In last month’s issue, I challenged some popular beliefs. This month, I talk about risk, opportunity, and how our expectations sometimes get the better of us.

If the embedded audio narration isn’t working properly or doesn’t sound good, tap this button to switch over to the podcast version.

Before I discovered cryptocurrency, I expected to build wealth through real estate.

By the middle of 2018, I realized with crypto, I could accomplish in 5 years what would take 20 years in real estate.

With that realization, I switched my focus from real estate to crypto—the technology, the markets, the people, and whatever seemed relevant for the investment opportunity.

In part, it was escapism—that dream of making lots of money and being financially independent.

Mostly, I wanted a chance to contribute to a new and growing industry while also giving my family an opportunity to build durable financial security without slaving away for decades.

A lot of crypto conversations get wrapped up in either hype and the allure of riches, or complicated economic and technical concepts. If I could offer an alternative, maybe I could grow an audience around sane, level-headed viewpoints.

Counterprogramming for a world full of shills and sociopaths.

A little goes a long way

While researching several projects for my book, Consensusland, I got to really understand the true potential of cryptocurrency. Namely, the power to put all the instruments of finance and commerce into the hands of individuals like you and me.

The Biggest Problem Cryptocurrency Solves That Nobody Talks About

I can safely admit I’ve wrapped my head around maybe 10% of this industry. Given the pace of innovation and growth, I’m content with that. My head probably can’t handle much more than that, anyway.

It took me the better part of six months to understand the basics of DeFi. I still don’t understand some of the financial engineering that goes into it, but at least I know the core mechanics, how the various pieces fit together, and what needs to happen for DeFi protocols to reach mainstream usage.

NFTs? I get the concept, I know it’s a really valuable, widely-applicable technology that will revolutionize our contemprary notion of ownership and property rights. I can’t tell you what JPEGs you should buy or what NFT project to put your money into, nor how to value virtual real estate.

Now I’m getting a ton of questions about the technical differences between L2s. Are you sure you want to get your technical insights from a bitmoji?

Doesn’t matter for your money

Technical knowledge comes in handy quite a bit.

When it comes to investment opportunities, it’s far less relevant than people think. Technology doesn’t decide how valuable it is. People do.

How do they value an asset? What would need to change to change how much they value that asset? How does the token capture that value? How much value can you realistically expect that token to capture?

What is its price today compared to its potential price in the future?

If that difference is very big, you have an investment opportunity. At that point, it’s all about how you make the most of that opportunity, which depends on your goals, risk tolerance, and technical skill regarding exchanges, staking, etc.

In a speculative market, you don’t have history or metrics to justify your decisions. You just have to make your best guess. Fundamentals don’t exist yet.

Some of the biggest projects have no users. The most widely-used altcoin, Ethereum, is so bad that its founders and developers are working feverishly to replace it with a new version.

All of the projects use experimental tokenomics. Most of the protocols are buggy. Many risks are unknown.

As a result, you may not want to get too caught up in chasing moonshots.

Some altcoins will do amazing things. Most will not. It will take years to find out which is which, and the likely winners won’t likely win because they have the best tech or the most usage today, but because they serve some future need that generates value for people who own their tokens.

Chainlink and Aave started as a shitcoins that nobody wanted. Look where they are now. Litecoin was once cutting-edge tech and Bitcoin Cash was hyped to the moon. Look at where they are now.

If you have a chance, read my altcoin reports on some interesting projects that haven’t necessarily gotten the respect or attention they deserve. They’re almost all small, though some have gone up a lot since I published each report.

Buy some altcoins but follow bitcoin

Altcoins offer great opportunities—they take up about 60% of my crypto holdings—but the crypto market goes in whatever direction bitcoin goes.

When bitcoin’s price falls, its gravity overwhelms even the hottest altcoin. When it rises, it pulls even the shittiest of shitcoins out of the gutter.

Certainly, some altcoins will eventually carve out their own path. For now, it’s all about bitcoin.

For that reason, I mostly look at bitcoin when I analyze the market. Sometimes, I’ll look at the altcoin market and occasionally focus on Ethereum.

It’s good to think about altseason and think about your ten-year hold/stake/use portfolio. When it comes to market analysis—those macro trends and the ebbs and flows that come along the way—only bitcoin matters.

That’s why I built my plan around it.

Three lines on a bitcoin price chart to guide every buying decision, two signals from on-chain metrics to guide every selling decision. Buy low and let the market do the heavy lifting. Use your crypto however you want. Sell only when the market forces you to.

While you don’t always get the lowest price at any given moment, you still come out way ahead of dollar-cost averaging, without trading or taking profits.

But today’s issue is not about my plan. It’s about risks and expectations.

Risks are everywhere

People think crypto’s a risky investment. That’s a good thing.

Usually, financial ruin comes from downturns in safe assets, not risky ones. When you feel a sense of complacency or security, only to have it ripped away through circumstances beyond your control. When everything seems like it can’t fail, and then it does.

Let’s look at some examples:

The stock market always goes up—until it doesn’t.

A house is the American Dream—until you can’t afford to pay the mortgage.

Bonds offer safety—the safest way to lose your purchasing power over time.

Gold is a great hedge against inflation—which hasn’t been true since the 1970s.

Dollars always lose value—except against other currencies that lose value faster.

This world is full of risks, often where you least expect them.

Growth is slowing in almost every major economy.

China’s dealing with major financial problems while balancing a 300% debt-to-GDP ratio.

A demand shock has overwhelmed supply chains almost everywhere, causing shortages across the board and sending the prices of many goods and services so high that some industries have nearly ground to a halt.

The US government will run out of money in a few weeks. It may shut down next week.

Global equities remain dangerously overvalued based on historical benchmarks. At the same time, average dividends are the lowest ever recorded.

Rent and housing prices far outpace wage growth in most advanced economies.

On top of that, $17 trillion worth of the world’s wealth remains locked into negative-yielding bonds that are guaranteed to lose money, with another $6.4 trillion sitting in junk bonds from unprofitable businesses that pay less than the rate of inflation.

And you think crypto is the risky bet?

Temper your expectations

Despite the near-total destruction of safe risk-adjusted investments, almost all of the world’s wealth is NOT in the crypto market.

Do you ever wonder why?

I don’t. It’s only a matter of time before almost all wealth is recorded on a blockchain and exchanged using cryptocurrency. It’s inevitable. The tech is too compelling. The need is too great. The financial incentive is too massive.

That will take decades to happen.

You can look at this as a letdown because you may have to wait years for that 100x moonshot to pay off. Or, look at this as an opportunity to build long-term, durable wealth for yourself and your family in a world that’s made such opportunities harder and harder to find.

But that’s the long view. Let’s set realistic expectations for the short term. What about the months and years ahead?

Using conventional measures of peaks and bottoms, bitcoin’s price would have to go to $120,000 before we need to worry about a market cycle peak. Its price could drop as low as $15,000 before we need to think about selling.

Those prices are based on markers that change over time and vary from one model to another, but bitcoin never goes above or below those markers for more than a day. Today, those markers sit at $120,000 and $15,000.

They’re also hypothetical. They represent the extremes.

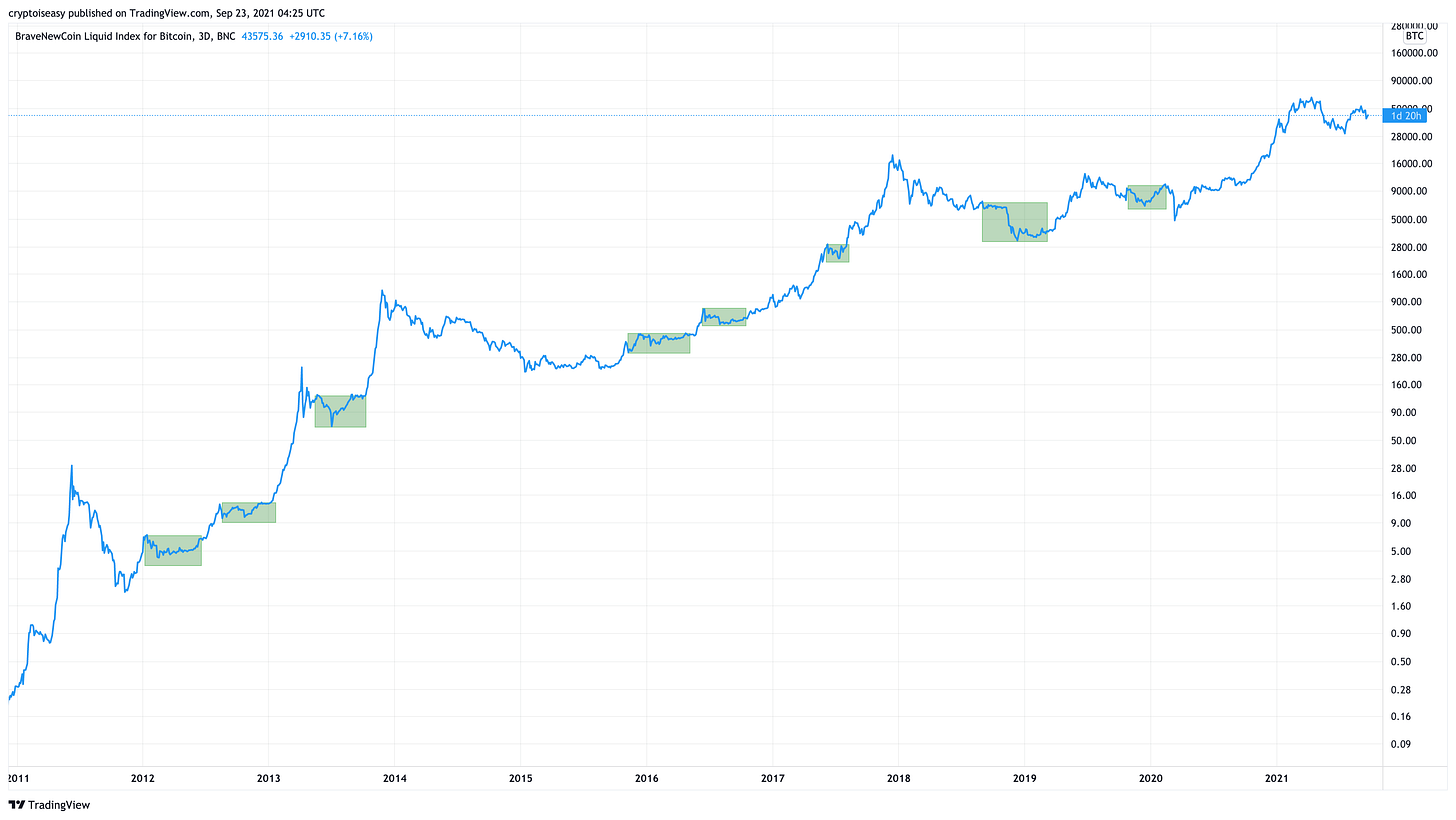

Once you look at similar market conditions over time, you get a more realistic range of expectations.

When you look at the on-chain data, trading patterns, and market trends we see today, they most closely match what we saw during the time periods shaded in this chart.

That includes parts of 2012, 2013, 2015, 2016, 2017, 2018, and 2019.

On September 4, I amalgamated all of those previous moves into a projection for what I expect from bitcoin in the coming months. There’s no perfect fit but it’s the closest approximation of how the next few months might play out if history is our guide.

Check it out:

The good news is, bitcoin DGAF what I doodle on a trading chart. You don’t have to, either. It’s all squiggles for giggles.

What’s more important is to look at the underlying conditions that drive markets up or down. If you’re interested in that, you may want to upgrade to a premium subscription.

You get to choose what you believe

Regardless of what the price does, what the on-chain data tells you, or what you see on YouTube, you get to decide whether to see an opportunity or not.

Whether we’re in a bear or bull market, golden cross or death cross, bull trap or bear trap, you can tell yourself whatever you want to hear.

I do the same thing. Mostly, I use facts, patterns, and history to justify my beliefs. You may use a different approach. At the end of the day, it’s the same—we build our own worldview on whatever terms we want.

Number go up? Supercycle.

Number go down? Bear market.

Number go up after going down? Bull trap, the rally will fail, next stop $20k.

Number go down after going up? Bear trap, the bottom’s already in, next stop moon.

Whatever you want, this market will give it to you—as long as you have the courage and conviction to act decisively when opportunities present themselves.

If you think $65,000 marked the peak of the market cycle and it’s all downhill from here, you get to believe that. Make sure you also act on that belief. Sell now and short the market.

Don’t get too wrapped up in the details, the day-to-day, the short-term trends that change quickly and in ways that don’t change the overall trends and behaviors that drive the market.

Once you start chasing the moment, you risk missing better opportunities. Those opportunities may not happen on your timeframe or terms, but they may be worth waiting for.

Mark, the market peaked in April, why don’t you see that?

Let’s define our terms.

When I talk about the market cycle peak, I’m not talking about halving cycles, hash cycles, four-year cycles, elongated cycles, “local tops,” or logarithmic curves.

I’m referring to psychological cycles, where you go from “nobody’s buying” to “everybody’s buying” and back down again. Like so:

As such, there’s no time frame or target. Also, these cycles play out on smaller timeframes as “local tops” and “local bottoms.” You’ll know them because altseason tends to mark the “euphoria” stage of each micro-cycle.

For the true market cycles peaks—those peaks that come before a 1-2 year bear market—I look for two specific signals, with data models for confirmation.

For the bottoms, I don’t have any good signals, just clear guidelines for what to look for after a market cycle peak. You can see both in my plan.

This market cycle started in December 2018 and has gone parabolic since that time, as you can see on this price chart:

Along the way, we’ve had big ups, big downs, and a lot of time moving sideways, but we have not had a market cycle peak. The data is very clear about this. On-chain data, trading patterns, and data models from previous peaks do not match anything we saw in April 2021.

For example, the Pi Cycle.

Early this year, many people said when the Pi Cycle crosses, the peak is in. Then the Pi Cycle crossed on April 15, the day of bitcoin’s all-time high.

You’d think that’s it, right? The signal came, the peak is in, it’s game over.

The problem is, only one permutation of the Pi Cycle crossed. Others did not. For example, take a look at the five permutations on this chart:

All of those Pi Cycles crossed at the three previous peaks, none crossed in April 2021.

Perhaps they will all cross at the actual market cycle peak? We shall see. Premium subscribers, I’ll keep you posted.

I don’t make decisions based on this data, but I take it seriously. Ignore it at your own peril. At the same time, let’s not read too much into it.

The end of cycles as we know it?

That assumes we will even have a market cycle peak. What if the market stops going through cycles?

Thanks to the transparency of bitcoin’s blockchain, smart money can gather all sorts of data, history, and metrics to assess whether the market’s hot or cold.

As a result, market participants can better time their buying and selling decisions. As the analysis shows the market’s getting too hot, they take profits. As the analysis shows the market’s bottomed, they buy back in.

Maybe this behavior leads to smoother tops and more mild bottoms? Shorter bull markets, shorter bear markets. Up for a while, then down for a while. No market cycle peaks, no crypto winters.

Seems reasonable. I’ll wait to pass judgment.

In February and March, when people were talking about supercycles, I said the market can either maintain its trajectory or continue the bull market through the end of 2021, but not both. Only one or the other. My plan said not to buy. The data suggested the market was running on fumes. I told subscribers I wasn’t buying, it’s too risky.

What did people ask me?

Great, Mark, so what should I buy now to make the most money in the next 5 weeks? I already spent my money, should I take out a loan? This could be the last chance to get in before the crash! Do you think I should take out a 10x leveraged long? Even if the market goes only 50% up, I can make 5x on my money!

At the same time, whales and institutions had already taken profits. They didn’t do it behind your back, they did it openly on Twitter, YouTube, and in the news.

But people still bought.

You’d be surprised how many people don’t know about, care about, or dismiss data models, on-chain analysis, and trading patterns. They don’t worry about OGs dumping their crypto. Tell them you’re not buying or taking profits, they’ll respond “have fun staying poor!”

They aren’t necessarily making bad decisions. Quite the opposite, for some. Lots of people did quite well. Perhaps so well, they will behave the same way next time.

As a result, the cycle will continue. We will reach a market cycle peak at some point. It’s pre-programmed—not into bitcoin or any crypto, but into humans. It’s part of our collective psychology.

Draw your own inspiration

You can choose whether to follow the path you’re on or choose another. Alternatives abound and you might not find them in whatever everybody else is talking about.

For example, trading guides and economics textbooks dictate a certain worldview. Read Rich Dad Poor Dad and Freakonomics so you can challenge yourself to see beyond conventional wisdom.

YouTube makes this market look easy. Confessions of a Crypto Millionaire shows you what it’s like to spend a bull market stressed and distracted because you maxed out your credit to put your life savings into ETH in 2016 only to watch it go sideways and crash for a year—in the middle of a so-called “bull market.”

The Bitcoin Standard is a historical fiction novel that concludes with a fairly cogent argument for bitcoin. Instead of reading that, try The Internet of Money for a much more realistic view of bitcoin and get The 7th Property to understand its significance in the context of today’s financial system.

See with your mind’s eye

Look at history, patterns, and trends. Try to see what they reveal about the market. That way, you won’t need “three reasons why the market crashed today” or “five altcoins that will explode in Q4.”

You can enjoy that type of content—I do—but you won’t have to get wrapped up in it. There are other ways to enjoy this market.

You can just take advantage of opportunities when they present themselves and take the market as it comes.

Does that mean everything will turn out the way you expect?

No, but it’ll probably come close. And if not, that’s ok. You can always make up for bad timing. Complacency kills.

When the safest assets on earth carry more risk and less reward than ever before, you can’t worry about a 10% swing or missing the absolute bottom. Until we reach a market cycle peak, you never need to sell. Whenever bitcoin’s price is outside the buying zone of my plan, chill and try to make more of your government’s money so you can trade it for crypto whenever the next opportunity comes.

You may even want to swap your fiat for stablecoins and get 7-12% returns on some of the crypto stavings platforms I use.

I’ll make sure you’re up to date with my thoughts and perspectives. When there’s something to worry about, I’ll tell you.

On any given day, expect a wide range of outcomes. In any given week, this market can swing violently up or down.

Step back and you’ll see three trends that are far more powerful than any swing trade.

A crypto market full of people who want to buy, not sell their crypto, just waiting for an opportunity they feel comfortable about. That’s the opposite of what we saw in the first few months of this year.

A global monetary regime committed to making your government’s money as worthless as possible.

A rising awareness, interest, and appreciation of a new financial asset.

But that’s the long-term, macro view. That’s the “call me in five years” view. Let’s just look at today.

A 50% drop from our most recent high of $53,000 would not even break the upward price trend we’ve formed since March 2020. Any price above $29,000 keeps the bull market intact. The past week’s order books show a ton of buy orders stacked up below $40,000 and far fewer sell orders above $50,000. On-chain data looks strong and bitcoin’s price patterns match what you see during normal, typical consolidations during bull markets.

As such, we can expect any big crashes to last a few months or less and possibly not come until prices go much higher. On top of that, we have far more room to run before we reach a market cycle peak.

We haven’t seen conditions this strong since the fall of 2020.

And you’d rather have your government’s money?

That’s fine. Your government’s money has a lot of utility. Just make sure to keep your expectations realistic and watch out for the risks nobody’s talking about.

Relax and enjoy the ride!

Share this post