Happy Sunday!

Were you surprised by the sudden pump and dump on Thursday and Friday?

Hopefully, you got my most recent update so you knew to expect those kinds of moves.

We may see even bigger swings soon, possibly lasting a few days or even weeks. Don’t read too much into it and keep in mind the other things I said in that update. You should’ve received it on Wednesday. If you missed it, get it now.

Tough times for crypto but even worse for passive investors in the US stock market. Two consecutive down months, a worse performance than bitcoin, rumors of a disappointing earnings season coming, expectations of a 75 basis point rate hike in November, and a strong US dollar that continues to crush profits from foreign markets.

Sadly, I don’t know much about the stock market. Can I offer some perspective on crypto?

On longer timeframes, bitcoin’s price shows a falling wedge pattern with bullish divergences on several trading indicators. You can see this on several charts, for example, the three-day trading chart (without the indicators for better readability):

It’s a bullish trading setup but these patterns emerge from time to time. I talked about it in my recent updates to paid subscribers. Once the pattern breaks, this is a simple trade to execute (though not necessarily profitable).

Since we don’t trade, we don’t need to do anything. It’s just perspective.

When you see a chart like that, your reaction might be “OMG THE BOTTOM’S IN BULL MARKET BUY BUY BUY!”

If anything, your reaction should be “ok, I’ll make note of that and take it under advisement.” Patterns change, trends shift, and sometimes the price does a fake-out or shows weak follow-through.

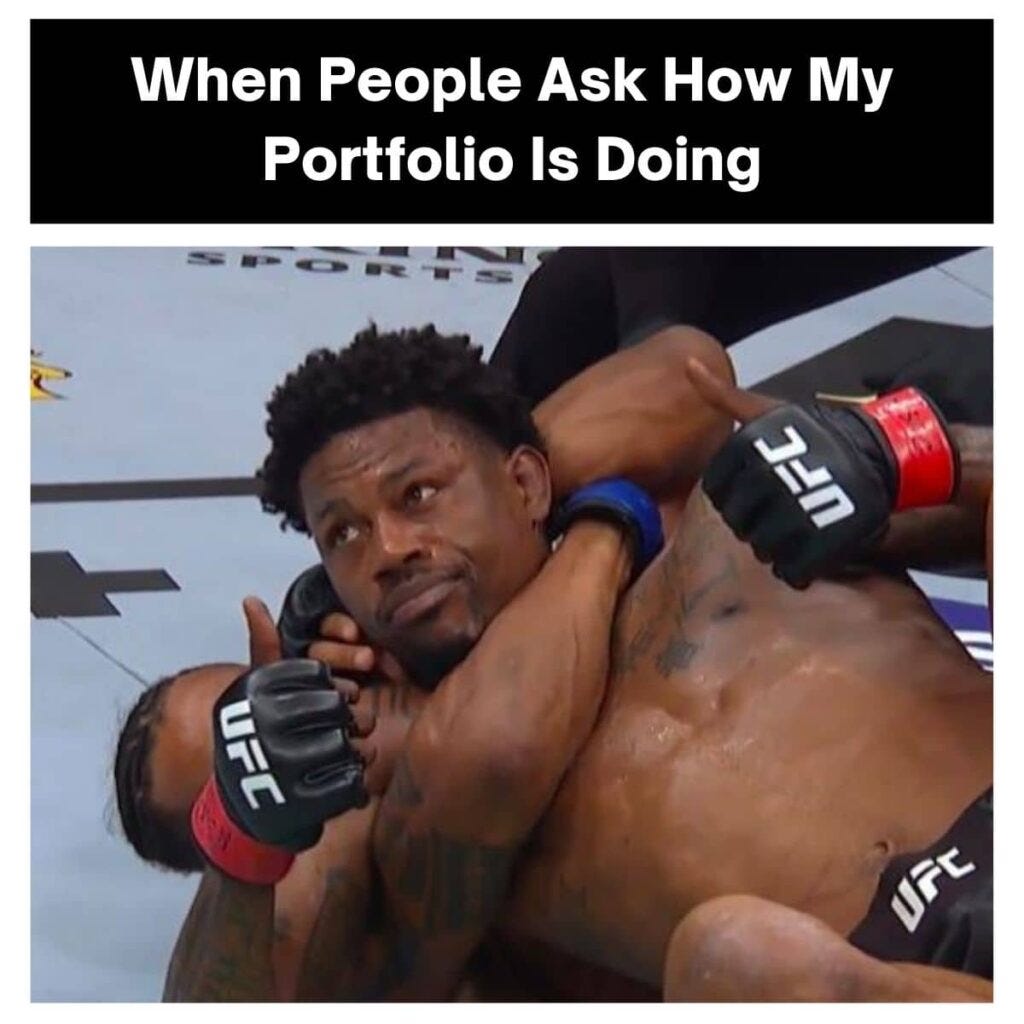

Scroll down for a poll, meme, videos, personal news, and articles you may enjoy.

Poll: why is bitcoin outperfoming the NASDAQ and S&P 500 in September and October?

Pick one:

Discord Channel Coming Soon

Thanks to Writers Dorm, I will soon have a Discord channel. To join, you will need to buy an NFT. I’ll tell you more about this in the coming weeks.

Before I launch it to everybody, I want to make sure it works ok. I don’t need all the kinks worked out—this is new technology, after all—but I want to test the process and features first.

To start, I airdropped NFTs to everybody who collected my first Mirror post, Hold This Thought. You’re the guinea pigs.

If that’s you, look for a little MATIC in your wallet and connect to Blockscan.Chat for a message to confirm it’s actually from me. All interactions will come from my public wallet, 0x9a6600c7B40801dda9A0Fa4E8DE7b1B99FE524a7.

(Only I control the keys to that wallet.)

Everybody else, stay tuned for more information.

For instructions on the NFT process, visit Get a Pass and View or Sell Your Pass or reach out to the Writers Dorm help desk. You can also email me at mark@markhelfman.com or DM me on Twitter.

Tap this button to learn more about Writers Dorm.

The TIE hosted its Q4 Crypto Outlook, a discussion of the top 6 ecosystems, Bitcoin, Ethereum, Arbitrum, Avalanche, Polygon, and Solana.

The team discussed each ecosystem as its own topic, looking at where it’s growing, where it’s shrinking, and how each one compares to the others.

It’s only accessible to those who have a LinkedIn account.

Some questions they raised:

As leverage leaves the market, is that good or bad for crypto?

How legit are centralization risks from entities that can hijack proof-of-stake protocols?

Does Arbitrum embody the “killer app” approach to ecosystem development? For example, Arbitrum activity is up 600% since August from GMX, NFT rewards, and a rumor of airdrops—despite having no token and using essentially the same technology as Ethereum.

What matters more: a high lending rate or a high staking rate?

While I’ve talked about the idea of bitcoin’s price dropping to $14,000 since May, only recently have I gotten questions about it. My answer in this video:

On a side note, if bitcoin’s price drops to $14,000 (27% drop to a natural technical level) and the S&P 500 drops to $2,400 (33% drop to match the proportional bottom of the dot-com bust)—would that make you feel different about crypto?

I don’t post much on YouTube but if you subscribe to my channel, you’ll get the videos when everybody else does.

Google selects Coinbase to take cloud payments with cryptocurrencies and will use its custody tool

Bottom line: Google will use Coinbase for crypto transactions and Coinbase will use Google’s data infrastructure for Web3 and application development.

My take: it sounds like a win-win. I’d love to see how much Google makes on those crypto transactions (Coinbase gets a cut). I’m not sold on the idea of people using crypto for routine transactions—I would expect simple payments will run on Lightning Network (start and end with local currency), collateralized payment protocols like Flexa and some DeFi platforms, or traditional Fintech as it does today. But it’s one more small reminder to mainstream users that crypto is a real thing, which will help lobbyists advocate for us and make some people more receptive to the technology (or at least less dismissive).

Why we care: it’s easy to think crypto sucks, will never recover, and everybody’s out to kill it. It’s also easy to get carried away with every story of “adoption” (that often isn’t really adoption). The truth is more nuanced and frequently more favorable to crypto than you might think.

Job Corner

Gainium | Content Writer | Link to position

OpenSea | Senior Manager, People Operations | Link to position

Polygon | Associate, Business Dev | Link to position

Wintermute | Senior Frontend Dev | Link to position

Aptos | Marketing Lead | Link to position

WOO Network | Marketing Intern | Link to position

Gomu | Developer Advocate | Link to position

Artblocks | Senior Project Manager | Link to position

Most of these job listings come from the ToolsForCrypto newsletter.

Relax and enjoy the ride!

Share this post