Last month, I shared my mindset on the market as it fell from its all-time high. This month, I talk about the significance of your decisions at this moment. While I use bitcoin as my example, you can apply the same ideas to altcoins, too.

If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version. My service provider, Substack, is having technical issues that may or may not affect your audio.

According to traders, the crypto market is about to fall off a cliff. Some say it already has. I’m still not changing the name of my bitcoin plan, even if I end up getting more hate mail.

When you look at the actual behaviors of people in this market, hardly anything changed from November to today. Institutions and some whales continue to trim their positions while new-ish HODLers sell and leveraged traders get liquidated.

What’s the difference now?

New money isn’t coming into the market and that’s freaking everybody out.

But Mark, we went down over 40% since November’s all-time high!

Yes, and we went up 40% in October. Healthy markets go up and down.

If you’re following my plan, you’re down as much as 30% but probably closer to even on your money. Some of you might have more than 650% gains, depending on when you started following me.

Why don’t I worry?

Because at this moment, only a small number of people dictate crypto prices. About 13% of bitcoins sit on exchanges and roughly one-third of those bitcoins exchange hands on any given day. Of $1.6 trillion worth of altcoins, less than $140 billion exchange hands on any given day (and that includes inflated volume from wash trading).

As a result, it doesn’t take much money to push prices up and down. We’re just not seeing enough new money enter the market to counter the selling.

Compare that to early 2021, when money came gushing in but we saw massive selling from strong hands, OGs, miners, institutions, and basically everybody but you.

Right now, bitcoin’s price can realistically drop to $19,000 or rise to $150,000 and still fit within its range of historical volatility.

Buckle up.

Until I see signs that this drop is more than a panic, there’s no reason to worry. Once I have a reason to worry, I’ll tell you.

Inflation is not your friend

Some people still bank on inflation to save the market.

Sure, inflation’s on a tear pretty much everywhere. Some think that’s good for crypto.

We shall see.

If you’re struggling to buy groceries and pay your rent because prices keep going up higher than your income does, it’s going to be hard for you to justify putting money into crypto.

While desperation can certainly force people to buy bitcoin, I’ll bet most people will seek refuge in something familiar and trustworthy, simply because that’s how humans tend to react when stressed. Bitcoin doesn’t fit the bill.

Also, when people put money into this market, there’s always somebody on the other end of the deal.

Let’s say people flock to crypto as a hedge against inflation. Prices will go up.

At that point, some whales, OGs, and insiders will see their portfolios double or triple, then sell. For them, supercycle means “sell super-fast when new money cycles in.” It’s hard to sustain upward momentum when the biggest players and so-called maximalists keep dumping on the market.

More than that, inflation is not guaranteed to continue. What if economies rebalance? If people find cheaper options? If businesses automate their wages lower? If central banks raise rates high enough? If some financial woe hits a major market?

You can’t bet on inflation always going up.

Yes, that’s the stated goal of all modern monetary systems, but they don’t always succeed. What happens if they fail? Did you think about what you might do if we get a deflationary or disinflationary economic regime?

Fear Not for COVID-19

Others think Omicron will crush the world’s economies, but this variant causes milder illness than other strains and essentially eradicates all competing variants. Vaccines make infections even milder.

Plus, doctors know how to treat those who catch the disease. Health specialists know how to prevent further spread. They continue to get better at it.

Once workers stop getting sick and go back to work, life will continue to return to normal. Many places went back to pre-pandemic life months ago. Some are only just getting there.

Could the new BA.2 strain upend this progress?

Nobody knows yet. New strains pop up all the time. On top of that, a different disease could create a new pandemic.

Same risks we’ve faced for the entirety of human history.

Unless something happens to make COVID-19 worse, it will continue to matter less and less with each passing day.

Don’t bank on a supply shock, er, squeeze

You may have heard analysts talk about illiquid supply, the portion of bitcoins located in places where they’re not easy to sell.

Illiquid supply remains high, over 75% as of this issue.

The thinking goes, when money flows into bitcoin, the price has to go up, because so much of the supply is locked up. This is the premise behind a so-called “supply shock,” a term some analysts use to describe a “supply squeeze,” a situation where supply can’t keep up with demand.

No.

At any time, all 19 million bitcoins can come to market. For the vast majority of bitcoiners, it takes a few taps on a smartphone or a few clicks on a keyboard.

Unlike other assets, bitcoin costs almost nothing to move and everybody can access the market anytime from anywhere.

Illiquid supply is a myth. There is no illiquid supply.

As a result, there is no such thing as a supply shock. Bitcoin’s price is a function of buyers and sellers. You’d be surprised how liquid those bitcoins get when the price goes up.

Bank on HODLers

We have something better than inflation, economic growth, and illiquid supply.

We have HODLers.

At least 65% of the market value of bitcoin sits in wallets whose owners tend to hoard them or send them to other people who hoard them. For 13 years, these wallets—and wallets that show the same behaviors—sell only when the price goes up.

Not when the price goes down.

Diamond hands, strong hands, true believers, call them what you want, they provide the floor for prices. They choose not to send their bitcoins to market. As a result, the market eventually runs out of people willing to sell bitcoin.

At that point, you just need buyers, and not many, to push the price up long enough for other people to think it will keep going up. At that point, everything else will take care of itself.

HODLers give the market room to go way higher, way faster than you could ever imagine—and it doesn’t matter where they keep their bitcoins.

Institutions don’t behave this way. They’ll swap crypto for cash as soon as their investment plans tell them to do so.

Some whales HODL but many will take profits on the way up or sell defensively when the price goes down.

Traders buy, sell, and get liquidated in all market conditions, regardless of which way the price goes.

Only HODLers keep this market from collapsing.

As more bitcoins flow to HODLers and newcomers who HODL after they buy, new money will stay captured on the bitcoin network, not traded away or sold for cash.

HODLers are the most important entity in crypto.

(Buyers are #2.)

As long as we see HODLers behave now as they have in similar past circumstances, we have nothing to worry about—even if the price goes down more.

For bear market types, go back to the bear markets of 2011, 2014, and 2018. Look at the movements of bitcoin and metrics built on those movements. You will find no comparison to today’s market.

If anything, today’s market looks more like what you see at the end of bear markets or the beginning of bull markets. Death crosses and bearish patterns on trading indictors. Most of bitcoin’s market cap sits in the hands of HODLers. Most sellers are capitulating at losses or taking profits from crypto they bought at much lower prices.

Price will go up after the price goes up

HODLers are great but they don’t push prices upward, they just set a floor for prices to fall. For prices to go up, we need more money coming into the market.

What will bring more money into the market?

Price just needs to go up.

Did you buy your first crypto with a clear investment thesis or understanding of crypto markets? Or did you buy because the price was going up and you felt the need to get in on it?

As economists have discovered in recent decades, people value financial assets purely on faith. People buy into the stock market because “it goes up,” bonds because “the payouts stay constant,” and houses because “they’re a good investment.”

When those things don’t work out the way they expect, they lose faith—usually, at the worst time. They rediscover their faith after only the assets behave in a way that again matches their beliefs.

The same principal applies to crypto. Once prices go up long enough for people to believe they’ll keep going up, they will come back.

As a content creator, I see this with every big upswing and big downswing. They leave after the price goes down. They come back after the price goes up.

That’s not a bad thing.

Better to feel good about what you’re doing than stress about this market. Life will give you plenty of opportunities to make money, you don’t need to buy crypto to do that.

Ok, Mark. You’re saying don’t buy until the prices go up?

No. Quite the opposite. But mental and psychological wellbeing have a value, too. This industry puts a lot of pressure on people to buy the peaks and sell the bottoms. Social media algorithms stoke your greed and feed your fear.

At the end of the day, we’re all going to make it. As long as you’re in now, you’ll be ok. Bitcoin will grow a lot. A handful of altcoins will do better.

Go at your own pace, a pace that feels comfortable for you. Nobody’s (yet) lost money on bitcoin from buying the peaks and HODLing until the next one. There’s never a bad time to buy bitcoin (though some times are better than others).

Just make sure you save some fresh cash to buy when bitcoin’s price goes into the buying zone of my plan, generally less than five non-consecutive months out of any given year.

Buying bitcoin below $50,000 in 2022 is like buying bitcoin below $10,000 in 2019. It’s the financial version of healthy diet and exercise. It feels bad in the moment, but gets better when you see the results. That takes time.

2019’s buyers don’t worry about buying at $7k or $10k, they’re just glad they did.

When you wait, you take a big risk of missing a prime opportunity to build wealth. Then, you end up chasing the market upward.

That can work out. With crypto, you can make money and build wealth—but rarely at the same time. I’ll let others give their perspective on making money. I’m more interested in building wealth.

To build wealth with crypto, you get the best results when you wait until after the market drops.

Not those 15-20% dips in the middle of an upswing, but those crashes of 20-50% that this market’s best known for. When “blood is in the streets,” as the saying goes.

Does that mean throw all of your money into the market as soon as the price crashes?

That’s up to you. Sometimes it works out, sometimes it doesn’t. I generally average into the market, with one limit-buy order slightly above a key price support level.

While occasionally that means I don’t get all of my money in when my plan says to buy, it lets me take advantage of further downside, if there is any. And whatever I don’t get up-front goes into a high-yield savings account earning 7-20% interest—dry powder for the next opportunity.

A little is better than nothing

The most important thing: get while the getting’s good, before the market goes up again. Do what you can, whether that’s a little or a lot. It’s more than 95% of the world is doing, and that’s good enough.

Bitcoin’s price went from $3,000 to $20,000 from the beginning of 2019 to the end of 2020. That’s 6x in less than two years.

Over that entire time, most people didn’t touch it. Chances are you didn’t, either.

When bitcoin’s price went from $20,000 to $65,000, you couldn’t help yourself but throw money into the market.

Who got a better deal?

Everybody who bought from $3,000 to $20,000. They had as much as 600% gains before you even set up your Binance account.

Ironically, looking at on-chain data, many of those people sold long ago. (I didn’t.) They probably sold to you!

It’s hard to sit on 600% gains without taking profits. For most people, a 50% gain is enough to trigger a sell order. Institutions and traders probably start peeling out after 20% gains.

And yet, if we didn’t have strong hands sitting on 600% gains, bitcoin’s price could not have gone up high enough for you to feel comfortable enough to enter this market. Too many would’ve sold too quickly. Prices would’ve taken too long to go parabolic. You would have been too bored or worried to put money into the market.

This same dynamic is playing out today. We had a crazy run from September 2020 to April 2021 with a long, healthy consolidation from May to November 2021. The gas tank’s full and ready to zoom.

The problem is, the riders have mostly disappeared.

Don’t let the letdown let you down

And for good reason.

When everybody promises you a supercycle in December 2021 or January 2022, they’d better deliver. Otherwise, you will feel let down.

They didn’t deliver.

Now those same experts who promised you a supercycle last year are talking about bear markets, expanding cycles, triple peaks, and the end of market cycles altogether.

Some of the same traders who told you to buy at $65k just told you to sell at $40k. I’ll bet those same traders set their stop-losses at $60k or $53k without telling you.

From the emails I’ve gotten over the past month or two—and posts from content creators I follow—everybody seems bearish. Everybody. Even permabulls have started qualifying their fractals. That was before a 10% mini-crash triggered mass capitulation a few days ago.

It’s absolutely justified.

The total crypto market cap fell 40% in two months. Bitcoin’s price did worse. Now you’re hearing about tether, scams, bans, crackdowns, and an unfilled CME gap at $9,600.

Who wouldn’t worry? Especially with the larger investment environment looking absolutely pathetic.

The thing is, those risks exist all the time, whether the market’s on a massive pump or crazy dump.

Crypto is a risky market. The larger investment environment has looked pathetic for months. Cash is losing value at the fastest rate in decades and you’re getting terrible risk/reward opportunities in every other asset that people like you and I can access.

While that’s a small consolation if you’re down 50% on your crypto, consider the alternative.

Crypto has a lot of room to grow, more than enough to compensate you for your risks.

Among legacy assets, safe investments essentially guarantee you will lose money and speculative investments carry more risks than ever.

Some traders say you should sell crypto to reduce your capital at risk.

I have news for you:

All of your capital is always at risk.

Even when you’re sitting in cash.

There are no good investments anymore, only guaranteed money-losers and high-cost gambles. Are you sure now is when you want to sell your crypto?

Bigger risks abound

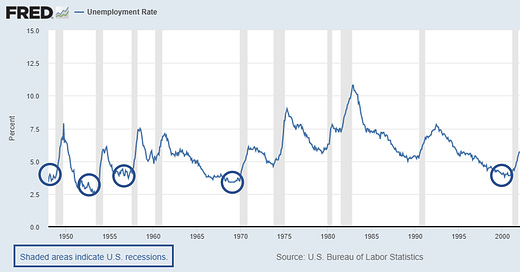

In the US economy, unemployment fell to a level we only see before recessions. Take a look:

Last month’s retail sales dropped far more than expected. Manufacturing is slowing amidst supply chain disruptions and labor shortages while rising prices have put a dent in consumer confidence among all but the poorest workers.

Does that mean I expect a recession for the world’s financial engine and largest economy?

Yes, of course. It will happen eventually, the only question is when.

Hopefully, not any time soon. Unemployment can stay low for years before a recession. A few months of economic slowdown can do wonders for the overall health of an economy.

I’m not bearish on the US economy. In any event, recessions offer fantastic investment opportunities for anybody who has a job, cash, or disposable income.

But I’m not exactly popping bottles of champagne when I hear good economic news. The music has to stop sometime.

And what about other economies?

China had to lower banking reserves twice last year to preserve the solvency of its financial sector.

Japan and the EU face their own problems. A rising US dollar has put a pinch on emerging market debt.

Global equity markets remain dangerously overvalued. Trillions of dollars are locked in money-losing bonds. “Safe” investments cost more than ever and carry higher risks with every passing day.

Unlike the crypto market, when the stock, bond, and debt markets tank, the entire world suffers. Business fail. People lose jobs.

As it did in 2020, today’s crypto market may offer a lifeline for people who have no good choices for where to put their money.

You probably missed 2020. Now you might have a chance to make up for it.

We’ll see.

Crypto gets more risky as the price goes up

Maybe you don’t have money or you feel compelled to keep cash handy?

Maybe crypto prices are going down, which makes you think they’ll keep going down?

You have good company. Even the strongest bitcoin bulls believe it gets less risky to buy when its price goes up.

Just realize, when bitcoin’s price goes up, you pay more for the same opportunity you get when its price goes down.

When its price goes down, you get the same opportunity for a steep discount.

Think back to November 15, bitcoin’s all-time high. What expectations did you have for your portfolio? 3x? 5x? More?

Now add 66% to whatever result you thought you were going to get. That’s the power of buying after a 40% drop. You take all the same risks but play for a much bigger reward.

Does that mean you need to “think long-term?”

Not necessarily.

Bitcoin’s price can zoom in all market conditions, good or bad, bull or bear. Since the beginning of the 2018 bear market, we’ve seen 10 moves of 60% or more over two months or less:

February 6, 2018 - February 20, 2018 (100% in 14 days)

April 1, 2018 - May 5, 2018 (57% in 35 days—close enough)

April 25, 2019 - May 30, 2019 (83% in 35 days)

June 4, 2019 - June 26, 2019 (87% in 22 days)

December 18, 2019 - February 12, 2020 (64% in 57 days)

March 13, 2020 - May 7, 2020 (161% in 55 days)

November 26, 2020 - Jan 8, 2021 (160% in 47 days)

January 27, 2021 - February 7, 2021 (100% in 25 days)

Jul 14, 2021 - September 4, 2021 (81% in 47 days)

Sep 21, 2021 - November 10, 2021 (75% in 15 days)

Why can’t that happen now? Many of those zooms happened in circumstances just as bearish as today’s market.

Even trading signals suggest this is a realistic possibility. Many indicators show oversold conditions across many timeframes. We just had a one-day death cross. Of the seven previous death crosses, three marked generational bottoms and two saw prices skyrocket in the weeks that followed.

Next month we’ll get a two-day death cross. That’s a 50/50 shot—two times, the price never went lower, and the other two times, prices reached the generational bottom about three months later.

While there is zero correlation between previous death crosses and anything that happens today, you can’t say “the market has to keep going down.”

It’s gone up before in similar circumstances. Why can’t it happen again?

Decide now what you will do

When you entered the market, you found a lot of excitement. Data models predicted riches. YouTube and Twitter told you the market would explode to the upside.

It doesn’t feel that way today, but it should. You’re in at the ground floor of the next boom, and it’s a whole different experience. Scary. Exciting. Frustrating. Terrifying. Stressful. Hopeful. A mix of emotions.

Whatever you’re feeling, you will feel this way again and again. This is a cruel and vicious market.

It’s also a wealth-creation machine, a generational opportunity to build lasting, durable wealth from owning a stake in the financial networks of the future.

Yes, it’s a hard way to make easy money, but look at your portfolio.

Imagine in three months, it’s worth twice as much as it’s worth today. In a year, it’s worth three times as much. Some of your altcoins will never go higher than their price today, but some will do 10x or better.

In five years, you could have a portfolio worth five times more than it is today without adding a penny more.

How does that make you feel?

What will you do when bitcoin’s price starts to run and altcoins can’t keep pace? Will you sell your altcoins for bitcoin when Twitter and Reddit tell you they’re dead?

A few weeks later, when altcoins catch up to bitcoin, what will you do when the price of your favorite altcoin triples in one week? Will you take profits? Sell out before the “real” bear market? Trade it for more bitcoin? Trade it for another altcoin? Take back your original investment and let the rest ride? Buy more?

When will you sell? Will you sell at all? What happens when you “take profits” on that 3x winner, only to watch it triple above where you sold it, while the rest of the market seems to run away from you?

What do you consider a “dip” worth buying? Is it a 10% drop? What about a 30% drop? Is 50% too much? Do you wait for that dip? If so, what will you do if the market doubles before that dip hits? Will you buy at that higher price or wait longer, in the hopes that the price falls back to where you expected it would drop in the first place?

How high will you let the fees go before you decide it’s not worth buying more crypto? Do you spend $50 in fees to buy $50 worth of crypto? If you need to sell, have you considered fees and taxes?

These scenarios seem insane and unrealistic, but you probably already lived through them. Everybody who came to this market in 2021 went through this at least once, possibly twice.

Do you remember July 2021, September 2020, March 2020, April 2019, and at least a dozen other times in bitcoin’s history, during bear markets and bull markets, when everything seemed dead and then sprung back to life?

My plan may help you navigate these decisions. Three lines on a chart tell you when to buy. Sell only when the market forces you to do so.

Tortoise or hare?

Sometimes people think my plan is too conservative and my analysis is too equivocal. Backwards, even.

Understandable.

If it seems backwards, consider whether we share the same goals. I want to use my government’s money to get more crypto. Most people want to use their crypto to get more of their government’s money.

Different goals deserve different strategies.

What do you want to get out of this market?

Decide now and pick a plan that fits your goals. A winning strategy for one person is a losing strategy for another. Plan for the outcome you want. Do it now, before the market picks up again or drops lower.

I created my plan because it can grow your crypto portfolio without a lot of risk or effort. “Squeeze the most juice" out of the market, not necessarily get the best prices or time the swings just right.

More tortoise, less hare.

Usually, that means buying only when the market’s in distress.

As a result, sometimes my portfolio goes bonkers—way higher, way faster than even I ever thought possible, or way lower, way faster than I’d like.

While my portfolio may go up or down a lot, my returns consistently go up. No trading, taking profits, or timing the market. When I’m down, it’s not by that much for that long (much = 50% or less, long = a few months or less, which seems crazy, but not for this market).

Think out of both sides of your head

I realize the wider world of content creators sells you “strong convictions loosely held.” Pick a bias, make a prediction, and then change your mind once the market tells you whether you’re right or not.

Nice work if you can find it. You could also let the market do its thing and take advantage of opportunities as they come. Why psyche yourself into one outcome or another?

Read my previous monthly issues and you will see a common theme: the embrace of uncertainty.

Sometimes, you need 50/50 analysis. At least then you get perspective.

I realize a lot of people think that’s bad. The old “one-handed economist” routine.

That’s ok. My analysis may be 50/50, but my decisions never are. When it comes to my decisions, I follow my plan.

You can still do fractals, data models, and predictions. I’ve been known to look at fractals and data models now and then. I’ve also published some predictions.

Food for thought, not a reason to act.

Just as a few months ago, I saw people calling for the bull market to peak at the end of 2021, Q1 2022, or summer 2022.

Now those same people are calling for a long bear market or a peak at the end of 2022 or 2023. Expanding cycles, triple peaks, domed houses, CME gaps, etc. Some say we started a bear market in February 2021.

Think twice before you dismiss these outlandish statements. They’re all useful perspective and I’m certain as we get more extremes, we will get more models and more people talking about when this thing will end (bear market or bull market).

Don’t worry about it. This market will go up, down, and sideways until you feel like you can’t take it anymore.

Take advantage of opportunities when they present themselves. You’ll do ok. Courage is not the absence of fear, but the ability to act in spite of it.

Be courageous.

Relax and enjoy the ride!

Share this post