If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version.

In last month’s issue, I talked about altcoins and market expectations.

In today's issue, I’ll give a long-view perspective on what to think about as we move through the regulation and litigation stage of crypto's evolution.

People seem concerned about US regulators and legislators. Maybe you are, too.

I guess we’ve reached the “then they fight you” stage of crypto’s development, at least in the US. Beats getting ignored and laughed at.

The good news?

Some of what you’re hearing is either wrong or a misinterpretation of how the US government works.

I realize the moment you buy bitcoin, you instantly become an expert on US constitutional law, regulatory affairs, judicial system, legislative process, and administrative bureaucracy.

I’m not an expert on any of those things, but as a former Congressional aide and current civil servant, I can assure you the US government is more messy, complicated, and unpredictable than you think.

We have good people on our side and powerful interests who want us to have good laws and responsible regulations. They won’t get you everything you want, but they’ll represent us better than you may expect.

What happens next?

By now, everybody knows the deal: the US central bank is trying to destroy the value of everything.

Yes, everything. Your house, cash, crypto, stocks, bonds, jewelry, furniture, and whatever else you own—not just in the US, but everywhere.

The problem?

Nobody knows the timing or extent of the damage, precisely what form it will take, and what will happen afterward. Not even the people who predicted it.

As you know from my portfolio strategy, I spread my risks so that I don’t have to take a directional bet on any asset. I can rebalance among non-correlated assets as market conditions allow.

This makes for an easy decision: bitcoin is undervalued based on all historical benchmarks. Almost every other asset is overvalued based on its historical benchmarks, even after crashing in 2022.

True, I have the good fortune to make money in US dollars, an asset that has gone up in a dangerous and unsustainable way. Look at this:

The last time it got this high was its most recent peak, during the COVID crash.

I’m sure it can go higher, but I’m scaling out as a defensive measure. What goes up must come down. I’ve done this for most of 2022.

The greatest investors of our age have all gotten zapped from too much exposure to one asset or one position. Soros, Drunkenmiller, Schiff, even Buffett. I can’t afford to take those kinds of chances.

In any event, I’m trying to build wealth. While it’s nice to make money trading things, I’m ok trading my time and talent for more of my government’s money, then putting that money into things that grow in value over time.

Marathon, not sprint. Tortoise, not hare.

Bonds and crypto

There is not a single chart or model that predicts how bad things will get or how long they will last.

Some say stick to cash.

You may want to think about short-term government bonds instead.

In the US, you can buy these online through TreasuryDirect. If you live in another country, you may need to go to a bank or dealer.

Why bonds?

It’s like an altcoin staking reward, except you get paid in your government’s money.

If interest rates keep going up, you can roll over your bond at a higher yield. If crypto prices keep going down, you can use your bond’s proceeds to buy more crypto. If you find yourself tight on cash, you can sell your bond for a small loss or draw against your lines of credit until the bond matures.

For the first time in years, you can actually earn yield from safe investments (though still not enough to keep up with the coordinated international effort among western governments to destroy the value of everything you have). Just six months ago, that wasn’t even an option.

That way, you get the best of both worlds—the relative safety of a government bond and long-term growth opportunities that you can only get from crypto at these prices.

What do you meme?

I’m sure for the wider world, that approach seems insane.

But when most currencies trade like shitcoins and most governments have no feasible way to pay off the debts they’ve accrued, it’s hard to tell which investment is the risky one.

Our legacy financial system has turned money into a meme. People believe in it because everybody else believes in it. Yet, most countries don’t produce enough “stuff” to justify the market prices of their currencies. You can see this in the collapse of almost every currency against the US dollar in 2022.

Your money is a mirage, the product of financial engineering, propped up by government decrees and collective nostalgia.

Do you ever feel like cryptocurrency is a meme, too?

So do I.

During Personal Capital’s recent client-only briefing on cryptocurrency, one of the presenters called it “Disneyland, the stock market, and a casino combined.”

Sounds about right.

Guess what?

Modern investing is filled with memes.

Fed pivot. Value stocks. Shares of artwork. SPACs. Precious metals.

My favorite is renewable energy. Very ESG, very woke.

Renewable energy uses copious amounts of plastics and heavy metals:

Lithium, cobalt, cadmium, lead, and other harmful metals that destroy the environment when extracted and seep into groundwater when disposed of.

Plastics that boost fossil fuel production and probably cause an array of health problems.

Very environmental.

These inputs are often sourced from China and low-income countries that don’t care about human rights or worker protections. In the US, they’re often mined in areas near or on Native American lands, sometimes under false pretenses, possibly because these areas are too often neglected by the larger American body politic or so poor that they’ll take whatever business they can get.

Very social.

Several native American tribes sued mining companies that promised "safe, clean" operations but delivered the opposite. As California’s solar panels reach their end-of-life, they’re piling up in landfills, leaking toxic chemicals, and local leaders can’t agree on what to do about it. Many ESG companies spend millions of dollars lobbying governments to craft laws for their benefit at your expense. Some hide toxic workplaces, shady business practices, and scandalous behavior among executives. Others do business with dictators and criminal syndicates.

Very governance.

So what? People invest in ESG because they feel good about the idea of clean energy. Feelings have value, too. And it's not like non-ESG companies are any better.

When you have a whole social and economic movement rooted in a meme concept, backed by many billions of dollars in capital, isn't it possible that the movement gets so big that you can't stop it?

When the power of that movement is so strong, do governments and businesses have to accept it? Or even more, embrace it?

Sometimes, memes go far further than their fundamentals suggest. Sometimes, fundamentals aren't as important as you might think. Few things are more powerful than an idea whose time has come.

Behodl the meme of memes

Does that mean crypto is an idea whose time has come?

No.

Cryptocurrency is an expression of a bigger idea: that everybody can have financial prosperity no matter who you are, where you live, what you look like, who runs your government, or how much money you make.

That’s a meme, for sure, but it’s also a reaction to a legacy financial system that fails too many, too often.

Fertile ground for those who promise they can turn $1,000 into $1 million, generate 1,000% yields from a smart contract, and trade altcoins for riches.

Also fertile ground for those who envision a fairer, cheaper, better way to create, distribute, monetize, and govern “things.”

That same great meme feeds both idealists and scammers.

We need the world’s governments to carve out a safe space for the idealists and keep the scammers at bay—hopefully, without crushing the ultimate goal: free, open, secure, and accessible financial systems.

The Doombergers say otherwise

Yes, crypto sucks, it does nothing, no fundamentals, no intrinsic value, all scams, everybody loses money, nothing works.

Some people are mean, spiteful, and ignorant. Even The Wiggles have their haters.

What’s the alternative? There are no good investments anymore. Your money is not safe anywhere.

The US central bank is hell-bent on making you poorer and destroying the value of everything you have, no matter where you live. Europe is confronting an energy crisis and has almost certainly entered a recession. Japan’s currency is depreciating at a record pace.

The corporate debt markets may have severely mispriced the risk of CLOs ($1 trillion) and institutions may have too much exposure to junk bonds ($7 trillion). Rising interest rates, smaller margins, a stronger dollar, and waning global economic growth make those investments riskier than ever. Commodity prices are cratering. Shipping has fallen off a cliff.

Australia’s housing market is a toxic mix of variable-rate mortgages and unprecedentedly high property values. Pakistan has to deal with a flood, food, and financial crisis all at the same time. Several governments seem on the brink of default. China’s real estate market seems like it’s on the verge of collapse.

Mark, you’ve been saying the Chinese real estate market is on the verge of collapse for more than a year now. And it still hasn’t collapsed.

Exactly my point.

If you wait for the Chinese housing market to collapse, or any of the terrible things you read about in the news or extrapolate from data charts, you could be waiting forever. Things can get worse. Times can get hard. Volatility and risk abound.

Expect this. Plan for it.

Also realize that good people are working hard every day to keep bad things from happening. Often, they see the same risks that you do. They spend their entire lives trying to make our financial and monetary systems function.

Sometimes, they succeed.

The European Central Bank and US Federal Reserve both opened new facilities for banks. China’s government has pushed stimulus and liquidity programs to buy bad properties, support floundering developers, and prop up its stock market. Global institutions like the hated IMF and much-maligned World Bank have lots of ways to support emerging market economies.

They might fail, but they might not. Humans are more brilliant, adaptable, creative, persistent, and industrious than you might expect.

Embrace uncertainty

Still, catastrophe looms behind every corner.

Perhaps this condition seems more acute for crypto because of the volatility, scams, hacks, crashes, schemes, shills, and a lot of hype that never matches reality.

Or maybe because people in crypto tend to believe the world’s going to fall apart anyway, so they find every way to spin every bit of news as “I told you so.”

Or perhaps because the drop in crypto prices has made you pay more attention to bad news? Lord knows there’s plenty to go around.

Or perhaps because the world’s financial leaders have orchestrated the greatest rug-pull in the history of mankind? Pretty unsettling.

If I wanted to out-Doomberg Doomberg, I could, but that would not make for very fun reading and it would be somewhat disingenuous.

First, I’d be doing you a disservice by making crypto seem so dirty, based, reckless, and shady that you’d miss all the good it has to offer and the opportunity we have at today’s prices.

Second, I could never tell anybody to avoid a financial opportunity simply because it’s risky. Your capital is always at risk everywhere, no matter what form it takes, in good times or bad times, in ways you might not realize.

On the other hand . . .

Whatever happens in the coming months will not stop cryptocurrency from its inevitable success.

In fact, it’s possible a setback in traditional financial markets will help people realize the merits of crypto as an alternative to the legacy financial system.

And what if, by some bit of freakish luck, we get enough good things to offset the bad? A recent PwC survey said half of US corporations plan to fire people in the coming months. What happens if the other half and the many small businesses hire the people they lay off?

And what about the other 5 billion people who don’t live in the US, Europe, or China? Many small and middle-income countries are growing. India is having a banner year. World peace might break out at any moment.

For every dismal forward indicator, you can find a mitigating factor.

Priya in the park shouts “IT’S ALL A BUBBLE” and she’s right, but that bubble’s lasted for almost a generation already. It was supposed to pop in 2008, 2011, 2016, 2018, and 2020. It didn’t.

At some point, it will.

Until somebody can tell me when that is, at what price, and how long it will take to recover, I’m happy to hedge my bets. Short-term government bonds and crypto. That way you win no matter what the Fed does.

Priya and the Twitter traders will do better, but they always know exactly what’s going to happen. Since I don’t, I follow my plan for buying and selling bitcoin.

If you’re following my plan, you’re down as much as 60% or up as much as 250% depending on when you started. Most likely, you’re down about 15-20%. With altcoins, you could be up or down a lot more.

Today, my plan says to buy. Tomorrow, who knows?

Institutions are on to us

“A new idea doesn’t triumph by convincing its opponents of its merits, but rather because its opponents eventually die and a new generation grows up that is familiar with it.”

—paraphrased from Max Planck

Science advances one funeral at a time. Why not finance, too?

Sometimes, an idea is too compelling. Too many people think they can make money from it.

For years, Personal Capital did not approve of cryptocurrency as an investment. Whenever the crypto market went up a lot, the company sent an email to remind clients that crypto has no value and doesn’t belong in an investment portfolio.

A few weeks ago, in that client-only call I talked about earlier, the company delivered this message:

“We won’t sell you crypto and don’t think you need any, but we’re comfortable with you putting 1-5% of your assets into crypto once you’re on track to meet your financial goals.”

Who died? What changed? Did they put some millennials on the investment committee? Did they get a nudge from Blackrock or Fidelity? Are they testing the waters? Did their clients demand it?

I don’t know, but I’d guess the people who run Personal Capital thought it might be nice to leave the door open to crypto funds once the market turns around. There might be some money in that.

Boomers keep dying. Millennials are inheriting their assets. Gen-Z is starting to get jobs and make money. Wall Street doesn’t want to get left behind. Institutions need to keep their options open.

Mark, institutions already left. Remember 2021?

Yes. In 2021, institutions were a meme.

Most sold in January and April, some sold in November and December, and at best they accounted for $70-100 billion out of a $3 trillion market if you believe the “we love institutions” crew.

Some reports put the number south of $40 billion at the peak, which seems more reasonable.

Even that number may be generous.

Let’s look beyond Grayscale, Microstrategy, and Tesla, to our more typical entities.

Harvard put 0.035% of its endowment into crypto in 2019 (and may have sold some or all of it in late 2021). A Houston pension fund put 0.5% into crypto during the 2021 mania. In 2017, a California pension fund bought $2 million worth of shares in a bitcoin mining company (and sold them in the spring of 2021). The State of Wisconsin Investment Board holds $19 million in shares of crypto companies. A Virginia county pension fund put 1% of its portfolio into crypto lending platforms last month.

We’re talking about a handful of multi-billion dollar funds placing teeny-tiny bets on crypto.

Why don’t they put more in?

Because cryptocurrency is not a safe way to lose money.

Hearts, minds, and bank accounts

It’s one thing to lose $50 million in the stock market. For a pension fund, that’s trivial. Nobody blinks an eye. No threats of lawsuits or politicians thumping on about bad financial decisions.

Lose $50 million in the crypto market? Pitchforks, petitions, and accusations of perfidy.

It’s dangerous enough to put money into speculative technology that fails a lot. Once you add the reputational and fiduciary risks, you’re going to have a hard time finding more than a handful of funds willing to touch crypto (even if their fund managers have some in their personal portfolios).

You might say $50 million is $50 million. Whether you lose it on stocks, bonds, crypto, or hookers, you’re talking about the same result with the same amount of money.

For institutions, investing in two of those things will get you in a lot of trouble. Investing in the other two might get you tax breaks or even a taxpayer-funded bailout.

With appropriate laws, regulations, and safeguards, institutions can make those fiduciary and reputational risks disappear. As long as the funds manage risks appropriately, they will not get sued. As long as they disclose the volatile nature of crypto to their clients, they can make money from their clients’ interests in making money.

Will that be good crypto?

I don’t know. For more on my thoughts, read Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency. Paid subscribers get it for free, along with my other books.

Wash off the filth

When every Web3 project is perceived as a cash-grab that will never work, you’re going to have a tough time changing hearts and minds. When the best-known DAOs exist solely to buy historical artifacts, govern Ponzi schemes, trade pictures, or evade US financial regulations, you’re not going to find many legacy institutions eager to dabble with the technology.

Far easier when all projects, even anonymous ones, have clear disclosures, curbs on sensationalist advertising, and safeguards against fraud and conflicts of interest. All the better if that happens without overly-burdensome and unworkable licensing and registration requirements.

Governments may get some things wrong, but they can marshal the collective willpower and resources of millions towards a common goal. In this case, a cleaner, more trustworthy crypto market.

To what extent, though?

A little soap cleanses the skin. Too much destroys it.

Trust that we have good people advocating for the things we believe in. In the US alone, crypto, oil/gas, and financial companies have put tens of millions of dollars into lobbying efforts. Several federal agencies and members of Congress already support what we’re doing. Others will surely come along, in time.

We’re talking about Senators, Congresspeople, public officials, and industry leaders speaking to and from Congress and the White House. We may even win a court case or two along the way.

With the attention that comes from Congressional hearings and public policy debates, we have an opportunity to put a new, clean, earnest, professional foot forward. Good PR is expensive, but when you’re a topic of discussion in Congress, the media comes to you. That makes the job much easier.

This doesn’t mean people will agree with us, but at least they’ll respect us—or at least recognize there’s more to crypto than bros, maximalists, and rug pulls.

But lawsuits!

Yea. Expect more of those. Once you’re a legitimate business, they tend to follow you.

I get 2-3 notices each month about lawsuits against companies I’ve done business with or own stock in. They’re always getting sued, and sometimes they actually do something to deserve it!

Every other month, I get a payout from some settlement or another. Something like this:

Passive income!

You’d be surprised how many household names have compensated me for some wrongdoing I didn’t even know about until the mail arrived. I’m looking forward to getting a few bucks from the class action settlement that comes from the Uber and Uhaul hacks that happened last week.

(Hopefully, those will come in time for Christmas 2024. $5 here, $5 there, pretty soon you’re talking about real money!)

The pursuit of profit is always fraught with ethical concerns. Humanity has yet to come to terms with what makes a decision ethical or not. Laws won’t change that.

Regulators will always hold people’s feet to the fires. Lawyers will always look for business. That’s their job.

Expect more, not less of that as crypto goes mainstream.

This is a rite of passage.

Tarzan say government bad

Sure, we may get bad laws, bad verdicts, bad regulations, and bad decisions.

We might get good ones, too. Imagine crypto without shills, scams, and shenanigans. The good actors can continue to do good things while the bad actors can go away or hide in the shadows.

You can imagine how excited banks and financial institutions might get about stablecoins. It’s basically a license to make money.

All they have to do is take deposits, put those deposits into one-month treasuries, earn an annualized yield of 3% or more, and the depositors don’t expect a single penny of interest in return. With a little persistence and good luck, they can even get laws that prohibit depositors from asking for interest. Financial stability or whatever.

This will essentially eliminate the need for a central bank digital currency. Once you tokenize the US dollar, you don’t need a CBCD. Banks can do the government’s bidding and earn a small profit for doing so.

Good people could argue whether that’s good or bad, but once you have private stablecoin issuers regulated, insured, and protected by the US government, you no longer need USDT, Terra, or other shady actors and experimental technology.

What if we throw in a two-year safe harbor period—or even government grants—for experimentation on decentralized or algorithmic stablecoins? And a robust privacy framework? And a requirement that recipients of tainted/stolen USD can keep their money unless the government has reasonable cause to believe they were part of the related crime?

Stranger things have happened.

What about NFTs?

Today, they only prove ownership. You can code smart contracts to do whatever you want with an NFT, but the law governs what types of business agreements you can make.

An invalid contract is an invalid contract, no matter how smart it is.

Wouldn’t it be nice to have rules or laws that clarify what you can and can’t do with NFTs? I’d rather not have to find out from the jury.

Rules, then innovation

As long as regulations preserve the core value proposition for cryptocurrency—public, permissionless financial networks that operate at a global scale without human intervention—we will get innovation. The human creative spirit will always find a way.

All the more compelling when the reward is a world where even the poorest of the poor can access humanity’s collective wealth and the smallest financial service can scale at pennies on the dollar compared to the legacy financial system.

Perhaps new registration or disclosures will raise those costs to nickels on the dollar or force new projects to raise money privately to find development before launching. We already got a taste of that in 2020 and 2021, when government crackdowns on ICOs led new projects to bootstrap with backroom VC discounts and pre-sale tokens that insiders dumped on the market as soon as they could.

Clear guidelines help good people figure out where to put their time, effort, and money.

They don’t prevent anonymous developers from creating, iterating, and solving new and exciting financial problems.

As I wrote in Consensusland, cryptocurrencies are simply code. Once created, they exist forever. No cryptocurrency dies, it simply fades away.

No government can stop every person on earth from writing and releasing code. Deep down inside, they know they can’t, and even if they try, they will only shut themselves off from the massive pools of capital that will flow to these new financial networks.

But the details matter. Governments set the contours and parameters of innovation.

Let’s see how MiCA works. Let’s see what the US and South Korea come up with. Let’s see what other countries do with the technology.

How will these laws work in the real world? What unintended consequences will we discover? What loopholes will we find? What sorts of new problems will regulations create?

Policies and laws are static. Humans or not. Our creativity, ingenuity, and drive will always bring us to new solutions that the law often doesn’t even consider. Governments will always be two steps behind.

At least with a legal framework, more people will feel confident enough to try themselves or support those who do without fear they’ll get sued or arrested.

Fool me thrice . . .

Some say that governments will crush crypto, people will give up on it, prices will never go up, and the technology is dead. The cat’s out of the bad, crypto will never be useful, and people are too smart to “fall for it” again.

They didn’t read this quote from a man upset that his pension fund lost $15 million speculating on crypto:

“I don’t like it,” [Mr.] Harris said. “There’s too many pyramid schemes that everybody gets wrapped up in. That’s the way I see this cryptocurrency at this time. … There might be a place for it, but it’s still new and nobody understands it.”

That emphasis is mine.

Or this quote from the research director of the National Association of State Retirement Administrators.

“There may come a day when crypto settles down and becomes adequately understood and mature as a potential investment that public pension funds might embrace them,” Brainard said. “I’m just not sure that we’re there yet.”

I hear this sentiment all the time. We’ve gone from “this is stupid” to “there’s something good there, I just don’t know what.”

Earlier this year, I took a call from a pension fund.

If you ever want to consult with me, schedule a time on Superpeer.

The fund managers want to allocate to crypto but don’t know how. They’re skeptical of the asset class and not impressed by the pitches they’re getting from the crypto funds.

Once we get laws and regulations—even if they’re bad—Wall Street will take care of that. Tony on the TV will still have a chance to hype laser eyes and short the bankers, but Mr. Harris and other skeptics will take their cues from the professionals.

With actual Web3 businesses running on blockchains, legal and regulatory frameworks in place, and established funds offering crypto services, everything will seem real—or better, “understood.”

Wall Street will say “no more pyramid schemes—the laws won’t allow it!” and “look at the businesses being built on such and such blockchain. You need a small allocation to its token, just in case this thing explodes!”

Aunt Sally and Uncle Morton will think the “grown-ups” figured it out, or the technology matured, or whatever they need to think to justify putting some money in once prices go up long enough for them to think prices will keep going up.

There are too many people like Mr. Harris, skeptics willing to keep an open mind, and too many people like us, who understand the power and potential of crypto as a technology and an investment.

At some level, aspirations matter more than facts. Facts change all the time. Aspirations rarely do.

People know the legacy financial system can no longer take care of their needs. They want an alternative.

Crypto is not yet a viable alternative, but it’s getting there—one protocol, one hack, one business, one venture, one lawsuit, and one law at a time.

Once we wash off the filth, get some laws, and let Wall Street take the lead, the “mainstream” will return.

Always a bubble, one after the next

That’s not necessarily a good thing.

Crypto is a series of bubbles, one after the next, big and small, over short and long timeframes, forever. Some bubbles last a few months. Some last a few years. Some last a few days.

In June’s issue, I delved more deeply into this idea.

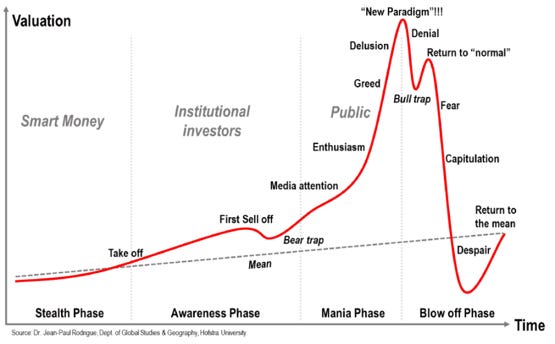

This chart lays out the anatomy of a bubble:

This is not a price pattern, but a psychological one. It’s the same pattern we saw during the six-month pump of 2019, the three-month DeFi summer of 2020, the altseason of early 2021, the overall swings of 2021-2022, and the larger 2018-2022 bottom-to-top cycle.

This model has defined all the peaks and valleys of the crypto market forever, from brief gyrations to years-long expansions and contractions.

At any moment, you will never know where you are in the bubble. Sometimes, you’re in the bear trap of one bubble and the stealth phase of another, depending on the timeframe and scale you’re looking at. Other times, you hit “new paradigm” within a small subset of the market, while the rest of the market hasn’t even hit the awareness phase.

My concern?

In a few years or sooner, once Wall Street and regulators make crypto seem safe and convenient, Aunt Sally and Uncle Morton will forget the risks. Billy the neighbor will forget about the money he lost trying to catch the pumps and dumps on LUNA and LUNC.

Tony on the TV will shout “adoption illiquid supply balance on exchanges laser eyes bulldog doji triple crow downward arrow castle formation on the daily chart we’re closer to $70,000 than $20,000” to get you hyped up again.

A few countries will reveal they bought some bitcoin to hedge against war, the US dollar, etc.

A new round of money managers will gloat about scooping up sub-$20,000 bitcoin.

The OGs will recycle all the memes of 2021.

A new breed of regulated crypto lenders—perhaps Wall Street subsidiaries—will figure out how to do CeFi-DeFi safely.

After years of trial-and-error, crypto projects will demonstrate real utility at scale with easy user interfaces.

A few trillion dollars will enter the market. Bitcoin’s price will hit $135,000 and your altcoins will go 5x higher than their 2021 peaks.

This time, with Wall Street and governments on board, there will be no voices shouting “bubble!”

Everything will seem safe.

It will be anything but safe.

T-minus how many years?

And at that moment, Samantha down the street will look at her portfolio and say “good enough for me.” After dollar-cost averaging since her now ex-boyfriend told her about crypto in 2021, she’ll decide it’s time to sell her crypto for a down payment on that house she always wanted or maybe a new car.

Maximalists who HODLed in 2018 and 2022 will take profits, “just in case” or “because remember the last time.”

Institutions and whales who are buying this year will scale out. The guys working at JP Morgan will dump and short everything.

These are the very types of people who set the floor for the market. They build the foundation for the next leg up. Once they leave, everything falls apart.

We saw that when LUNA and 3AC failed, zapping a whole bunch of people who would have otherwise held or bought more crypto. Utter devastation. Panic. Collapse.

But this time, it won’t happen to a small cohort of speculators.

Instead, it will happen to a whole world of people who didn’t know any better, thought they could trust their financial advisors, and let their investments bleed into their larger portfolios.

With crypto platforms more integrated into legacy finance, the crisis will spread beyond a tiny niche market into structured products, lending agreements, and business ventures tied to retirement funds, pensions, and corporate treasuries that support the needs of small businesses, workers, and retirees.

Just like the stock market.

And that collapse—that final bubble—destroys everything.

The creatures looked from pig to man, from man to pig, and from pig to man again; but already it was impossible to say which was which

My fear?

We will get over today’s financial turmoil. If we don’t get panic/collapse like in 2008, people will again dismiss the Cassandras and naysayers (“they were wrong this time so they’ll always be wrong forever no matter what happens”).

Big, deep-pocketed, selfish financial interests will take advantage of uncertainty, low prices, and insider connections to corner the crypto market, as they do every other market.

The soothsayers will return with promises of turning $1,000 into $1 million. New data models will pop up. Wall Street will make everything seem legitimate. Governments will make everything seem safe.

Complacency will return. People who are sitting on their hands today will put their money in tomorrow, at higher prices, under the assumption this market is less risky.

Except it will be as risky tomorrow as it is today. The risks will change, not disappear.

And people on the other end of the deal will be just as mean, insensitive, and uncaring of your fate as today’s traders, scammers, and YouTubers—except they’ll wear suits and have governments to protect them.

Aren’t those the very people we’re trying to escape?

Relax and enjoy the ride!

Share this post