你好 Ni hao!

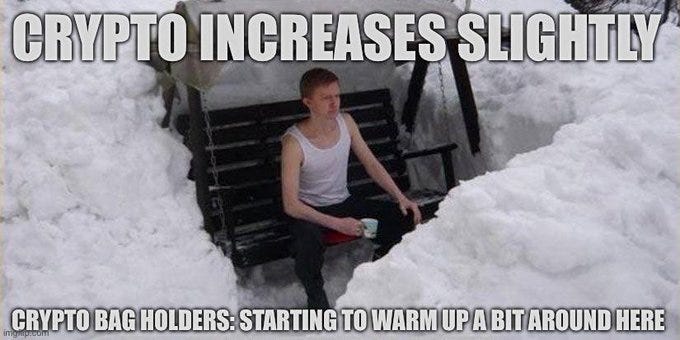

WhatsApp, Telegram, Discord, and Twitter tell me altcoins are pumping, but most of mine are up only 30-200% in the past 7 days. Not sure what everybody’s getting so excited about.

Catch my most recent update for my assessment of the situation.

If you’re thinking about taking profits, add costs for taxes and fees. And if you’re one of the “sell half at the first double” people, you need to sell more than that to pay your taxes.

In the US, that means selling an extra 20-35% of your tokens in addition to the half you got “for free.” In other countries, you may have to pay 50% or more to your government.

Isn't that ironic?

You give up 60% to 75% of your investment to get back the money you started with and still expect to get a 100x moonshot on the 25%-40% remaining on your investment.

Are you planning to buy after the inevitable crash? You just might see your favorite altcoin go up another 100-500% before that crash sends prices down 50-90%. If that very-realistic scenario happens, you’ll end up buying back into the market at roughly the same price that you sold at.

Depending on what you want to get out of the market, that may be a perfect decision. I'm still sticking to my plan.

Watch this video for a little more of my thoughts about what to do now.

When the market goes up, you never feel like you put enough money into it. When the market goes down, you always feel like you put too much money into it. Change your CoinGecko app to show prices in BTC terms, it may help calm your nerves.

Scroll down for a poll, articles, a meme, a podcast, and some job listings.

Poll

Mt Gox?

Are you wondering why the $2 billion in Mt. Gox distributions didn’t push the market down this month?

Because those bitcoins did not hit the market. The Mt. Gox repayment got pushed to March at the earliest.

That means we still have $2 billion in bitcoin hanging over the market for at least a few more months, waiting for trustees to distribute. Plus the fracas with Digital Currency Group, a government takedown of Nexo, more FTX turmoil, higher interest rates, and possibly a wave of crypto exchange failures.

Can’t catch a break, can we?

Mark Yusko Chats DCG & Grayscale Bitcoin Trust

Former US Congressional candidate Matthew Deimer interviewed hedge fund manager Mark Yusko about DCG/Genesis/GBTC and what you should and shouldn't worry about regarding the 600,000 bitcoins sitting in the Grayscale trust.

If you’re at all interested in what’s going on, listen to the interview.

You can also find this interview on Spotify and Apple Podcasts.

YouTubers said they destroyed over 100 VHS tapes of an obscure 1987 movie to increase the value of their final copy. They sold it on eBay for $80,600.

Hmmm…

Turns out some YouTubers bought all the copies of a movie, hyped it up to their followers, artificially manipulated the supply to create false scarcity, then sold out their collection for a profit—all openly, in plain view, for the public to see?

Good thing those VHS tapes weren’t NFTs or else US regulators would have already opened an investigation.

NFT creators, here is your new, US-approved strategy:

Start a YouTube channel instead of a Discord server.

Buy the entire supply of an old, unused NFT collection. (Don’t create your own.)

Call them “tapes” and tell your followers about them.

Burn all but one (or a few).

Sell the remaining NFTs, er, “tapes” on eBay instead of OpenSea. (Like these guys did.)

Run the same playbook, just change what you call it, where you sell it, and remove all utility from your NFTs. If you’re open and transparent about it, Gary Gensler will let you sell whatever you want.

JPMorgan says it was duped by founder who made up 4 million customers

Bottom line: JP Morgan invested $175 million into an app designed to help students through the college financial aid process. That app was a fraud, as was its founder (who, like SBF, was on the Forbes magazine’s 30 under 30 list).

My take: now’s no time for the “student loans are a scam” bit. Anybody can make a case that college is a Ponzi scheme and student loans are really bad investments, but both serve valid needs. I’m not surprised that a company that laughed at FTX investors got zapped for the same thing with one of its own investments. There are no safe investments. The moment you have a penny in your hand, you have a penny at risk (or in this case, 17,500,000,000 pennies).

Why we care: because scams and frauds exist everywhere, not just in crypto. Also, the Forbes 30 under 30 list seems just a little bit shadier now, doesn’t it?

Jobs Corner

CertiK | Digital Marketing Analyst | Link to position

Ontropy | Senior Blockcahin Engineer | Link to position

Nascent | Venture Analyst | Link to position

Gemini Exchange | Senior Product Designer | Link to position

Gelato Digital | Developer Relations | Link to position

DXdao | Treasury Manager | Link to position

Nethermind | Dev Ops | Link to position

Zapper | Data Engineer | Link to position

DeFiYield | SEO Expert | Link to position

Aurora | Legal Counsel | Link to position

These jobs come from the ToolsForCrypto newsletter. If you’d like to post a vacancy here (for free), email mark@markhelfman.com.

Relax and enjoy the ride!

Share this post