In last month’s issue, I reflected on today’s circumstances and the expectations you may have about what the coming months might bring. This month, I share my mindset at this moment and what it might mean for you.

If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version.

Did you buy bitcoin above $60,000?

No worries. In a few years—possibly a few weeks—you will feel the same way about buying at $60,000 as others feel about buying at $10,000. In time, you’ll feel better about it.

This may not make sense now, with gloom surrounding you and fear gripping the market, but it will become more clear the longer you stay in this market. Today’s market conditions are the same as they were last month and the month before. Only the price has changed.

For the traders who dominate social media, price means everything. As a result, they look at 2021 and see bear markets everywhere. How many so far this year? Two? Three? Five?

I look at 2021 and see a market that was running out of fuel for the first four months, had a healthy crash, then made higher highs and higher lows for the rest of the year. Today, its total market cap is 185% higher than where it started.

That’s the opposite of what you’re supposed to see during bear markets.

Perhaps that’s why everybody who follows my plan is down 3% at most and possibly up more than 900% on their bitcoin.

Primacy and Recency

Does that mean we won’t get a bear market?

No. Crypto can go into a bear market from any price at any time. It can also stay in a bull market from any price at any time.

Just as it can drop way faster than you would ever expect, it can also go way higher, way faster than you could ever imagine.

In October’s issue, I talked about the three-year parabolic rise of bitcoin’s price and said one of two things will happen: either the parabola will break or the market will melt up to its ultimate peak.

If the parabola breaks, it will bring terror. If the market melts up, it will bring ecstasy.

Terror or ecstasy.

The parabola broke. We got terror.

And because of that, the bull market continues.

Bull market terror?

Yes, sometimes bull markets bring terror.

Read Confessions of a Cryptocurrency Millionaire so you can see how terrifying the 2016-2017 bull market was.

Yes, that bull market, the stuff of legends, that millionaire-making event that brought crypto into the mainstream, a bull market so celebrated that most analysts base their assumptions on that one, brief stretch of time, often to the exclusion of anything that happened in any of the other 11 years of bitcoin’s history.

In that book, Dan Conway shares how he struggled with anxiety and stress as his $100,000 investment in Ethereum in 2016 grew to $20 million, punctuated by several drops of 50% along the way (including one immediately after he bought his first batch of ETH).

This guy had a nervous breakdown in the middle of a raging bull market. Several times, he questioned and doubted his conviction.

How did he come out ahead?

He bought when the opportunity came and persisted through the ups and downs that followed. He didn’t buy more as the price went up, try to time each move, or take profits. Instinctively, he knew what he wanted from his investment and had the fortitude and courage to see it through.

Such is the price of glory. It’s no fun to ride the inevitable dips and drops that come your way. Far more exciting to buy when everybody thinks the market can only go up, never down.

While you can do well when the price goes up, remember what Warren Buffett says. You pay a high price for a cheery consensus.

Last month, everybody expected a supercycle to culminate in a market cycle peak.

That’s an oxymoron—by definition, you can’t have a supercycle and a market cycle peak—but that’s what people said. Don’t take it literally. They were just trying to say “prices will go up a lot, quickly.”

That was a realistic expectation. So was a drop below $50,000.

Both outcomes would have made sense and fit historical patterns of behavior.

Only one outcome could have sustained this bull market.

We got that outcome.

But Twitter says . . .

Yea, I know what Twitter says. Bear market. I’m on Twitter, too.

Social media gives you lots of great info. Sometimes, it’s just presented in a way that feeds a certain narrative or optimizes for readership. Social media algorithms give you whatever the algorithm thinks you’re looking for. Your feed generally matches your thoughts and feelings. Your whole experience fits your worldview.

Especially when it comes to traders sharing charts. Bullish here, bearish there, with such certainty about what it means.

The problem is, bullish and bearish data don’t necessarily tell you what you think they do.

For example, NVT, an on-chain metric that displays bitcoin’s market cap relative to the number of transactions that settle on-chain. Here’s what it looks like on the bottom of a price chart:

Traders say when the NVT turns black, that’s bearish. When the NVT turns red, that’s bullish.

Yet, if all you did was buy the day after it turns black and sell the day after it turns red, you’d make money on almost every trade.

If you do the opposite of the traders, you’re practically guaranteed to make money off of the NVT.

Pull up a chart and see for yourself. I can’t show it here because it’s too messy and unreadable, but it has a success rate of like 80% (though some of the gains are so trivial that it’s hardly worth the effort).

Oddly enough, if you buy the day after it turns red and sell the day after it turns black, you’d do well, too. While you lose a lot more often, you catch some massive upswings that more than make up for the losses.

Maybe NVT doesn’t matter in the way you think it matters?

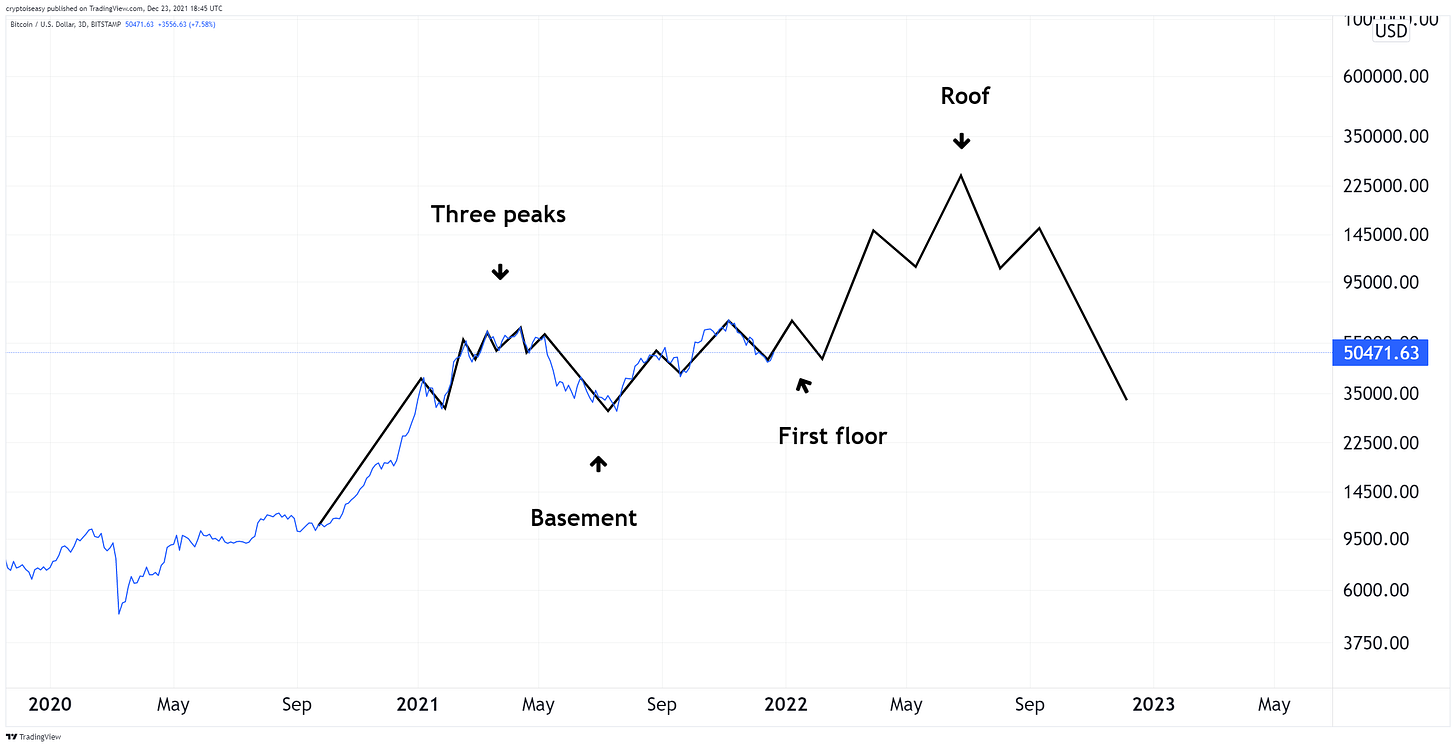

Another pattern the traders talk about is the “three peaks and a domed house.”

They say it’s a bearish pattern but when you look at the textbook, template format for this pattern, it’s wildly bullish. In fact, if that pattern plays out, bitcoin’s price will explode next year. Take a look at what the projection would look like:

Why do so many traders say this is bearish?

I don’t know, I don’t trade. I don’t even see how the pattern matches the price movements. We had four peaks at the beginning, not three, and no waffling on the way up from the basement, and the domed house hasn’t even happened yet.

Maybe we need to wait for the pattern to play out, but if we have to wait until it’s complete, what good is speculating about it now?

Also consider the famous death cross, when bitcoin’s 50-day moving average drops below the 200-day moving average on a price chart.

That sounds bad, but bitcoin’s price usually goes up after death crosses. If you only bought at the death crosses, your returns would beat everybody who only bought at the golden crosses, supposedly super-bullish events that see those moving averages flip.

We need traders

At the end of the day, it’s irrelevant for us. Traders use these patterns and data to identify entries, exits, stop-losses, and hedges. If you can do that well, you can probably do great in this market, even after paying fees and taxes.

Will you beat dollar-cost averaging? Can you get a better result than people who buy at opportune moments, then HODL, stake, and use their crypto?

Lots of people come to this market to build long-term, durable wealth, not trade crypto for more of their government’s money. People like us.

For us, traders provide a valuable service. They give us opportunities to get in at a discount without sending the market too high, too fast. They help us “buy low.”

And, if we ever need to exit, traders give us the liquidity to scale out quickly without crashing prices. They help us protect our gains.

As a bonus, they like to borrow bitcoin, altcoins, and stablecoins to fund their bets. This means we have an opportunity to make extra money off of our idle crypto by depositing it into savings platforms that lend to traders.

Thanks to traders, you can get 3-5% interest on your bitcoin, potentially more from altcoins, and 7-20% on stablecoins. Tap this button for referral links that give you some free crypto on top of the interest you get on your deposits.

Also, you can learn a lot from traders about some of the ways markets move and some potential risks and opportunities that come from those movements.

Traders bring immense value to the market. They’re bearish now, but the moment price goes up for a bit, they’ll switch their bias in a heartbeat.

Wait for greed and you’ll get it

Once the market turns bullish again, you’ll find your feed flooded with bullish signals.

Sometimes that’s fine. Since May, this market’s shown increasing strength and momentum, with higher highs and higher lows since June.

Today’s price is higher than the last swing low, which was higher than the one before that. Meanwhile, each swing high gets higher.

The trading chart doesn’t lie:

On-chain data show persistent accumulation and traction on many metrics and measures, despite the recent drop in bitcoin’s price.

While on-chain activity doesn’t cause prices to go up—it only tells you about people who are already in the market, not new money that enters—there’s no reason bitcoin’s price couldn’t have gone to $100,000 this month. The conditions were rife, far more similar to what you see at the beginning of bull markets, not the end of them.

While $100k won’t happen this month, let’s not assume it won’t happen soon.

Over the past month, some whales, institutions, and recent buyers moved bitcoins to the wallets of long-term investors with a history of keeping bitcoin to themselves or sending it to other long-term investors who don’t cash out.

That selling pressure drove prices down, but also put more crypto in the hands of people who really value it and have shown little intention to sell unless the price goes much higher.

Meanwhile, stablecoins continue to pile up on exchanges and in private wallets.

Of course, some of those stablecoins represent proceeds from selling crypto, but they’re not getting cashed out. Meanwhile, more stablecoins continue to come into the market. People want stablecoins, not cash.

Whether that’s for deposit on a savings platform, yield farming, or a limit-buy order, it’s all dry powder for buying more crypto.

Once the price goes up long enough for people to think it will keep going up, people will sell those stablecoins for more crypto. Some will move even more money from their bank accounts onto a crypto exchange.

To a certain extent, that’s already happened. After all, somebody bought all that bitcoin the institutions and speculators dumped over the past four weeks.

Fear forever?

While you may think fear will rule the market forever, consider the circumstances.

Institutions that bought at $30k pared back their exposure in November, as did some people who bought since the May 2021 crash. We can tell from the movement of bitcoins and cash across funds, exchanges, and the blockchain.

When you have 50-100% gain, you tend to scoop some cream off the top. “House money” as they say.

Also, a lot of fast-money traders got zapped in a massive liquidation event on December 3, 2021 and some OGs shipped off bitcoins they’d held for years.

At the same time, strong hands gobbled up that bitcoin while normal people like you and me added a little more to our portfolios. New money continues to flow into exchanges.

Accumulation and healthy churn.

Evidence of this activity will never get captured in trading charts. For that reason, I cover this data for premium subscribers.

In bear markets, you see different patterns.

Over the entirety of 2011, 2014, and 2018, the biggest wallets kept dumping on the market almost constantly. Price went up and down, but instead of making higher highs and higher lows, it trended downward for weeks and months. You couldn’t find evidence of new money coming in with any force. Market participants HOLDed—they didn’t accumulate.

The market sank until there was nobody left to sell.

Today, whales mostly continue to accumulate, with some dumping from individual whales every now and then. Same with small and new wallets.

Moreover, HODL patterns show a lot of those “sold” bitcoins went to wallets that did not cash it out. Bitcoin deposits into DeFi platforms continue to grow. Miners continue to sell at roughly the same pace they have for months—a far slower pace than they did last year and the beginning of this year.

Healthy churn. Price on an upward trend since June. Each time sellers have tried to push the market down, they push the price down less each time. Each time buyers lift the market up, they push it higher than before.

This will change eventually—nothing lasts forever—but until then, don’t psych yourself into or out of any decision. Accept that prices go down even in bull markets. Understand that bear markets can start from any price. Realize that shifts in momentum take time to play out.

Until you see a change in the overall trend or direction of the market, you have nothing to worry about. Appreciate the ebbs and flows. Healthy markets don’t go straight up.

Peak, where are ye?

For all of 2021, you heard influencers talk about the market cycle peak. In February, “up forever.” In May, “the peak is in.” In August, “we’re going to get TWO peaks like we did in 2013.” In October, “we’re going to hit $135,000 before Christmas.”

The most bullshit, I mean, bullish scenarios projected over $200,000 by the end of the year, possibly as high as $288,000.

Funny thing is, as outlandish as those predictions sound now, they were all plausible at that moment. (Except “up forever,” don’t ever fall for that.)

Do you wanna know my most bullish scenario?

Never a topping out. No market cycle peaks. No bear markets. No bull markets.

Up a lot, down a lot, sometimes sideways, gradually, forever, with fewer extremes over time. Give the world a chance to buy, sell, and use crypto without feeling scared about the consequences. Let the natural evolution of this technology bring you new opportunities to create a better life for yourself and your family.

In my perfect world, we will never have four-your cycles, hash cycles, expanding cycles, Elliot waves, stochastic RSIs, or any of that. Just organic growth, technical progress, and healthy, rising prices along the way.

That’s a nice thought, but I’m not one to bet against history.

At a certain point, the market will get so greedy and people so reckless that the prices will go so high, so fast, the market will collapse 80% or more, with a year or two of bleeding before the next bull market cycle starts.

We’ve seen this happen with every financial asset ever created. We’ve already seen this three or four times with crypto, depending on how you classify 2013’s double peak.

You may feel compelled to wait to see which way the price goes before you decide what to do about it.

When it goes up, you buy until it starts going back down. Then you sell.

When it goes down, you wait until it starts going back up, then buy.

You might also feel compelled to dollar-cost average, listen to astrologists, or follow data models.

You can do well with all of those approaches. The problem is, when you wait for the market to confirm your bias, you usually miss the opportunity. You end up selling lower or buying higher than you need to.

Sometimes, you buy the top and sell the bottom. You rarely get the outcomes you’re promised.

As an alternative, you could wait for great opportunities, take advantage of them, and not worry about the day-to-day movements in price, bear markets, bull markets, data models or trading indicators. Keep all those things in the back of your mind, definitely don’t dismiss them, but acknowledge that opportunity does not care what price comes with it. Price and opportunity are different things.

Sometimes, this will work against you.

Often, it will put you ahead of everybody else.

Same risks, lower price

Mark, that’s too risky. Never catch a falling knife. Always take profits on the way up.

No.

Today, you face the same risks you had last month when bitcoin’s price was $69,000. Those are the same risks you had in October when bitcoin’s price was $65,000.

What’s the difference?

Today, you get a much better price for taking the same risks, with a lot more upside. Why wait for prices to go back up again? Catch the knife.

Once prices go up again, there’s no reason to sell unless you have to. Why pay taxes and fees to trade an asset that has massive growth potential for an asset that’s designed to lose value forever? Do you have that much faith in other assets that you’d get rid of your crypto and all of its future gains to get more of your government’s money?

China’s second-largest real estate company can’t pay its debts. China’s banks are so short of capital that the government dropped reserve requirements twice this year. As a country, its debt-to-GDP ratio tops 300% and its financial system shows cracks all over.

This is the #2 economy in the world and most countries’ largest trading partner.

What about the S&P 500? It’s gone straight up for over a year. That can’t last forever. Other stock indices remain flat or falling. Omicron’s sweeping the country. Almost half of US corporations make no profits.

Do you really want to put money into the US stock market?

The US central bank says it will cut back on monetary stimulus. Gold has trended down for 18 months. Prices of almost everything have gone up almost everywhere on earth at near-record rates over the past year.

Emerging markets have trillions of dollars in debt that they have to repay with US dollars. The price of a US dollar has gone up almost all year. As a result, those debts continue to get more and more expensive to pay. It’s tough to grow an economy when your debt payments keep rising.

Over $14 trillion of the world’s capital sits in sovereign bonds that are designed to lose money. Another $7 trillion in corporate bonds from businesses that have no profits. Even more money sits as cash on a bank’s ledger, losing value even more quickly.

People joke about $36 billion locked in a smart contract contingent on an ETH 2.0 upgrade that may never happen and may not even work.

Is that really any worse than locking 500x more money into investment contracts that are guaranteed to lose money? At least that ETH 2.0 pays decent interest.

Fortune favors the bold

Let’s level with ourselves.

There are no safe investments anymore. There are only guaranteed money-losers or speculative gambles that barely compensate you for your risks.

And yet, life will give you many opportunities to make money. You don’t have to use crypto to do that. You can put your time, talent, energy, and natural skills into all sorts of ventures that can reward you way more than this market will.

Good luck finding an asset that has as much potential to grow and protect your wealth.

You can choose to worry about the risks or accept them. Weigh those risks against the rewards of owning a stake in the financial networks that will power the world’s economies in the coming decades.

To paraphrase US civil war general William T. Sherman, some think crypto is all glory, but I assure you, it is all hell.

This market is cruel, its participants are callous, and its swings are horribly violent.

I said this when bitcoin’s price was $16,000. I said it when bitcoin’s price was $60,000. I say it again today. I will say it when bitcoin’s price hits $100,000, $200,000, and every price beyond, whether that’s on an upswing or a downswing.

The moment you think it has to go up, it drops. The moment you think it has to go down, it zooms.

Substantively, nothing has changed in the past month. Some big holders took profits. Leveraged traders got liquidated. Last week, some OGs cashed our their old wallets. We see this clearly from multiple sources of data.

Bitcoin’s price is only 45% higher than it was six months ago, only 11% higher than it was at the start of October, and down 10% on the month.

The investment opportunity is the same now as it was then. Only the price has changed.

All the behavioral patterns that carried this market from May to November still hold:

Accumulation among market participants of all types and sizes.

Historically low rate of selling from miners, whales, and OGs.

Steady flow of bitcoins from “young” wallets and speculators to wallets of people who rarely cash out even after unrealized gains of 300% or more.

Growing interest from the legacy financial system (i.e., more businesses want to make money on crypto).

Sometimes, this market gets a little ahead of itself. Your expectations get so high that this market can’t help but let you down. Terror ensues.

Prices can change direction at the drop of a hat, up, down, or sideways. Altcoins fail. Protocols get hacked. Governments fuss.

The market persists.

Bold, however you define it

Whatever you want from this market, you can get it. All the opportunities you had last month? You still have them today.

Probably more.

You can chase fast money for quick profits or build wealth from owning a stake in a new financial network.

Yes, you can do both.

But not at the same time.

Decide which one of those things you want and act accordingly.

Fast money? Wait for prices to go up high enough that you feel comfortable getting into the market. Then dive in and hope for the best.

Just keep in mind, fast money is hard money—hard to find, hard to get, hard to keep.

Wealth? Act decisively when the time’s right and let a rising market grow the value of your investments.

It’s slow money, but it’s easy money. While everybody else is down on their investment or out of the market, you’re roughly even or way ahead. Once the market turns around, you can sit on your hands and enjoy your good fortune while everybody else tries to catch up to a market that’s running away from them.

No wonder so many people feel like they need to hustle and take excessive risks. It’s hard to get ahead of the market.

It’s easier to buy when the market demands you do so, then let time take care of the rest.

(At least buy until my plan tells you to stop, which could happen sooner than you think.)

While it may not feel as good as chasing the hype train to FOMOtown, you may find it’s far more rewarding in the end. Good things come to those who wait. Sometimes, better things come to those who act.

Relax and enjoy the ride!

Share this post