Bitcoin‘s price is down 3% since the beginning of September and the rest of the crypto market is up 6% over that time.

Some of you may worry about this. Don’t. As long as bitcoin‘s price stays above $29,000, the bull market will continue.

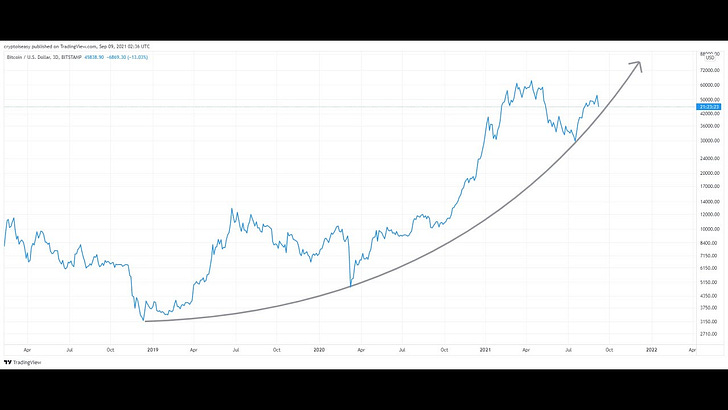

Bitcoin’s price remains on a parabolic path dating back to December 2018. I posted a video about this multi-year parabola. Watch it:

Why haven’t I bought bitcoin since August 7?

Just following my plan, as premium subscribers know. Three lines on a chart, no trading or taking profits, better results than dollar-cost averaging.

Now I’m setting aside stablecoins in high-yield savings accounts while I wait for the next opportunity to buy more crypto. If you’re interested in getting a little free crypto for depositing the crypto you already have into a savings account, tap this button for crypto savings referral links.

You can get 7-12% on stablecoins with these savings platforms. Some think it’s riskier than keeping your money in a bank, and that’s a fair criticism. But the bank gives you 0.1% or less while these licensed, regulated platforms give you up to 100x higher yields. Are they really 100 times riskier than your bank?

BTW the US government will run out of money in October but nobody seems to care. European junk bonds now carry negative real yields, which means there are a lot of people paying a premium to lose money on businesses with no profits. And thanks to “banking reform,” China’s banks will soon have to lower the interest they pay on deposits.

And you’re worried about crypto?

I don’t have much to share this week. Coinbase and Ripple are fighting back against regulators, as they should. The total altcoin market cap briefly touched its previous all-time high. Prices went up on a lot of things. Other stuff happened that other people have covered quite well.

This week I have only one article that you may find interesting, below. Maybe more next week!

Benoit Coeure calls on central banks to 'act now' on crypto and DeFi

Bottom line: an executive at the Bank for International Settlements, one of the world’s most significant legacy financial institutions, warned his peers that DeFi will make legacy financial institutions irrelevant.

My take: Coeure says it best in his own words: “CBDCs will take years to be rolled out, while stablecoins and crypto assets are already here.” Either private innovation will force governments and legacy systems to adapt, or governments and legacy systems will usurp this innovation for their own means. In both cases, the modern banking model will die—it’s only a matter of time.

Why we care: we’re at the forefront of a revolution in monetary thought as significant as the industrial and digital revolutions, which likewise upended institutions that had persisted for millennia. There is nothing the legacy financial system can do to stop it. They’re too late but they don’t realize it. Don’t tie your rope to a sinking ship.

Relax and enjoy the ride!

Share this post