If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version.

In last month’s issue, I gave perspective on what to think about as we move through the regulation and litigation stage of crypto's evolution.

This month’s issue looks at the facts and worldviews that frame our perspective at this moment as we look ahead to the growth we can expect in the coming months and years.

End of the Biggest Pump and Dump in History

Here we are, on the wrong side of the biggest pump and dump in history.

Did you think I was talking about crypto?

No.

In the first two decades of the 21st Century, the world’s central banks pumped outrageous amounts of money into the financial markets. Look at the world’s supply of money from 2001 to today, as a percentage of GDP:

Little by little, they bought assets, slowly building up a base, gradually taking supply from weak hands, bidding up prices.

Then, in 2020, they pumped a bunch of money into the market. You can see this in the spike on the right side of the image above.

Shortly after that, the prices of everything went up a lot, quickly. As the owners of so much of the world’s assets, central banks could control the pace of selling. They let prices zoom.

Once enough people bought into the pump, central banks started to raise rates and sell assets. They yanked money out of the system, rug-pulled asset holders, and left new buyers holding the bag.

It’s market manipulation, but at least they told you what they were going to do before they did it. Transparency!

If it seems like the worst is over, remember that assets like stocks, bonds, and real estate remain higher than their historical benchmarks.

In other words, even after central banks wiped possibly $50 trillion off of the world’s balance sheets, major legacy assets still have plenty of room to fall before they get back to “normal.”

Crypto, on the other hand, already crashed. Its pump has already been dumped.

Can’t ignore reality

In May 2022, bitcoin’s on-chain and technical metrics showed the same signs as every previous market bottom. In June, we saw even more signs in the movements of bitcoins and historical measures of investor sentiment. Over the summer, those signs persisted.

Paid subscribers saw this play out in real-time.

Do you remember this image in the weekly rundown from October 9, 2022?

We’re in the squiggly lines in the circle.

With our recent pump from $18,160 to $21,000, you might think we’re climbing out of depression and into the disbelief stage.

You might be right, but not because of a trivial 15% upswing over two weeks. That’s meaningless for a market as volatile as crypto.

If you’re right, it’s because all of the circumstantial, behavioral, and technical evidence matches what we see at the generational bottoms of the crypto market.

We’ll have to wait months, possibly years before we know for sure (and even then some people will still call for $10,000 or lower). These patterns take a long time to appear and can last longer than you might think.

Look around

Still, our recent pump was enough to convince some analysts to take profits and proclaim a new bull market.

Surely they’re kidding, right? Crypto prices are still lower now than they were last month.

Only the bond market has had a worse year than crypto by historical standards, and bond prices are still high enough that governments and businesses struggle to find buyers.

Legacy assets offer less upside and more risk than ever. Crypto offers more upside and less risk than it has in a long time.

We can agree that bitcoins price can realistically drop to $14,000.

At the same time, you have to appreciate the circumstances and accept the reality of the situation.

Mark, you’re saying everything else will crash and crypto will boom?

No.

Mark, you’re saying everything else will crash and crypto will crash, too?

No.

Mark, you’re saying everything else will recover and crypto will boom?

No.

Mark, you’re saying the bottom’s already in for crypto?

No. The bottom is $0. Most altcoins will get there. Bitcoin might, too, but probably not.

We still don’t see a lot of new money coming into the market. Meanwhile, miners still sell all the time. Lots of whales have bitcoin they can dump at a profit, even at these low prices. The class of 2021 remains skittish from bull market losses and household budgets that are getting squeezed.

Legacy equity markets are still waiting for the next shoe to fall. Winter is coming. China’s struggling. Europe’s also having a tough go of it. In too many places, too many people have too little food, too much inequality, and not enough money.

We have many reasons for people to stay away from crypto and many reasons for people to sell their crypto.

This is a not good thing but it has a silver lining. We need entrance liquidity.

When you’re out, I’m in

You may have heard of exit liquidity, the money insiders get when they cash out of a project. You buy high, they sell high.

What about entrance liquidity? Can we make this a new term? Something to describe the situation where people like me buy crypto after prices fall 30% to 95%?

They sell low, we buy low.

Outside of a few weeks in March, April, and May, I bought crypto throughout 2022. If you’ve followed my analysis and plan for buying and selling bitcoin, you would have also bought during those times.

In hindsight, I should’ve waited until the last week of January to start buying into the market again. Still, with my plan, you’re up as much as 300% or down as much as 60%, probably closer to down 10% on your investment.

For the past five months, I have focused on altcoins simply because of the favorable market conditions. One altcoin every two weeks.

With each update for paid subscribers, I tell you what I bought and also review five or ten altcoins out of the top 100.

When you get a chance to enter this market at such steep a discount, you have to take it. The upside is so massive and the downside is so small, you can’t sit on your hands—even if you expect prices to fall.

What's the next narrative?

For some people, it's not enough that crypto prices are low. They need a different reason to put money into this market.

A key level on a trading chart. Some macro or technical signal. A leading indicator. A key milestone in the four-year cycle theory. The halving. World peace.

Others think we need a new story to attract new buyers. So many people have been burned by crashes, scams, fraud, recession, and losses that the old narratives don’t work anymore.

Bitcoin as an inflation hedge?

Failed. Its price is up only 300% since governments went BRRR / money printer / stimmy / negative interest rates during the pandemic.

Bitcoin as a store value?

Failed. Its price is the same now as it was in 2017 and 2020.

Bitcoin as money?

Failed. Nobody spends it, saves it, or trades with it.

Narrative, where are you?!?!?

Oh look, there you are. You’re the same narrative that you always were:

Price. Go. Up.

As long as bitcoin’s price can go up long enough for people to think that it will keep going up, everything will work out fine. People will come up with all sorts of reasons to buy it. Then you will find the new narratives you seek.

Along the way, people may even dig up old narratives.

Some stay Stock-to-Flow is not valid but it’s as valid now as it ever was. Bitcoin’s price has gone way above and way below S2F’s predicted price for years at a time.

In fact, bitcoin’s price is almost never where S2F says it should be. Look at Glassnode’s “S2F Deflection” chart, which tracks how far bitcoin’s price has strayed from the S2F model.

Plenty of time above and below bitcoin’s price (sometimes way above and way below).

If you believed in S2F in 2020 or 2021, there’s no reason to stop believing in it now.

You could also try my U2R model.

I made it up, but it’s a line on a chart. That makes it legitimate, right? It seems reasonable that you could use it. There’s even some math involved.

(I think 🤷♂️)

What about expanding cycles? Shrinking cycles? Dynamic cycles? Halving cycles?

Perhaps you prefer the four-year cycle? That makes everything easy. You can just buy a full allocation in December 2022, take profits each time bitcoin’s price doubles, and then sell whatever you have left in December 2025.

No matter what happens with price or time, you can fit a model over bitcoin’s price. For example, even if bitcoin’s price never goes lower than its June 2022 low of $17,600, people will say it bottomed in Q4 (October-December 2022).

How can that be?

The power of the mind. In 2021, the lowest price came in June but people say the bottom was in July. The last bull market started in 2018 but people say it started in 2020.

Now, bitcoin’s price is lower than it was in July, August, and September, but only recently did you hear chatter on YouTube and Twitter about bull markets and bottom formations.

Laws first, then money

While it’s nice to think that higher prices will validate cryptocurrency’s place in our modern life, it’s only one part of a bigger story. At some point, this stuff has to be useful. You can only string people along for so long. Eventually, you have to deliver what they want.

Better technology will help, for example, good U/X, apps and interfaces that remove some of the technical steps that people screw up, battle-tested smart contracts and developer tools, uniform technical standards, and improvements in security and governance.

Laws, too.

Developers and entrepreneurs can’t push the technology to its transformational potential when they never know whether they’ll get sued, fined, or jailed for doing so.

Use a mixer to protect your privacy? Dutch and US authorities may freeze your funds and put your developers in jail.

Sell NFTs to raise money for a business venture? US regulators may wait a few years, then fine you retroactively for violating securities laws.

Create a new cryptocurrency? Put one on your balance sheet? Leverage the technology for payments or settlement of business transactions?

These are simple activities, easy to execute, and mostly harmless—but if you do them the wrong way, your government may zap you. Not to mention, anybody who manages another person’s money risks breaching their fiduciary responsibility.

While this is a concern everywhere, it’s particularly salient in the US.

The US economy makes up one-quarter of the world’s GDP and its financial markets hold most of the world’s wealth.

A lot of that wealth comes from rich people and institutions, the kinds of people I talk about in Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency.

They can’t allocate to crypto until they know the US government will shield them from its excesses and protect their opportunities to profit from its success.

Yet, US laws and regulations stem from ancient precedents that make no sense for crypto.

It’s a security, commodity, property, and money rolled into a single technology. The problem is, the US legal system has different, conflicting laws for each function.

It’s not just big institutions that need laws.

Aunt Sally and Uncle Morton need protection from scammers. Samantha Down the Street needs protection from fraudulent lending platforms. Billy the Neighbor needs somebody to disclose who’s paying for the hype/shill job he’s FOMOing into. Bruce the Banker needs to know who he can sue when things go wrong and on what grounds.

Without legal and regulatory clarity, they will never feel comfortable about crypto. They just got thrown to the wolves with scams, hacks, frauds, and a big crash. You can’t expect them to see the technology as safe and legitimate without giving them a reason to do so.

A little government goes a long way.

Likewise, you can’t expect the legacy financial system to appreciate all of the good things you can do with crypto as long as it’s just a casino game. What does Coinbase do again? Oh, yea, lose money. Is Tether solvent yet? What does this Web 3.0 even mean, anyway?

Until the world’s governments create clear guidelines and expectations, every innovation will be met with caution. Every bit of progress will come with a caveat.

This won’t stop people from trying to do great things, but it will deprive the rest of us of the benefits of their work.

Crypto’s Future Killer App

While you’re looking for narratives, wondering when the bull market starts, and waiting for your government to make crypto safe, don’t sleep on NFTs.

Today, they only prove ownership.

That may seem lame and not very useful, but once you have global, immutable proof of ownership and the rights and privileges that go with it, you can remove layers of bureaucracy and recordkeeping while also crafting automated protocols to transfer, fractionalize, securitize, amortize, and distribute assets to anybody, anywhere, anytime, without human intervention, with certainty that everybody has access to and control over the things that they own.

More importantly, you can sell, rent, or lease your stuff to anybody, anywhere, anytime, in any amount, with whatever conditions you want.

This puts a lot of power in the hands of creators, inventors, property owners, and the people who support them.

It also creates a new investment opportunity: creators and businesses that empower their creations.

For example, metaverses like Pavia and Illuvium, which use NFTs as deeds and vouchers. Publishing platforms like SolType, Mirror, and Sigle, which use NFTs as subscriptions and receipts. Community platforms like Writers Dorm and Bored Apes Yacht Club, which use NFTs for membership and access to exclusive offers and spaces. Marketplaces like AtomicHub, CNFT, and Looksrare, which give people ways to buy and sell their NFTs.

These are not cryptocurrencies, though cryptocurrencies play vital roles within their platforms.

These are Web 3.0 entities servicing the real needs of real people in the real world.

In the real world, I can’t sell you a car that I don’t have. In the digital world, I can do this. I can dupe, copy, or recreate anything. I can lie and defraud you. I can bait-and-switch you.

With NFTs, I can’t do any of that.

NFTs provide the one functionality the modern digital world lacks: ownership.

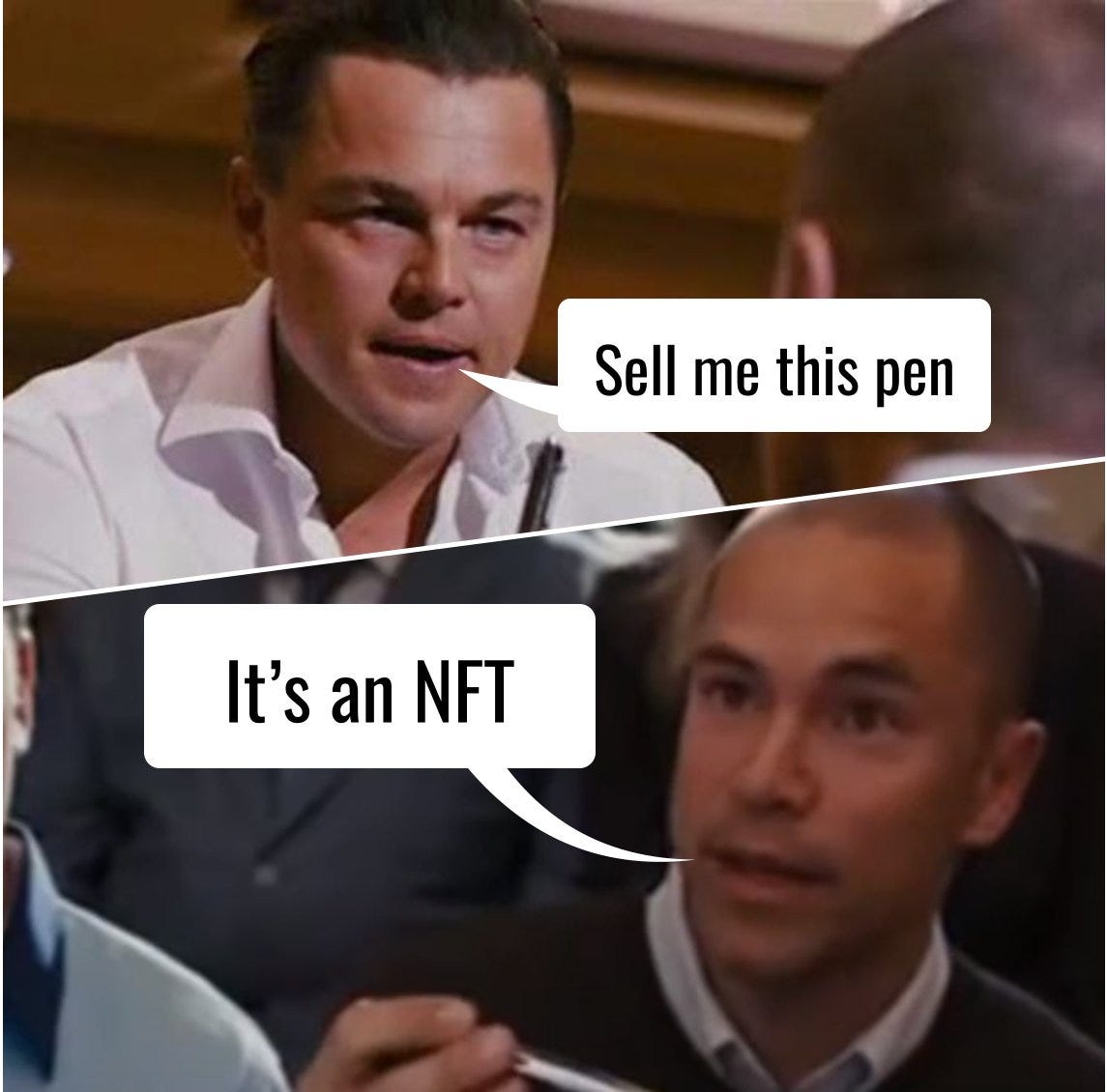

Have you seen that meme where one guy says “sell me this pen” and the other guy says “it’s an NFT?”

Here it is:

That meme is truer than you think. NFTs really are like pens.

You can make them all different types, shapes, colors, and features. Some are worth more than others. Some cost more than others. Some give you special perks, some do not. Some bestow special status, some do not. Some work better for some purposes, others work better for other purposes.

Pens revolutionized the way people convey thoughts, ideas, images, and emotions. It made these things portable, transferable, and spontaneous in a way that nobody had ever done before.

If only my government regulated NFTs like they regulate pens, life would be so much easier.

Where will the value flow for NFTs? Will it go to the altcoins and networks that support the NFT protocols? Will it go to the businesses that build on those protocols? Will it go to the NFT holders?

Will any of this activity drive value to altcoins? Or will the NFTs steal value from those altcoins—for example, as capital enters to buy the NFT, then exits once the deal is done?

We shall see.

Bool Marckit?

Sounds great, Mark. Also, boring. When does the bull market start?

When prices drop 30-50% in bull markets and rise 100-300% in bear markets, terms like “bull” and “bear” lose all meaning.

If bitcoin’s price stays above $17,600, we’re in a bull market. Otherwise, we’re in a bear market.

Guess what?

It doesn’t matter.

From looking at the on-chain data, it’s clear that the bears don’t have enough crypto to push the prices down.

From looking at the world around us, it’s clear that the bulls don’t have enough money to push the prices up.

Until that changes, we’ll continue to move sideways in the form of big upswings and downswings for the indefinite future.

May I offer a consolation?

This world has a lot more money than crypto. I think we can both agree on where the market’s going to go once we get decent laws and a little momentum.

Up.

Your goal: get in before that happens.

Once you see the on-chain data turn positive, strong trends emerge, and economic stability return to the world’s financial markets, you’re too late. Once bitcoin’s price goes above $50,000 and people tell you to take profits, you’ve missed your opportunity.

Perhaps buying before June was too early. Oh well. You can make up for bad timing. Complacency kills.

Some say that you need to wait for more miners to go out of business or until the world’s governments start printing money again.

What will you do if prices start going up before that happens? What if bitcoin’s price runs to $30,000 and your altcoins double or triple in value?

Will you sell because “this rally will also fail” and YouTube shouts “take profits!”

Will you buy more because “everybody says the bottom’s in” and YouTube screams “bull market!”

What will you do if bitcoin’s price crashes to $14,000 and then bounces up to $19,000 two days later? Will you sell because “dead cat bounce, it’s going lower” or buy more because “that has to be the bottom?”

What will you do if the market goes sideways for another five months and invalidates all the cycles, growth curves, and data models?

Choose now, before the market forces your hand.

I’m happy to help you with that.

Relax and enjoy the ride!