

There are thousands of Random Joes working on altcoin projects. Some will deliver amazing products and services that challenge the boundaries of law and finance.

And no government will be able to stop them. Governments rule over people. Cryptocurrencies are not people. They’re protocols. DAOs and source codes.

Only then does “shit get real.”

For those who say the industry will police itself or competition will lead to better governance, I suggest taking a little deeper interest in history and psychology.

Cryptocurrencies are usually scarce assets and blockchains compete in a zero-sum game. What do people do with scarce assets and zero-sum games?

Fight, compete, and screw each other over.

For every Jack Dorsey, there’s a Roger Ver. For every Caitlin Long, there’s a John McAfee.

If government is inevitable, let’s have good government. Let’s advocate for freedom, not profits. Goods and services, not capital gains.

We know the money will come. We don’t need to flaunt it.

Instead, push for sane rules, shared goals, and fair playing fields. Find opportunities for cryptocurrency to serve the public’s welfare.

We need to make sure our legacy is not BitMex, Mt. Gox, and Lambos.

The more we can do that—advocate for freedom, choice, fairness, empowerment, and access to financial opportunities—the less it matters who wins this, or any, election. Some human values transcend politics.

Support politicians who agree with you.

A movement without political affiliation

For that reason, I’m writing in my vote this year. I will vote for bitcoin.

Until a leader shows me they care about any of the values we stand for, I can’t give him or her my vote. At least bitcoin has my back.

Is that a cop-out?

No.

Those who understand the U.S. political system know some states are so overwhelmingly partisan, one candidate is all but guaranteed to win its presidential votes. I live in one of those states. My vote for president doesn’t matter.

I have the luxury of voting my conscience.

Does that mean I think government actions will keep cryptocurrency prices from going up?

No, quite the opposite. Those actions will make people think crypto’s legit. Nobody kicks a dead dog.

In turn, they will find it easier to justify participating and investing. This will lead to more growth, awareness, positivity, and traction. It will build a strong social foundation for the growth that comes after this next market cycle peak, once the gains are made and lost.

I only hope those gains go to people who truly need it, and those losses affect only those who can afford it.

At some point, politics may matter for crypto’s fate. Today, we need only worry about the values our leaders bring to government service.

If we do that, everything else will take care of itself.

We know bitcoin’s price will go up, bringing the entire cryptocurrency market up along with it. Our investments will almost certainly grow.

How do I know this?

As I’ve shown premium subscribers, the data is overwhelmingly convincing.

Meanwhile, economies continue to struggle and COVID-19 seems to never end.

Perhaps all is not as bad as it seems.

Economic recovery: reality or mirage?

Despite a steady stream of news reports lamenting second waves and new lockdowns, some of the world's economies have seen recent growth.

For example, this past quarter, U.S. GDP grew possibly as high as 14% on an annualized basis. Unemployment dropped, as did personal savings, showing people and businesses have started to gain confidence in their financial situations.

China logged an 11% annualized growth rate. In many countries, the pace of decline has slowed or reversed totally. People are getting jobs again. Markets are finding new efficiencies and opportunities to grow.

All signs point to recovery.

Yet, it seems absurd to expect our economies will continue to go up.

Over 30% of U.S. households are behind on rent. More than 60% of businesses plan to downsize office space regardless of whether or not they make more money. Huge segments of the economy remain closed. Businesses are failing at the highest rate in 12 years.

Nobody talks about debt markets that are still out-of-whack, millions of people living check-to-check, billions of dollars locked in zombie corporations, trillions of dollars in bad debt sitting on central bank balance sheets, the looming end to government-imposed deferrals of rents and mortgages, a near-collapse of commercial real estate markets, and the total destruction of safe, income-generating investments.

Maybe we didn’t give ourselves enough credit? Perhaps we were too resilient and adaptable.

We have lots of amazing people fighting to keep our economies afloat and so many proactive, enterprising people fighting for their financial lives—and ours.

Maybe they’re succeeding?

Light at the end of the pandemic tunnel

Some say we will have another global lockdown because COVID-19 infection rates have shot up pretty much everywhere. Recently, several countries have imposed new restrictions.

As alarming as this seems, I can’t imagine these measures will last very long. Flare-ups will continue until people consistently wear masks, wash hands, and avoid close social contact.

Our standards of care and medical countermeasures have improved a lot since the beginning of this year.

When COVID-19 started, lockdowns were pretty much the only effective response.

Today, everything has changed. We know how to stop the disease from spreading and we can better screen for symptoms, trace contacts, and test effectively.

Also, while infection rates have gone up in recent days, those infections have led to fewer deaths and faster recoveries in almost every country.

Perhaps this is because milder COVID-19 strains have replaced the deadlier ones? Researchers have found some evidence of that.

More likely, it’s because we’re so much better at testing, tracking, and treating COVID-19.

U.S. President Trump serves as a great example of how far we've come in our fight.

Thanks to better standards of care, improved testing, and experimental drugs, he survived a case of COVID-19 so severe that his doctors had to give him a course of treatment normally reserved for people about to die. The people he infected had a chance to quarantine and distance from others. For the contacts who needed medical care, they had a chance to seek treatment before their symptoms got worse.

The president went back to work after five days.

Six months ago this incident could have led to a super-spreader outbreak that immobilized the U.S. government—or worse.

Today, it sends a few people to the hospital and forces the others to stay home for two weeks.

Vaccine research progresses at a rapid pace and we have several promising treatments that could enter the market soon.

As somebody who works for the U.S. government agency responsible for COVID-19 research, I think most people will be surprised at how quickly the world’s governments, pharmaceutical companies, and public health organizations will move once we know what works and what doesn't.

I’ll bet we’ll have the information we need by the end of this year.

How long will it take to get the right treatments into the hands of enough people to end this pandemic?

Months, probably.

To some, this sounds like an eternity. To others, it seems too soon.

Either way, we will soon move the global bastard from “urgent pandemic” to “one of many diseases that sometimes kills people.”

Then, life will go back to normal.

Prepare for what comes next

Things can change in an instant, but in the big picture, the overall trend looks positive on all fronts.

What does this mean for cryptocurrency? Does it really follow the stock market? Will we get another crash, a global depression, and a deflationary cycle? More BRRRR from central banks? Stimulus checks deposited into bitcoin ATMs and Coinbase accounts?

I’m still not convinced crypto markets have any correlation to the real economy or any government stimulus.

The world’s governments printed trillions of dollars and barely a fraction of a percent went into the cryptocurrency markets. Exchange inflows and outflows show no relationship to GDP growth or government spending. Almost 2/3 of all bitcoins haven’t moved in a year.

Of all the correlations people throw out to explain bitcoin’s price movements, the U.S. dollar is the strongest I’ve seen yet. When USD goes up, bitcoin goes down. When USD goes down, bitcoin goes up. We’ve seen this pattern for years.

Guess what?

USD continues to fall.

Whether the world’s economies recover quickly or plunge into a global depression—or anywhere in between—USD will probably continue to fall.

Some economists think that USD’s fall will help the world’s economies recover from COVID-19. It makes emerging market debt easier to finance, lowers international barriers to commodity markets, and encourages U.S. consumers to buy locally as the prices of foreign imports rise.

Complacency kills

As great as the big picture looks, with all the big trends pointing up, we can’t get ahead of ourselves. We remain stuck in a financial crisis, a pandemic outbreak, and an economic downturn.

That’s today’s reality.

When you look around, it may seem like everything’s stable. Hell, bitcoin’s up 50% on the year.

Still, I can’t help but worry. It’s not rational for so much positive data to come in such a dismal environment.

For that reason, I stick to my plan for bitcoin’s bull market. It keeps me from overthinking the day-to-day shifts in moods and sentiment (mine and the markets).

This plan distills all my decisions into three lines on a chart and a simple execution strategy, based on twelve years of data and on-chain metrics regarding human behaviors and what they mean for bitcoin’s price.

If my plan says to buy, I buy.

When crypto markets imploded in September, premium subscribers knew to expect it. Those who followed my plan bought more crypto when bitcoin's price went below $10,100, a 22% drop from the August high (some altcoins dropped 50% or more).

Going back to March, when I published my plan, you would’ve bought bitcoin between $5,400 and $7,800, then again between $9,800 and $10,100. And if you’re into altcoins, you would have bought altcoins at the same time you bought bitcoin.

You can expect my plan will call for us to buy more within the next few months, possibly sooner.

No predictions, just expectations. My plan makes sure we capture opportunities to buy when prices are not likely to go much lower for much longer, and very likely to go up higher and never return.

So . . . buy bitcoin now?

That’s the question I get the most.

We are so far from the market cycle peak, there’s no reason to think about that.

Every price is a good price. Where we’re headed, you won’t care whether you bought at $10,000 or $12,000. If anything, you will regret not buying more at either price.

But, some prices are better than others.

Why buy bitcoin at $12,500 when you can probably wait a few weeks and buy at $10,000?

In the worst case, bitcoin’s price goes up for a little while longer, then drops back down to $12,500. You get to buy at the same price you would’ve bought in the first place while avoiding the FOMO.

In the best case, you get 25% more bitcoin for your money (perhaps 100% more of some alts).

Does that mean we should buy cryptocurrency only when prices go down?

No.

It does mean we should avoid chasing the pumps and keep some money on-hand to buy the dips.

Premium subscribers have access to my plan, market updates, and recommendations of small, lesser-known altcoin projects with massive upsides that nobody’s talking about.

If you’re not subscribed to the premium plan, you may want to try it out.

Choose the monthly option and you can cancel any time.

Stay the course

My investment thesis on bitcoin has not changed, nor have I seen any data to suggest it should.

Some altcoins will outperform bitcoin. All of the long-term drivers of value remain strong and the data points in one direction for crypto prices over the long-term:

Up.

Don’t be fooled by Square and Microstrategy investing trivial amounts of their reserves into bitcoin.

Sure, corporate filings suggest public companies have moved at least $7 billion into bitcoin funds. That’s not enough to move the markets anymore, and besides, they can pull that money out at a moment’s notice.

But they’re not investing this money as a swing trade or pump-and-dump. They expect to ride this train for a long time.

Everybody I know on the inside says money from family offices and portfolio managers is coming in by the truckload, from all directions. HODL waves show OGs and whales accumulating bitcoin like crazy. VCs are inking deals like it’s 2017 again.

At the same time, traditional investment assets have lost their yields and gained new risks, making crypto look comparatively more attractive.

With so much positive momentum in our favor, we just need to commit to the market.

This should be easy—after all, the prices are low, the upside is high, and the technology is developing at a rapid pace.

Yet, I see your emails and read the comments in my WhatsApp and Telegram chats. For too many of us, it’s not easy.

I hope my analysis and content make it a little easier. This analysis and content will get more and more valuable as the markets rise, your investments go up, and your emotions get stronger.

As you have more money to lose with each market swing, it’s natural to worry.

Everything will get harder

Once we get closer to the market cycle peak, you will worry more.

I realize some of you will not be subscribed to this newsletter once we get to that point, but that’s really when you’re going to need it the most.

Did you find it hard to buy bitcoin when its price crashed below $10,000? Did you feel anxious when its price started going up again?

If you found it hard to handle a move from $9k to $12.5k to $10k over three months, just wait until we go from $90k to $125k to $100k in three weeks.

Have you ever lost $20,000 in a week?

You might struggle to resist the urge to “take profits” and “sell the local top,” even though my plan tells you to wait until we see very specific, time-tested signals that the market’s near its peak.

On the flip side, imagine how hard it will be to sell once we do get near the market cycle peak, when everybody else is getting in, feeling great, and making fast money. Your portfolio may double or triple in a month. And then, seemingly out of nowhere, my plan will tell you to sell.

Just when everybody else is finally on board.

It will be the right decision—after all, backtested, my plan would have forced us to sell only when prices [entered the red circles below, at] reached the market cycle peaks:

The next time prices hit those levels, smart money, OGs, and Wall Street will crash the market and run off with your family’s wealth.

(We have data on that, too.)

You need to protect yourself.

If you think losing a few hundred bucks on a DeFi rug-pull hurts, imagine how bad it will feel when insiders, early investors, investment firms, and so-called champions like Square and MicroStrategy start yanking billions of dollars out of the markets all at once.

Do you have the courage to execute that plan when everybody else tells you you’re crazy and it seems like prices will do nothing but go up forever?

You’ll have to.

In the future, not now

Today, we don’t have to think about that. We’re lucky.

We’re invested in this market when there’s no bad time to buy and no price too high (except for dead coins and DeFi pump-and-dumps).

For that reason, I’m not upset that during this most recent crash, I only invested 22% of the money that I had set aside for it. Just one of the hazards of averaging into the market. Statistically, you’re supposed to get more value from that approach, but it doesn’t always work out that way. That’s ok.

There will be more dips along the way, possibly worse than the one we just had, and possibly a continuation of it. I’ll keep my cash in my Celsius account at 11% interest and wait for the next opportunity.

If you’re thinking about selling, keep in mind: every time you sell your cryptocurrency, you give away your stake in the financial networks of the future.

Perhaps you’ll have a chance to buy in at a lower price—but if that’s the case, why not just add to your stack when we reach that lower price? Do you have no other source of income? No other reserve to pull cash into the market? Is crypto your only hope of making money?

If so, you may want to use this time to think about your finances. That’s not easy, either—but it’s easier than guessing which direction crypto prices will go.

We may never reach another market cycle peak. It’s possible crypto will either die or continue to grow naturally, organically, in measured steps, without another speculative bubble.

How many years can you stay invested in this market under those circumstances? Are you willing to wait a decade to find out whether your favorite alt is really the next bitcoin?

Those are probably rhetorical questions.

More likely, we will continue to see prices, interest, and innovation rise while governments largely ignore us. Pro-crypto special interests will continue bending the right ears and throwing money at the right politicians. Economies will recover, slowly, with a lot of pain and hardship for too many people. COVID-19 will join the long list of tragedies that humans have overcome.

And these young financial networks will grow to such scale and value, you will look back on this moment and wonder what you were ever worried about.

Relax and enjoy the ride!