Happy Weekend!

Sometimes, people ask me why I don’t talk more about altcoins, dive into projects, and share my portfolio.

Occasionally, I do, most recently in the November 18, 2021 update.

I prefer to keep my portfolio to myself, as you can hopefully understand. If you’re looking for altcoin ideas, read my Altcoin Reports and my Advice for Altseason.

As far as analysis goes, don’t worry about altcoins. They still follow wherever bitcoin goes.

Not every altcoin exactly at the same time, but the general trend always points in whatever direction bitcoin’s heading. So it has been since altcoins began.

Bitcoin tells you everything you need to know about the direction of the market. Today, its price is $59,000, down 8% since my last weekend rundown.

In that rundown, I ran a poll asking whether bitcoin’s price will drop below $50,000 any time before December 31, 2021. Choices were “yes,” “no,” or “I choose not to respond.”

70% of respondents said “no.”

My answer?

I choose not to respond. A drop below $50,000 would seem reasonable. Any price down to $40,000 would not surprise me. We’ve seen bigger drops in more bullish circumstances than we see today.

If that happens, on-chain data suggest the market would recover within months. Something like July 2015, March 2020, and a few other times when the market conditions were strong but the price dropped a lot, quickly. Everybody freaks out and two months later, we’re back to even and off to the races.

At the same time, today’s market has a ton of momentum. Don’t dismiss the possibility bitcoin’s price shoots up quickly, soon—possibly to its market cycle peak.

All previous market cycles ended roughly the same as this one’s playing out, as you can see in this trading chart:

You have a steady rise into a modest drop / complacency lull (shaded green) followed by a crazy, fast, powerful zoom (marked in black).

You might point out the slope of the previous curves are steeper than today’s. That’s an optical illusion from the way the lines appear on this chart.

Once you isolate the price movements over the months that came before that final zoom, you see a similar pattern all four previous times—the price went generally sideways and up for months before the complacency lull.

Not literally the same movements step-for-step, but along the same general path. Check it out:

Look at today’s price movements over roughly the same time frame.

You can’t tell me that’s so drastically different from what we saw in the lead-up to those previous zooms. Similar contours. Similar timeframe. Same general path.

Does that mean we have to go straight to the market cycle peak once the market gets over this lull?

No, but if you dismiss the possibility, you do so at your own peril. You can make up for bad timing. Complacency kills.

Of course, that assumes this is a complacency lull. It could be normal volatility or the start of a bigger drop.

Yes, I know, 50/50 analysis, “could go up, could go down” but if that’s your conclusion from what I just wrote, you’re missing the point.

When the price goes up, too many people get too bullish. When the price goes down, too many people get too bearish. The moment you say “that’ll never happen,” there’s a good chance it already has happened at some time in bitcoin’s history—or at least something similar.

While the analysis may be 50/50, the decisions never are. No matter what happens from here, I buy or sell only when my plan tells me to.

Today, that means not buying. Tomorrow, who knows?

Read below for some content you may enjoy.

Quick poll:

Will the next bear market start before July 1, 2022?

I’ll share the results—and my own answer to this question—in next week’s rundown. Read below for two articles, a video, an NFT, and a meme you may enjoy.

Where do investors stand on cryptocurrencies? Faith outweighs fear, new survey finds

Bottom line: a survey shows 73 percent of investors plan on investing in cryptocurrencies in the final months of 2021 (i.e., now).

My take: that matches my personal experience. The question is, how many of them will sell and how quickly will they do it?

Why we care: on-chain data shows strong HODLing among people who bought in May 2021 and earlier while people who bought over the summer already started selling to people entering the market now. Can new buyers sustain their enthusiasm long enough to overwhelm this profit-taking from short-term buyers? We shall see. The answer will determine which way the market goes in the coming weeks and months.

On a recent episode of Untold Stories, Charlie Shrem hosted Adam Jackson, one of the builders of Braintrust, a decentralized marketplace for talent acquisition.

In this conversation, you will hear a clear articulation of Web 3.0 and its disruptive potential. I haven’t found many examples of this concept so well explained—and with a concrete, real-life example to boot. You can listen to the podcast or watch this video of the same.

Please note, I don’t know enough about Braintrust or its BTRST token to comment on the project itself. I just thought this interview explores one way cryptocurrency will challenge traditional paradigms and create new business models.

Exclusive clubs called ‘DAOs’ are popping up online. What’s it all about?

Bottom line: one journalist wrote about a DAO that he thought was stupid and sleazy.

My take: I realize the journalist is mocking DAOs but his observations are prescient. Dead on. Many DAOs seem stupid, sleazy, odd, or scammy. Founders sell their tokens for access into a club. As more people buy access, the token price goes up. Founders sell more tokens. Club members enjoy the benefits that come with participating in the DAO. While it’s essentially a new take on subscription or membership fees, it seems shady because, well, I don’t know, it’s different, I guess? Perhaps because tokens enable more efficient pricing? Maybe because token holders have a financial stake in the network that grows around the DAO? Or because founders can create value from nothing? Are those now bad things? Help me out here . . .

Why we care: I would just keep this example in the back of your mind when somebody talks about mass adoption. We’ll get mass adoption eventually, but we’re a long way from that. Articles like this journalists article tell you exactly why. People generally enjoy building closer relationships with people who share their goals and values, forming communities that can accomplish something greater their members can do on their own, and making all sorts of other meaningful and valuable contributions to the betterment of mankind. But once you introduce a token, then people think it’s weird. 🤷♂️

One of my readers shared his newly-minted NFT with me. Check it out.

Only 10 of these NFTs will ever be created. The bidding is open!

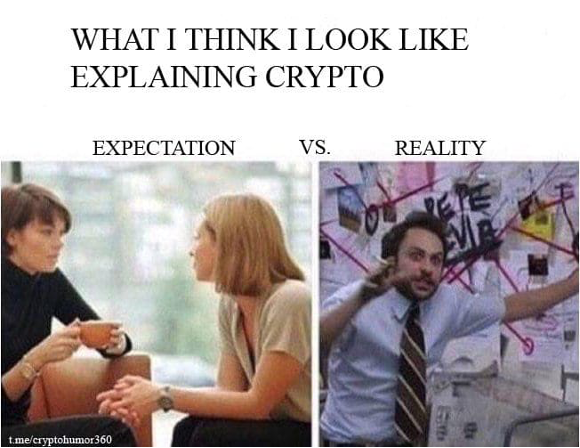

Speaking of NFTs, a quick meme before your family asks you “what’s an NFT.”

Relax and enjoy the ride!

Share this post