Before jumping into today’s newsletter, I wanted to remind you about last week’s altcoin report, which includes:

👉 An introduction to the altcoin, its history, team, and most importantly, why the token matters.

👉 A simple explanation of the utility of this token and its potential price trajectory.

👉 The state of adoption for this token, including key partnerships and features.

👉 Some things that COULD go wrong with it.

👉 How to buy and stake this token

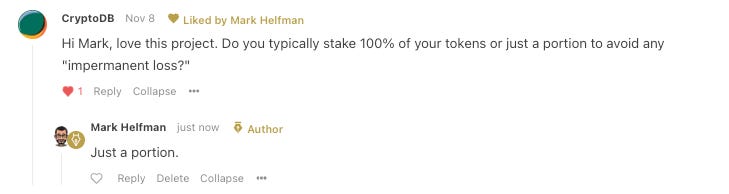

Bitcoinist named this project among its top 5 DeFi projects to watch in 2023 and NewsBTC has it as a top interoperability pick. Read what one reader said about it 👀:

Also, make sure you saw my other posts from this week.

BTW I’m listening to the FTX Twitter space.

Note, some sources have told me to be concerned about Crypto.com and Gemini exchanges. I do not have any information, facts, or evidence to substantiate why these entities would have problems. While I’d hate to needlessly steer you away from them, I feel compelled to bring this to your attention as I have referred people to these platforms. Better safe than sorry.

In general, you should self-custody your cryptocurrency (that’s the whole point of the technology).

It’s been a CRAZY week. Thanks for sticking around!

When LUNA/3AC imploded, a lot of people unsubscribed and gave up on crypto altogether.

This time, I haven’t seen that among my readership, but I’m sure some of you will cancel in the coming days. I’m sorry to see you go.

I know you’re feeling pretty bad and may have lost money from FTX. Even FTX.us users lost their money, which means the regulators failed. Under US laws, registered exchanges are supposed to keep user funds with a separate custodian. No US customer should ever lose access to their funds.

I suspect we’ve only scratched the surface of what’s going on, though I urge caution with some of the bigger conspiracy theories. You can twist facts in many ways.

For example, this TRON move.

You might that’s a good tweet. Give people assurance! Build trust!

That’s fine but the Tron DAO reserves are all stablecoins. There’s no reason to trade one stablecoin for another stablecoin as a safeguard.

Where does the $300 million come from? Does TRON DAO worry about the quality of its reserves? Does USDT need an extra $300 million to shore up its own reserves? Is Justin Sun concerned that people doubt the integrity of USDD, Tron’s stablecoin? Does Tether need to cover a $300 million shortfall? Are we all just reading this the wrong way, interpreting the words to mean something that wasn’t intended?

Maybe it really is just a well-meaning tweet trying to reassure a skittish market.

The problem is, NOBODY KNOWS.

Billions in Capital Calls Threaten to Wreak Havoc on Global Stocks, Bonds

Bottom line: private funds may not have enough money to pay back their investors. If too many people ask for their money back, these funds will have to sell assets or collapse.

My take: does that sound familiar? Like crypto, you have a structural risk in a niche market that may cause outsized damage to the wider financial system. And this is on top of $1 trillion in CLOs that may not be rated properly and $7 trillion in junk bonds for businesses that make no money. UK pension funds have it easy, I guess.

Why we care: you might exit crypto to avoid one risk and walk right into another one.

Did you know I have a list of newsletter recommendations?

Substack, my newsletter provider, only gives me space for seven recommendations, but I subscribe to more newsletters than I can fit on the list. I also subscribe to The Marco Compass, which covers international finance, especially central bank actions.

A nice article from Dr. Richard Smith titled Fibs, Frauds, and Futures, where he briefly examines the role of stories in investing.

In one part of the article, he unpacks the core dilemma with crypto: everything is both a Ponzi scheme propped up by a narrative and a real financial ecosystem with a legitimate function (my summary, not his words).

Note, in the article, he cites Matt Levine’s Bloomberg piece, “The Crypto Story.” As part of the coverage of that story, Matt interviewed SBF on an episode of the Oddlots podcast. I cover this in the July 10, 2022 weekly rundown, you may want to read it.

Jobs Corner

Stacks Foundation | Blockchain Engineer | Link to position

Reservoir | Data Scientist | Link to position

WalletConnect | IOS Engineer | Link to position

Alchemy | Protocol Specialist | Link to position

Status | Software Engineer | Link to position

Fuel | Marketing Manager | Link to position

ZKX | Content Creator | Link to position

These jobs come from the ToolsForCrypto newsletter. If you’d like to post a vacancy (for free), email mark@markhelfman.com.

Relax and enjoy the ride!

Share this post