Happy week, everybody!

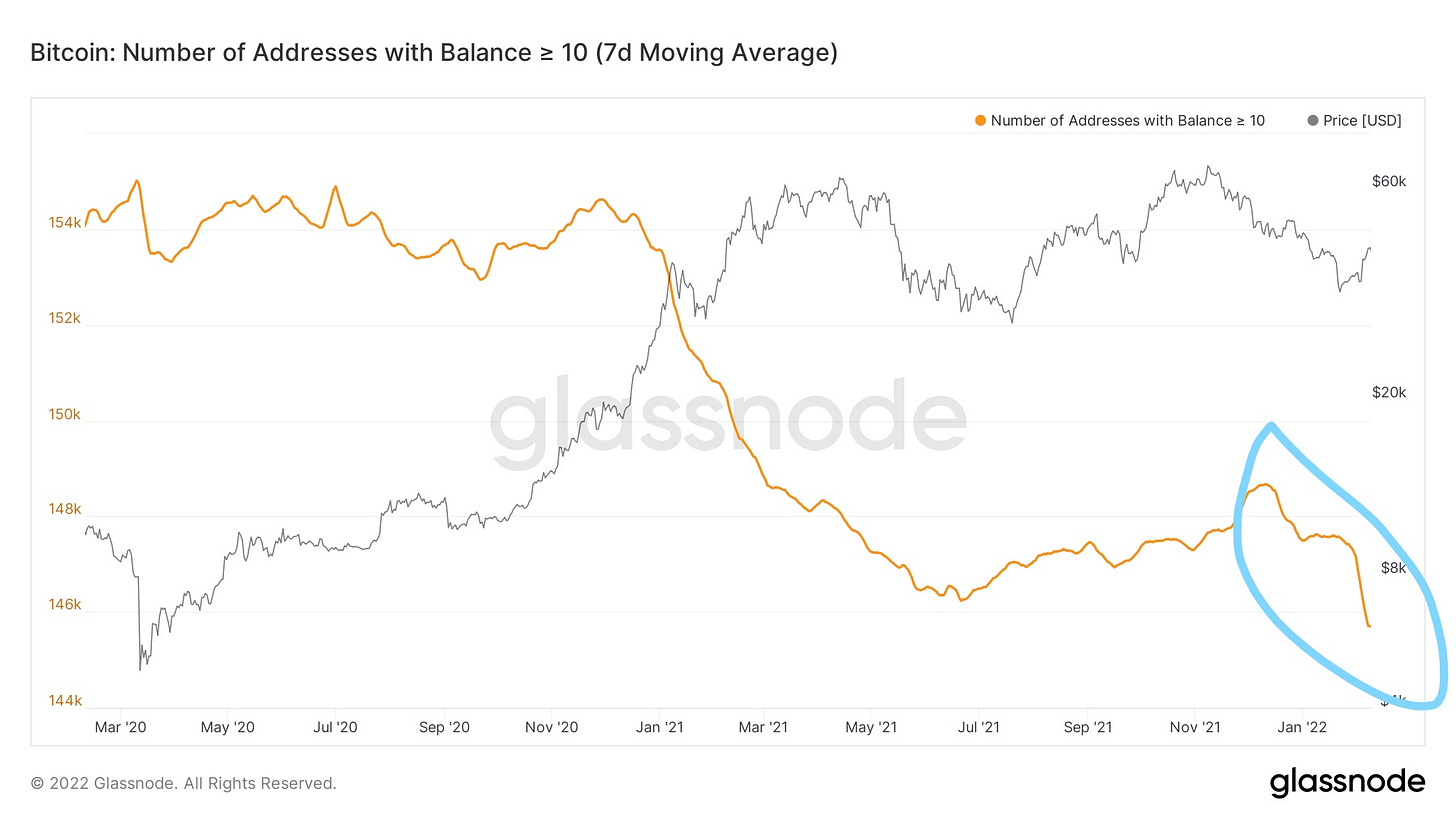

In my most recent update for premium subscribers, I pointed about a big, sudden drop in the number of wallets with more than 10 bitcoins, right at the beginning of February. Roughly 2,000 whale wallets shipped off their bitcoins over roughly one day.

While this continues a trend we’ve seen for months, the drop came out of nowhere. Even smoothed out on a seven-day moving average, you can see it falls off a cliff:

After that update, I discovered that the Bitfinex “hackers” had spread their coins across more than 2,000 wallets. Around the beginning of February, US authorities seized those wallets and emptied out the contents. It’s safe to assume that’s why the number of large wallets fell abruptly, seemingly out of nowhere.

Does this matter for us?

No. One piece of data means nothing and you can interpret this a dozen ways. We knew whales have trimmed for a while. The absolute levels matter less than the trends and behaviors they reveal. I’ll talk about this and other metrics in my next update, possibly two this week (no promises).

Scroll down for a poll and two articles you may enjoy.

Poll: what crypto market theory do you think fits best?

123-Year-Old Hydroelectric Plant Sees New Life Mining Bitcoin — Revenue 3x Higher Than Selling to the Grid

Bottom line: after a disagreement with the local utility company, an old power plant sold its renewal energy to bitcoin miners.

My take: that’s great but somebody’s going to get mad that the plant’s power went to magic internet money instead of their houses and businesses. They won’t realize that the energy that went to bitcoin would have never reached their houses or businesses in the first place.

Why we care: bitcoin miners can operate anywhere, which means they can run off of any power source. Whether that means renewable energy or waste from oil drilling sites, bitcoin miners fill inefficiencies in the energy market. While some see that as a public benefit and a good use of wasted energy, others will get mad about it. Prepare accordingly.

The NFL on display this Super Bowl will seem like a crypto-happy league. It’s anything but.

Bottom line: even though some of its players advocate for crypto, crypto exchanges buy airtime on its programs, and some of its partners sell its NFTs, the National Football League plans to stay away from crypto. In contrast to the National Basketball Association, which has integrated crypto into its business plans.

My take: if that story came from a social media influencer, the headline might say “#1 US SPORTS LEAGUE WANTS TO KILL CRYPTO.” To the contrary, the article presents a range of views and perspectives on why the NFL remains cautious even as public interest and enthusiasm rises. When crypto brings potentially billions of dollars in reputational and operational risks, the NFL wants to tread lightly. That’s all there is to it.

Why we care: like fund managers who buy crypto with their personal funds while selling their clients’ crypto, or food workers who serve dishes they wouldn’t buy for themselves, people often act differently with their own money than with others’ money. There’s no reason to get worked up about the NFL shying away from crypto.

Relax and enjoy the ride!

Share this post