In last month’s issue, I offered my perspective on the next phase of the bull market and questioned some conventional wisdom. In this month’s issue, I reflect on today’s circumstances and the expectations you may have about what that next phase might hold.

If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version.

When I started writing my first book, Consensusland, I cared about the social, political, and cultural aspects of cryptocurrency.

This technology challenges our conventional paradigms around money, wealth, governance, and commerce.

What does it mean to be rich when everybody can create their own money or access capital from anywhere, any time, in any amount, on whatever terms they choose? What role does government play when technology can secure your rights and property with mathematical certainty—better than your clerks or magistrates can do?

Those few questions only scratch the surface. The possibilities are endless.

The financial opportunities are just as vast.

As entrepreneurs, developers, and financial experts build the financial networks of the future, you can own a stake in those networks and expect the value of your stake will grow tremendously as these networks grow.

Usually, these kinds of opportunities are reserved for the wealthy or well-connected. Insiders, scions, and those fortunate enough to access the closed networks of politics, finance, and industry from which these kinds of opportunities emerge.

Not with cryptocurrency. With cryptocurrency, everybody can participate.

What about the social benefits of this technology? Fairer markets? Personal sovereignty? Privacy? Data security? Financial inclusion? Permissionless access to capital?

Yes, sounds good. We’ll get there eventually. Let’s make some money first.

Life-changing wealth

Rarely does life give common people like you and me a chance to get ahead of the global elites.

The question is, how?

This technology puts all the tools of the wealthy into the hands of even the poorest among us. All the instruments of finance at the fingertips of anybody with a smartphone or laptop. All the power of money in the palm of your hand.

At the same time, you can flip cryptos for fast money. A trivial investment can yield unthinkable gains. Price swings can double or triple your investment in a matter of days—sometimes, hours.

Over the long term, bitcoin returns annualized gains of 200% and some altcoins have the potential to do better.

When you have an opportunity to build such long-term, durable wealth in a new asset class with unlimited potential, you want to make the most of it. That means different things to different people.

Do you want to trade your way to fortune? Farm yield for extra cash? Stake for passive income? Or perhaps buy a few coins and wait for the market to push the value of your crypto higher?

How much risk do you want to take? Do you borrow or lend? Play for today or years from now?

Whatever you want to get out of this market, you can get it—as long as you recognize that today’s market is probably not what you think it is. The images you have in your head may not mesh with the reality of this moment.

Whenever you think something can’t happen, it can

Perhaps that’s why bitcoin’s recent drop from $67,000 to $55,000 spooked the market.

In October—er, “UPtober”—seemingly everybody thought this market would go straight up to a supercycle supernova moonshot lambo and maybe even market cycle peak.

November’s still red, down 6% on the month. Quite the contrast.

Don’t think we can’t hit $100,000 by the end of the year. We could go even higher. All the conditions that existed at the beginning of the month exist today, too.

If we do hit $100,000, you can be sure Twitter will push a bunch of 2013 and 2017 fractals into your feed and Reddit will go bonkers about the market cycle peak. It’ll be just like two weeks ago, but even more insane.

Everybody will have a point. We see a lot of similarities with the conditions of late-2013. Bitcoin’s recent price movements mirror those we saw heading into the end of 2017. And if we had better data for the 2011 peak, I’ll bet we’d see similarities with that run, too.

Why can’t we see a rerun of 7% average daily gains we saw in the final 37 days of the 2011 cycle peak? Or maybe the 4% average daily gains we saw in the final 38 days of the 2013 cycle peak? Possibly the 3.5% average daily gains in the final 36 days of the 2017 cycle peak.

Let’s say bitcoin’s price goes up only 3% each day from today to December 31. That’s slower and lower than 2011, 2013, and 2017 over the same timeframe.

If that happens, bitcoin’s price will go above $170,000.

You may think that’s crazy, but similar types of runs have happened in bitcoin’s past. It’s not only possible, it’s happened before.

On the other hand, this market gives us a very wide range of realistic expectations. Today, any price up to $140,000 or down to $17,500 would fall into bitcoin’s historical range of volatility.

Let’s not get too complacent.

Choose your data models wisely

What about the data models? When do they predict the peak? End of December? Spring 2022? October-November 2022? Sometime in 2023?

And at what price? $137,000? $250,000? $288,000? Higher?

I used my own data model to predict how high bitcoin will go.

My model doesn’t actually use data or model anything. I don’t make decisions or plans based on it. It’s just a thinking exercise, as explained in a special issue, How High Will Bitcoin Go. Tap this button to read it.

Why don’t I use data models?

Because they all contradict each other.

Mark, even Stock to Flow?

Yes. Stock-to-flow and its sibling, S2Fx, allow such a wide range of prices that almost every number fits within the model. Bitcoin’s price has gone 400% higher and 70% lower than S2F for months at a time. You get the same accuracy from almost any line that goes up and to the right on a price chart.

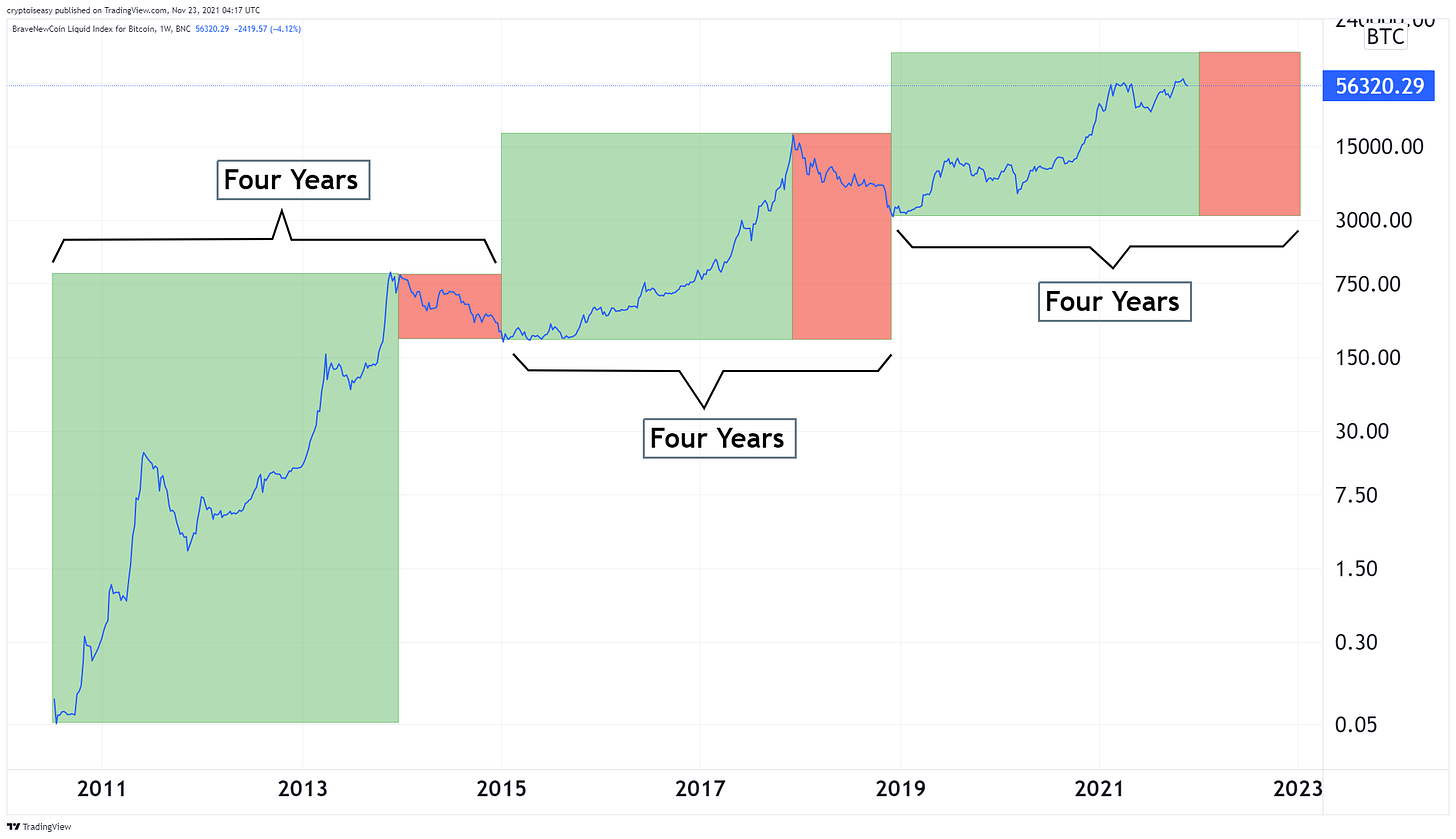

Of all the data models I know about, only two seem to make sense: the four-year cycle and the expanding cycle.

Both have data and history behind them. Both derive from dependable, well-established patterns of behavior.

And both cannot be true.

Four-year cycle theory says bitcoin’s price moves through bull and bear cycles that take roughly four years to complete.

Wherever you start counting from, this theory reflects human behavior and investment psychology based on thousands of years of financial speculation, applied to the particular idiosyncrasy of bitcoin’s halving and demonstrated in the actual movement of bitcoin’s prices.

This theory predicts the bull market will peak soon, at a very high price. As altcoins follow bitcoin, they will peak soon, too. A bear market will follow.

Expanding cycle theory says each market cycle plays out longer than the one before it, with diminishing returns and more mild ups and downs between peaks and bottoms.

This theory reflects observations of how assets behave as they grow. It captures all of the tops and bottoms from bitcoin’s inception, which the four-year cycle does not.

This theory predicts the market will peak in a year or more, at a fairly modest price relative to previous bull markets. Since altcoins follow bitcoin, they will peak in a year or more, too. A bear market will follow.

It’ll be interesting to see which model fits this market cycle. Maybe neither of them do.

Maybe no data model does.

Think out of both sides of your head

Data models are great but have you ever tried to identify reasonable outcomes, then think through what options you have for each potential outcome?

I can think of a few potential outcomes for crypto over the coming weeks and months. You can probably think of more. For now, I have only four on my list:

Supercycle. Everything goes up forever, only occasional pullbacks.

Melt-up. Crypto prices shoot up to a parabolic peak, ending the bull market. 1-2 year bear market ensues.

Crash. Big drop—30% at the minimum, 100% at the maximum. After that, everything recovers or dies.

Natural, organic, gradual, healthy rise in prices with some extended periods of sideways or downward movements. The market rises and falls along a generally upward trajectory, with the swings gradually getting smaller as the technology matures and usage grows.

Are you prepared for each of those outcomes? Can you think of other possibilities? What’s your plan?

Figure that out now, before the market decides for you.

What’s best for you depends on your values, goals, and personality. Only you know what those are.

For me, I follow my plan. It’s based on almost 13 years of history and patterns in bitcoin’s price movements. It beats dollar-cost averaging in every scenario I could find.

Just three lines on a chart tell you what to do. Buy only on average five months or less each year, usually non-consecutively, only in certain conditions. Sell very rarely, only in the most extreme conditions. Sit on your hands the rest of the time.

Some people think it’s too simple or conservative, which is fair. It still beats dollar-cost averaging in every scenario I could find. It probably beats most traders (but not the good ones).

Anybody who has followed my plan will have gains of 21% to 1,000% on bitcoin. For altcoins, you’d have somewhere between 70% loss to 12,000% gain, depending on what you bought and when you bought it.

On top of that, my plan covers each scenario.

Supercycle. You’ll never put another penny into the market. Even .001 bitcoins will set you up for life. You can spend your government’s money on other things and let the supercycle make you rich. You’ll have an eternal source of collateral to borrow against. You will never sell. Your investment will go up forever. Fountain of financial youth. Infinite wealth.

Melt-up. You’ll sit on your hands, let your investments grow, sell if the plan says to do so, and wait for a crash or bear market to give you a chance to buy today’s hottest tokens for literally pennies on the dollar. (Bear markets are the best times to buy. Far fewer scams. Cheap transaction fees. Bad projects fail, great projects build. Once the bull market starts, you’re in an amazing position.)

Crash. You’ll buy bitcoin and altcoins when bitcoin’s price goes into the buying zone of my plan. You’ll keep buying until the market turns around OR the plan says to cut your losses and exit.

Natural, organic, gradual, healthy rise in prices with some extended periods of sideways or downward movements. You’ll buy when the time is right, never sell, and gain a durable financial asset that you can pass down to your children and grandchildren.

What do you do when my plan says not to buy?

Enjoy your life.

You can also earn a relatively safe 8-12% interest on your idle cash with crypto savings platforms.

The time for 100x has passed

Yes, one of my altcoin recommendations delivered a 12,000% gain when you include rewards for early adopters (only 10,000% when you don’t). That’s 120x (100x without the rewards).

Two of my other altcoins, LUNA and LINK, did better. And a fourth, AAVE, would have done that, too, if I’d bought it in 2018 or 2019 instead of the peak of the 2017 bull market (remember ETHLend?)

To get those results, you had to buy those altcoins in the middle of a crash, a bear market, or a global financial crisis.

Even then, you had to wait months or years for the rest of the world to see the good things those projects were doing. And never take any profits along the way. And accept that most of your altcoins will lag the overall market, as most of my altcoins do.

Can you get a 10,000% return now, when the market’s far closer to the peak than the bottom?

Yes, but I wouldn’t bank on it.

Look at this smattering of altcoin performances from January to May 2021, our most recent altseason. That CRAZY altseason when seemingly everybody got rich.

This chart shows the relative performance of BTC, LTC, ADA, LINK, AVAX, LUNA, THETA, TRX:

Your best performer, LUNA, peaked at 30x in March. The rest didn’t even make it to 10x before altseason ended.

Mark, you’re cherry-picking! Take it from September 2020, when the bull run started.

Ok. Technically the bull run started in December 2018, but I get what you’re asking for. Here’s that same chart, starting from September 2020.

You’d have bought the absolute local bottom, sold the absolute local top—and still gotten only three altcoins that gave you 10x gains.

No, think about the end of the last bull market. Something like THAT is what we’re talking about. Not normal altseason but a really big, face-melting, cycle-ending explosion.

Sure.

Same chart, from September 2017 to January 2018. I had to find new altcoins because my examples above either didn’t exist or had no USD charts for that time period. Take a look (now BTC, LTC, ADA, XMR, TRX, XLM, DASH):

Three of them did amazing, over 40x. The other five didn’t even break a 5x multiplier.

But Mark, those are large caps. You gotta look at the micro caps.

Ok, sure. I guarantee probably 100 out of 10,000 altcoins will do 100x before the bull market peaks. You’ll hear about them after they shoot up.

The question is, can you find them before they shoot up?

That’s a hard task. Everybody knows about Shiba Inu. Nobody’s heard about the dozens of wanna-be Shiba Inus that never made any money for anybody.

DCA at your own risk

Most people dollar-cost average into the market. Buy a little bitcoin on fixed intervals regardless of price.

Sometimes you buy high, sometimes you buy low, but you’re always stacking sats no matter what the price is doing.

That’s a great approach. Nobody goes broke dollar-cost averaging into bitcoin and everybody comes out ahead over time.

Over time.

I know lots of people who dollar-cost averaged from December to May 2021. They spent most of that time buying high. No worries, no stress.

Are they getting massive multiples on their investment?

No, not anymore.

At this point, with bitcoin’s market cap already really big and the bull market already almost three years old, dollar-cost averaging is not going to give you the massive multiples you’re thinking about.

Ten years ago, sure. Five years ago, probably.

Not now. One of my readers sent me this pattern of DCA returns since bitcoin’s inception:

Each passing year, the returns drop exponentially even as bitcoin’s price keeps going higher and higher.

DCA into altcoins?

Maybe you think you’ll do better averaging into altcoins. The entire altcoin market has gone up 7x this year and 26x since the start of the bull market.

Over the long run, some altcoins will do way, way better than that—but will the overall market keep that pace?

Can you do that and avoid rug-pulls, pump-and-dumps, selling too early, and chasing “the next bitcoin” that fails to be the next bitcoin? What if you dollar-cost average into a dying altcoin? Many of the top 50 altcoins fit that description.

No altcoin has ever outperformed bitcoin from one market peak to the next, only at arbitrary intervals in between.

When you dollar-cost average into altcoins, you risk pouring money into projects that lose forever.

What do I do?

Buy only small altcoins up to a fixed USD amount, stake them when possible, and wait for them to grow or die. Read my portfolio strategy to learn more.

You’ll have a chance to get easy 20x opportunities when the market crashes. 100x opportunities come during bear markets.

Plan accordingly.

Are you ok seeing your portfolio *only* double?

While your crypto investments probably won’t return 10x or 100x before the end of this market cycle, that leaves room for your crypto portfolio to go up 5x from now until the peak, whether that’s soon or in a year. A 2x return is almost guaranteed if you can hold through the volatility.

In any other market, that’s insane. In crypto, it’s realistic.

Don’t let the last two weeks fool you. We have a rising market with a lot of momentum behind it. Expect good things—just not always up 100x lambo moonshot turn $1,000 into $1 million by the end of the year (or next).

Will you get sad if you *only* double or triple your investment in the coming months or years? If so, where else can you get that opportunity?

When the market drops 30, 40, or 50% will you see that as a chance to raise your allocation or a reason to sell your crypto so you can buy it back at a lower price that may never come?

Whatever happiness and excitement you had when you entered the market, summon that enthusiasm when the next great buying opportunity comes. At that time, you can expect your portfolio to do better than 2x-5x.

Possibly much, much better.

Beware of altcoins that promise great things

Until altseason comes, you’re not likely to get those great outcomes from altcoins promising high yields or massive rewards.

Sure, some of those altcoins are legit bad-ass protocols and platforms doing awesome things.

Others seem designed solely to enrich their founders and hype their tokens. Here’s a very common approach:

Call yourself a DAO.

Create a whitepaper that uses the words DeFi, Web3.0, decentralization, governance, or some combination of those terms.

Create a token.

Give yourself a shitload of those tokens.

Sell those tokens for a big, widely-used, well-established, highly-liquid altcoin that you can easily cash out. E.g., Ethereum or BNB.

Give buyers insane yields to stake the token—except, pay those yields in your own token.

Give influencers free tokens to promote your project.

Release new tokens constantly for people to buy and stake.

Sounds pretty good, right? You get awesome yields—free money!—and the founders get compensated for their efforts. Win-win!

These are not rug-pulls. It’s a standard model for many tokens, even the ones that have good intent or noble ambitions.

But think of it this way: if you pay me for a pile of shit and I promise to give you 1,000% more shit each year, you just end up with a whole lot of shit and I end up with your money.

If you’re in the fertilizer business, you’re happy. Actually, you’re ecstatic. You get a lifetime of supplies for one upfront payment. Great for your business.

As an investor, you will see the value of those tokens dilute forever. If you think 6% inflation of your government’s money is bad, why would you accept 1,000% higher inflation from that hot new altcoin everybody’s pumping?

Dirty business, this

That’s not to pick on DAOs or the many DeFi protocols that take a similar approach. Some projects have good developers, mechanisms for capturing value, noble founders, and features that offer the potential for long-term growth in the real world. Also, far lower yields and stricter token emission policies.

In any event, all altcoins have problems, even the biggest ones.

Ethereum can’t scale and costs too much for small users. ETH 2.0 gets delayed all the time, nobody knows if it will work the way they expect, new tokenomics screw up some DeFi protocols, and behind-the-scenes conflicts breed a lot of drama.

Binance is a walking FUD magnet. People say Cardano will never work and Charles Hoskinson is a megalomaniac who does terrible things to people.

EOS's leader bailed on the project after raising $4 billion illegally. DOGE has an unlimited supply. Sushiswap started as a rug-pull. Some people think Uniswap is a corporate powerplay.

ICP investors pumped-and-dumped their tokens on innocent newcomers at the peak of the last altseason. Thorchain has suffered at least three hacks (but at least it works, unlike most projects).

Expect slip-ups, mishaps, FUD, leaks, rumors, back-stabbing, and incompetence. People will undermine each other. Protocols will fail. Smart contracts will break. Good ideas won’t work out.

This is a messy place.

The problem is, if you wait until it's clean, well-managed, professional, and everybody's figured everything out, you will miss the investment opportunity.

Altcoins are early-stage, experimental technology with uncertain product-market fits and novel tokenomics. You have to grade on a curve and accept that your favorite altcoin may pump, dump, or die at any moment. You should assume it will screw something up.

I’ve talked to many founders and team members. The good ones realize the odds are stacked against them and they have a lot of work ahead of them.

Hopefully, you realize that, too.

Up is the trajectory, for now

Speaking of curves, we’re sliding up the final slope of a three-year parabolic bull market, as shown in this image of bitcoin’s price.

We don’t have a lot of room left for “higher lows” on the way up.

Over the coming weeks and months, something has to give. Whether the price goes up or down, one of two outcomes must occur:

Either we break the parabola or we hit the market cycle peak. Terror or ecstasy.

As I’ve covered for premium subscribers since the summer, on-chain measures of human behavior match more closely to what we see at the beginning, not end of bull markets.

With a catch.

Those behaviors set the floor, not the ceiling for prices. They play out over long periods of time and tell you nothing about what the price will do.

As any investor will tell you, assets don’t determine their prices, people do. Traders look at prices. We look at people. Prices change quickly. People do not.

As a result, this data reveals the aggregate mindset of buyers, sellers, and HODLers. It only tells you about opportunities, not prices.

To thine own self be true

Ok, Mark, that’s great, thanks for telling me all that. What’s the point? What should I do?

You have to consider your goals, investment time frame, living conditions, financial status, tax situation, and risk tolerance. I can give you my perspective and share my plan with you.

While my analysis is often 50-50, my decisions never are. Buy when the time’s right, HODL on the way up, never take profits, and sell only when you see specific signals (hopefully, never). Premium subscribers, I’ll tell you when that is.

Does that sound like fun?

Maybe, maybe not. Would you rather chase after the market as it seems to run away from you?

At some point, I’ll get back to writing about all the things that excited and intrigued me in 2018 (and still do today).

With cryptocurrency, entrepreneurs and developers are rewiring a thousand years of financial and trade networks, disentangling commerce from monetary policy, and offering new platforms for organizing people, protecting property, and distributing goods and services on a global scale.

That also gives people like you and me a chance to grow our wealth in ways we never could have imagined just a few years ago. We can own a stake in the financial networks of the future at a massive discount to their ultimate worth.

Ask yourself what you’re trying to get out of this market.

Are you trying to make money? Or are you trying to build wealth? Which type of person are you?

Whatever you answer, you have a friend here. We’re in this together.

Relax and enjoy the ride!

Share this post